-Investability

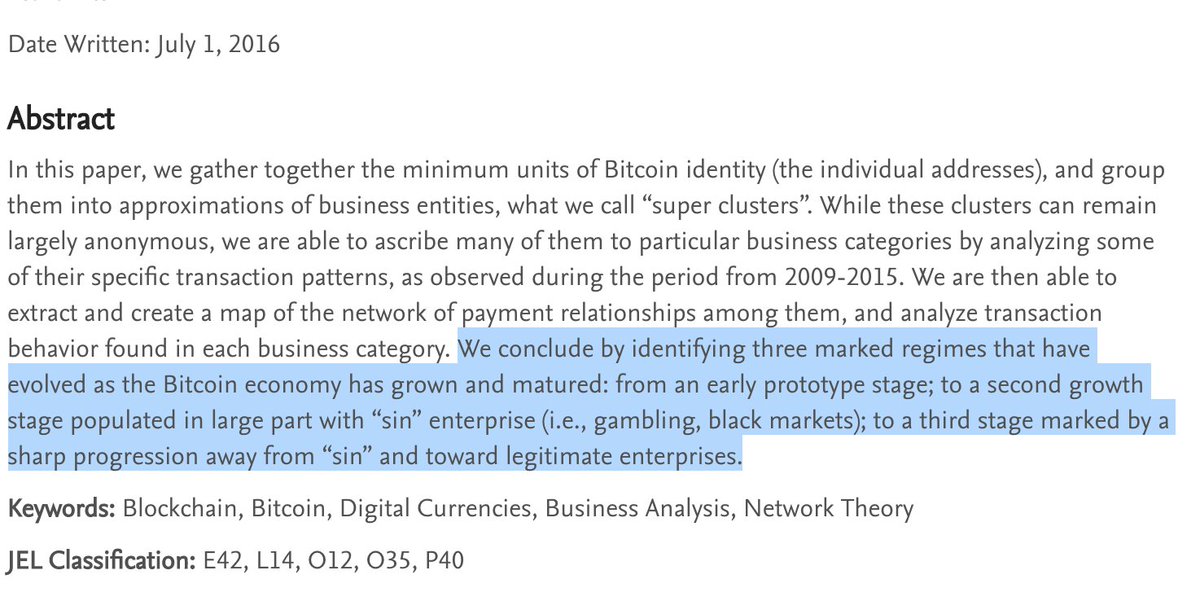

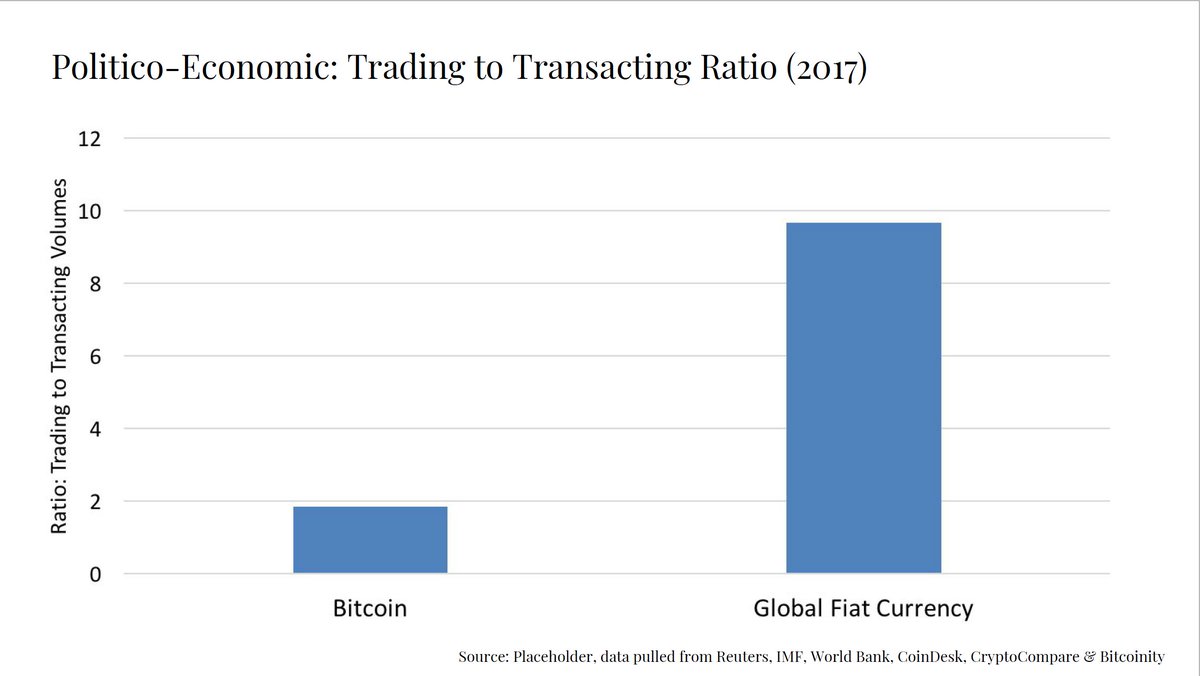

