At the same time, institutional money is flooding into (now largely cov-lite) leveraged loans.

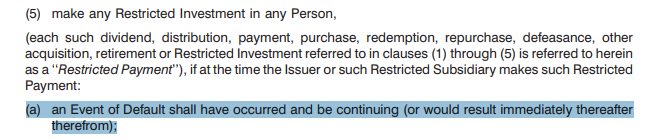

Lowell's deal deleted the "Default" part, to just leave "Event of Default"

If you miss an interest payment, it's a default. But the formal "event of default" doesn't happen until 30 days later, as the bonds have a grace period.

The bad news: several deals last year had the "default" part deleted, but the buyside didn't notice.

"Oh sorry guys, you didn't notice that we deleted two words on page 363 of the documentation, so you can't stop us hollowing out the business before default!"

But when the shit hits the fan, PE firms do use this optionality. Remember that thing about maximising value for LPs?

ft.com/content/a0ed27…

Well. Anyway. Now hopefully you know why covenants are important!