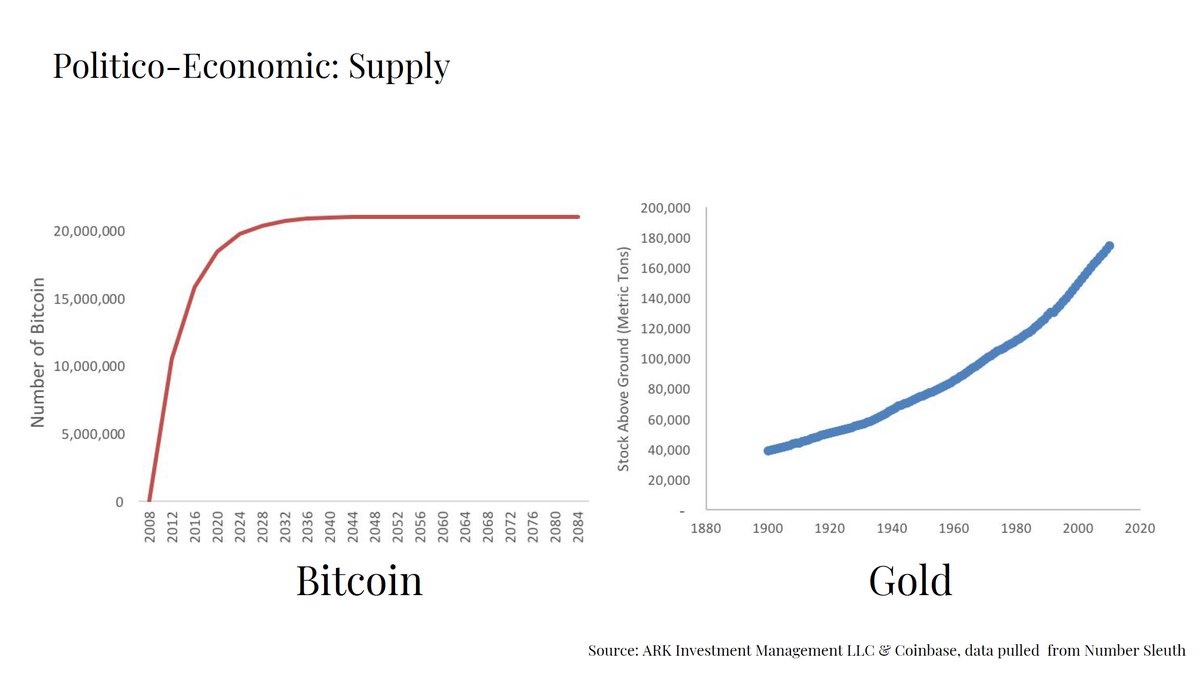

-Politico-Economic Features

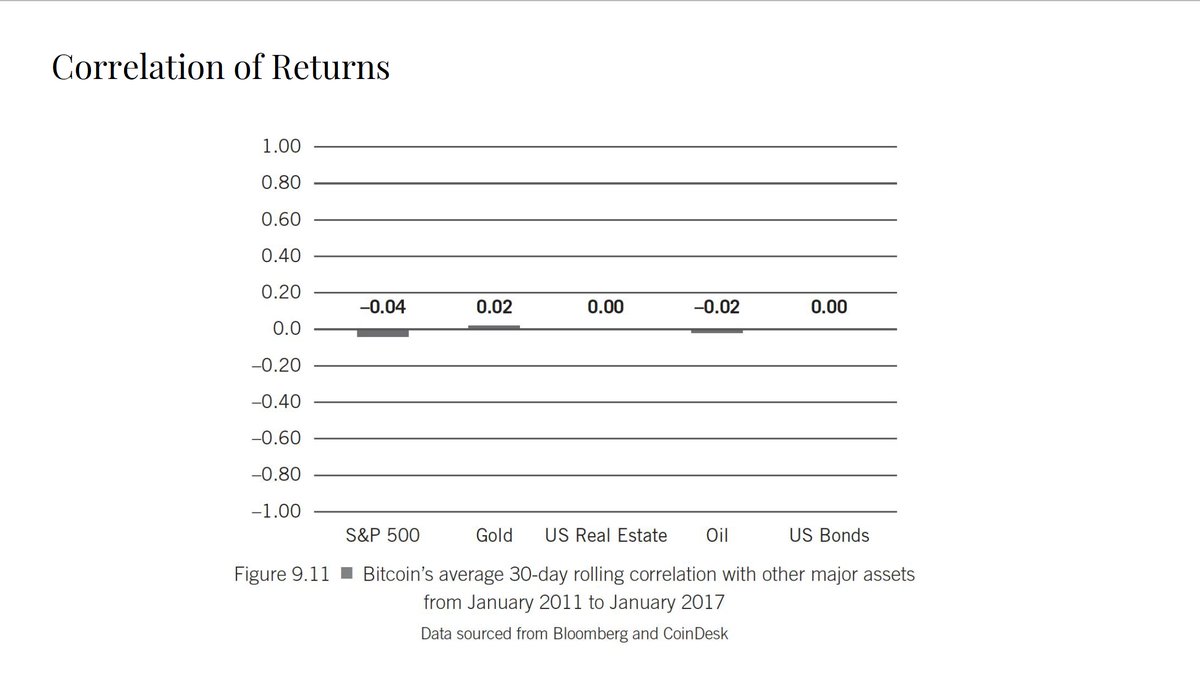

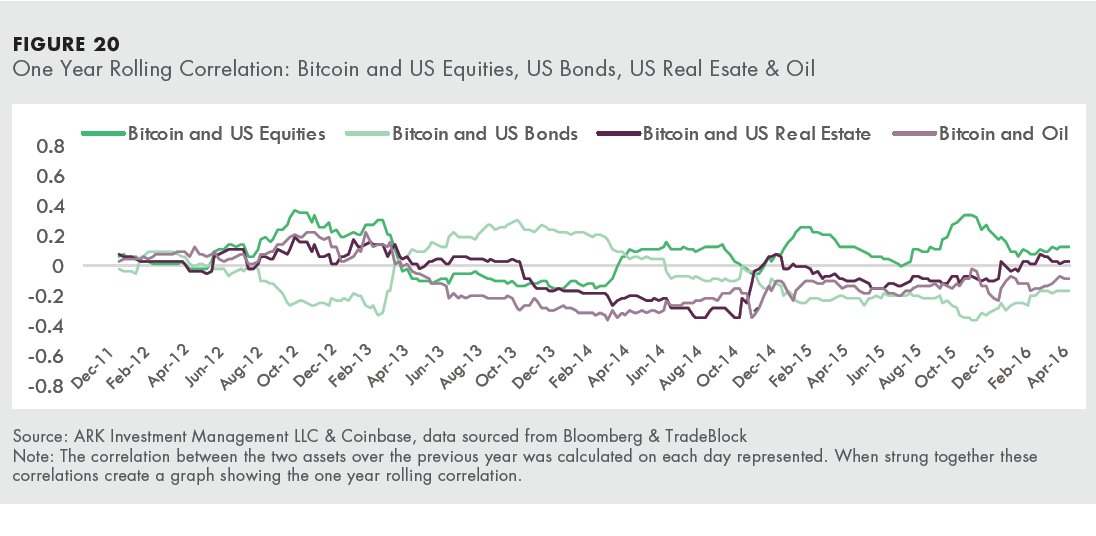

-Correlation of Returns

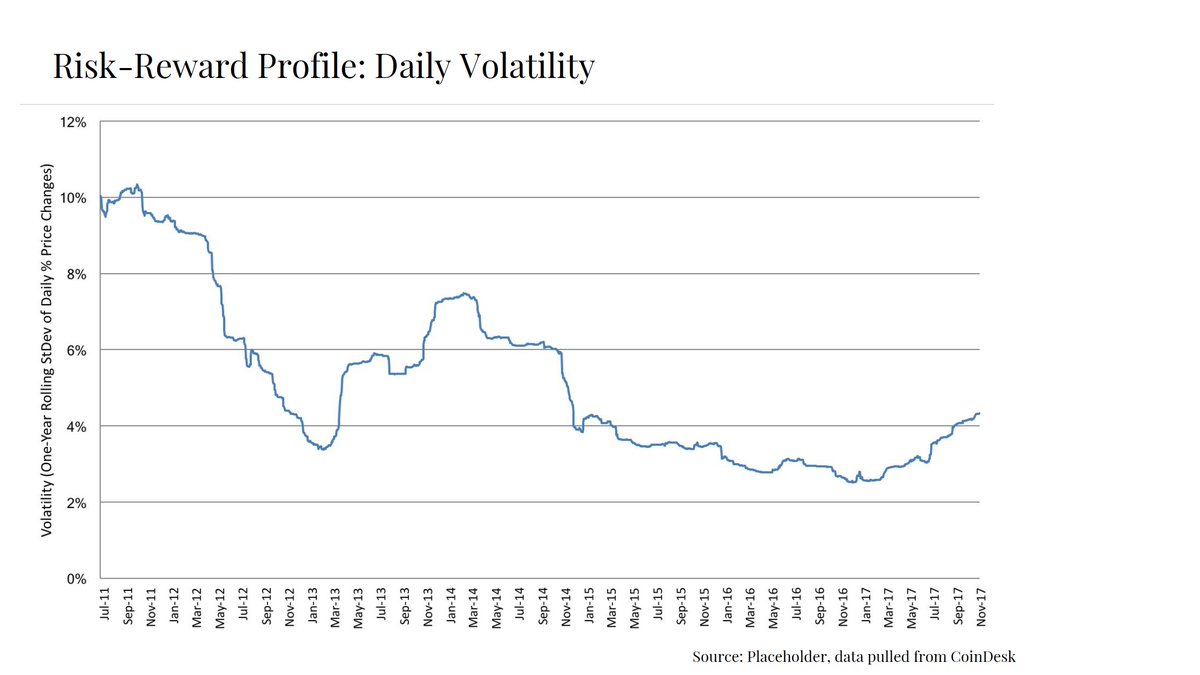

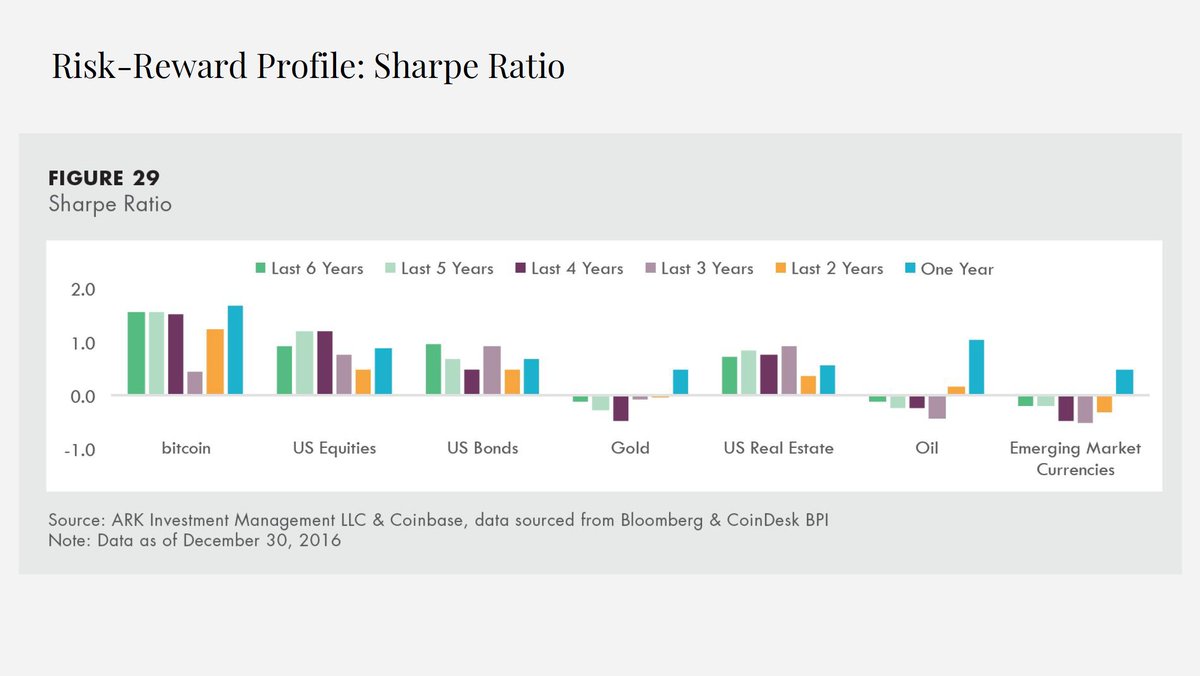

-Risk-Reward Profile

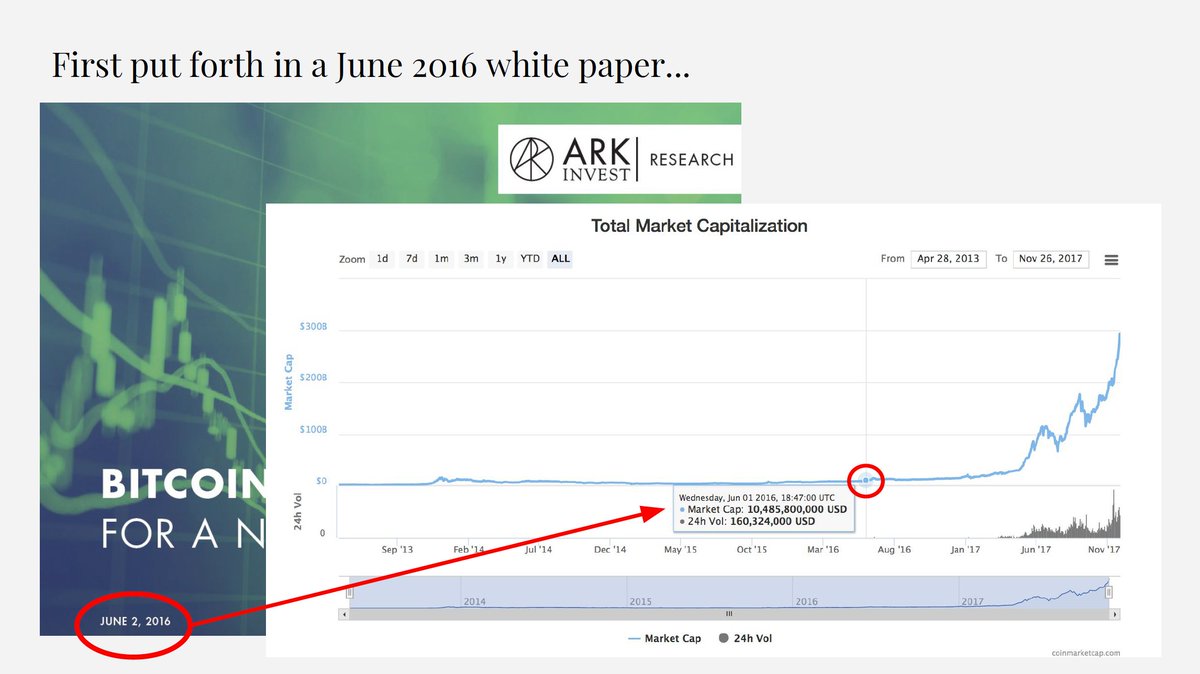

Which is also how I structured the @coindesk prezo

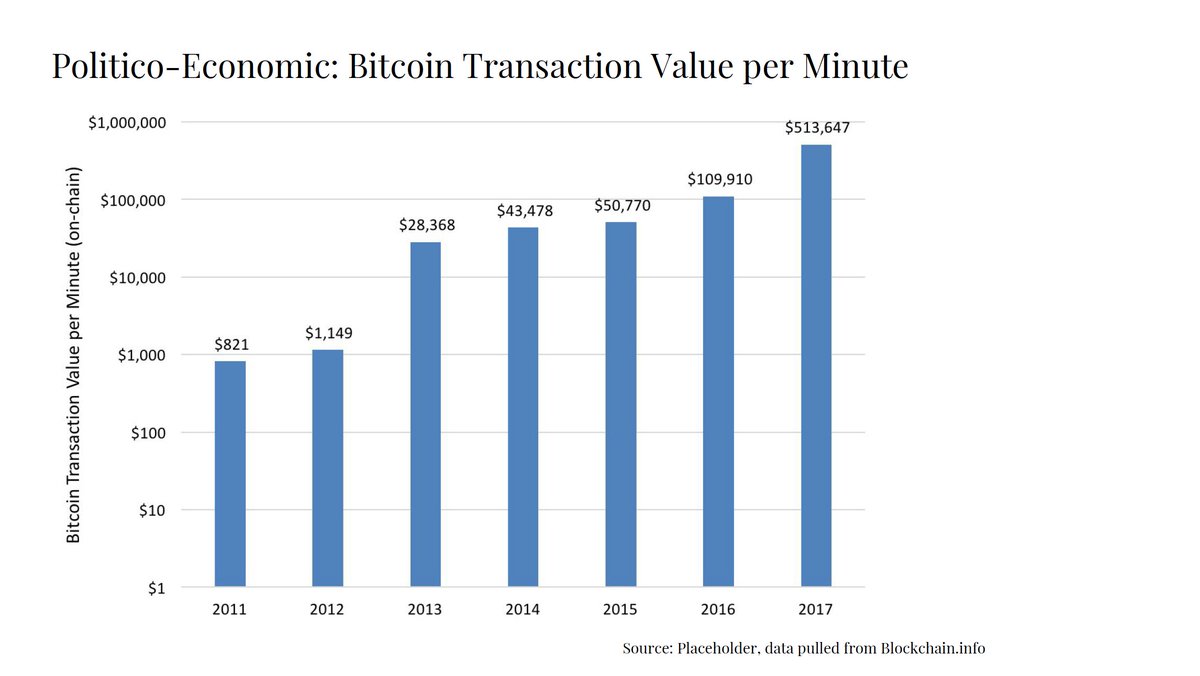

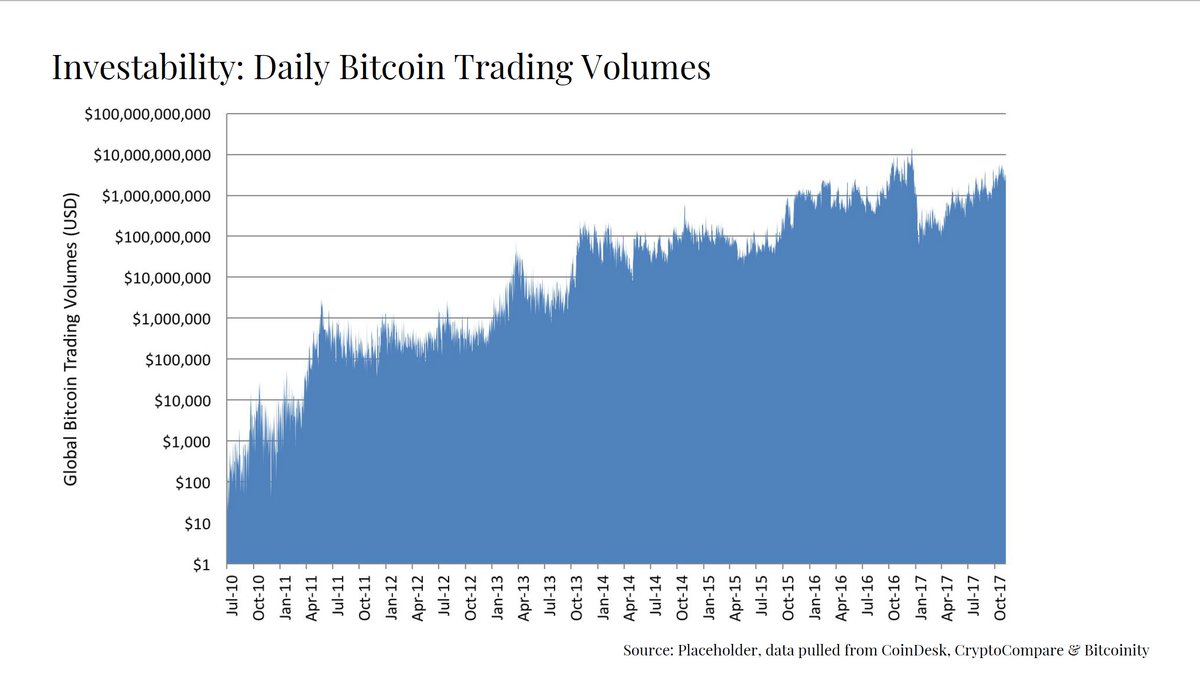

2017: $513,647

2016: $109,910

2015: $50,770

2014: $43,478

2013: $28,368

2012: $1,149

2011: $821

#bitcoin as a means of exchange.

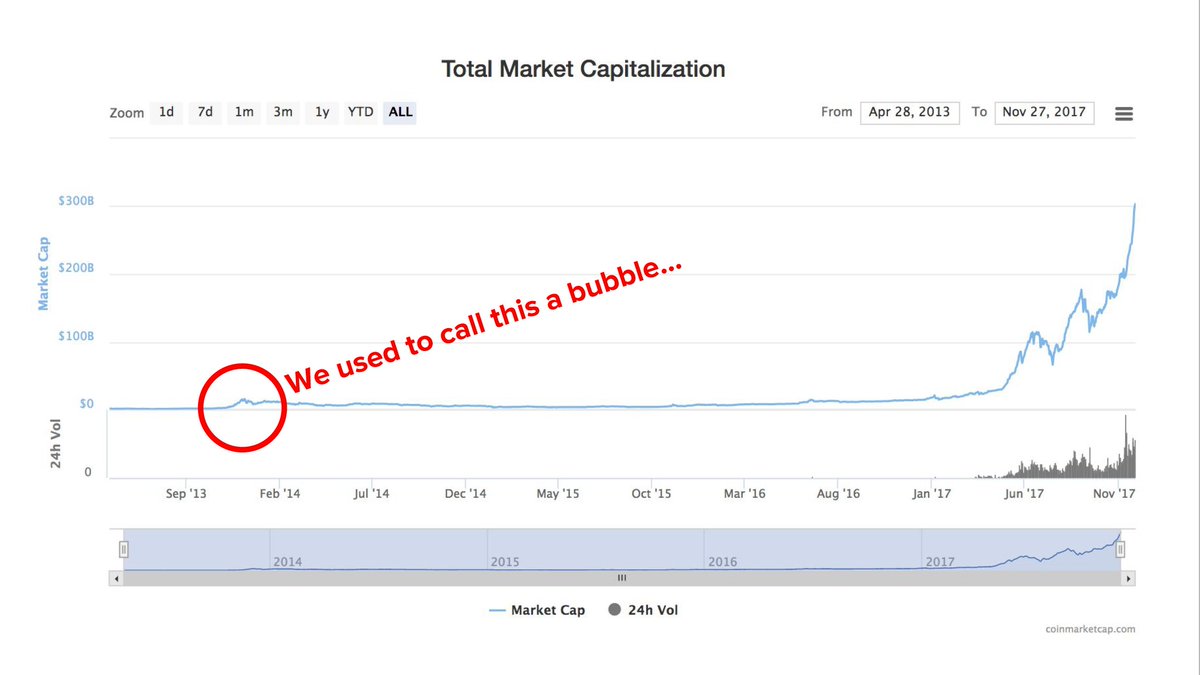

(graph is log scale)