CA, MBA (IIM Indore), Tedx Speaker

Learner of Investing, Wealth Management, Building Business, Personal Productivity!

How to get URL link on X (Twitter) App

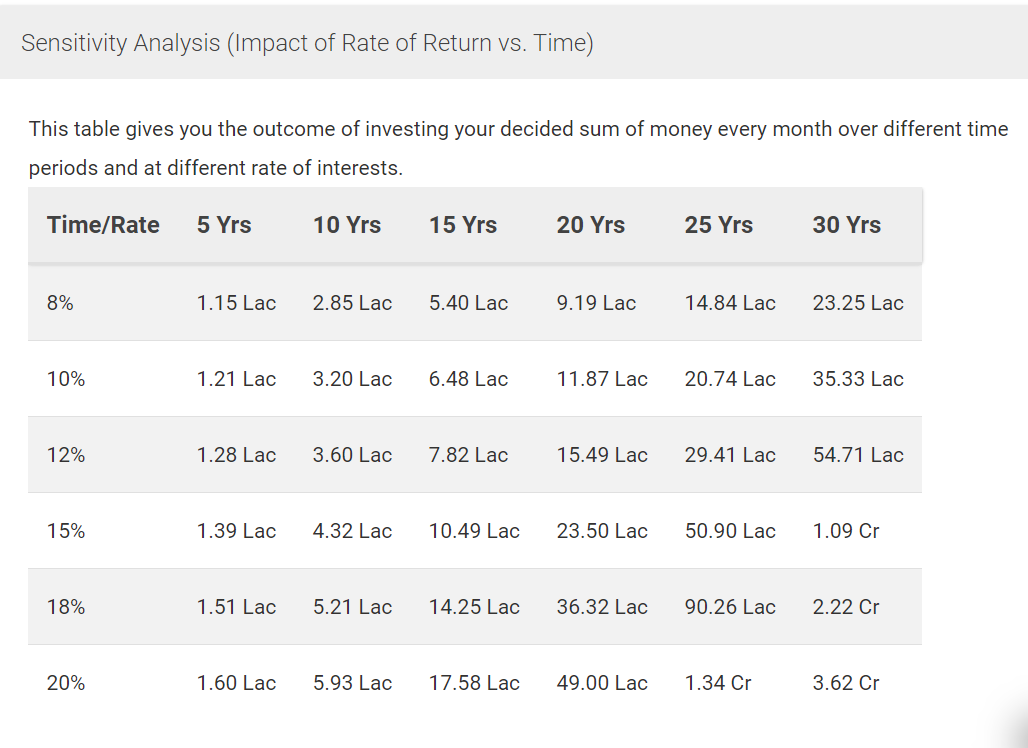

💸SIP Calculator

💸SIP Calculator

#Market Analysis is broadly categorized into two main methods.

#Market Analysis is broadly categorized into two main methods.

💸SIP Calculator

💸SIP Calculator

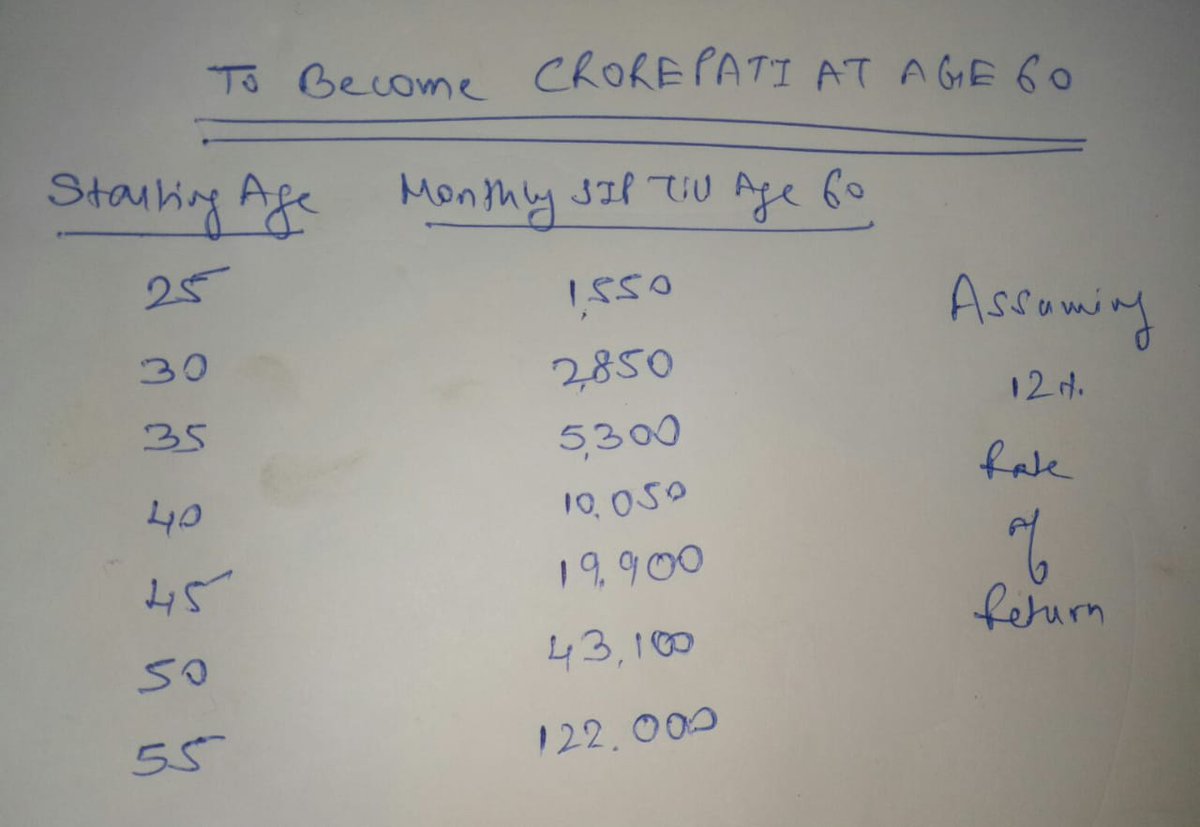

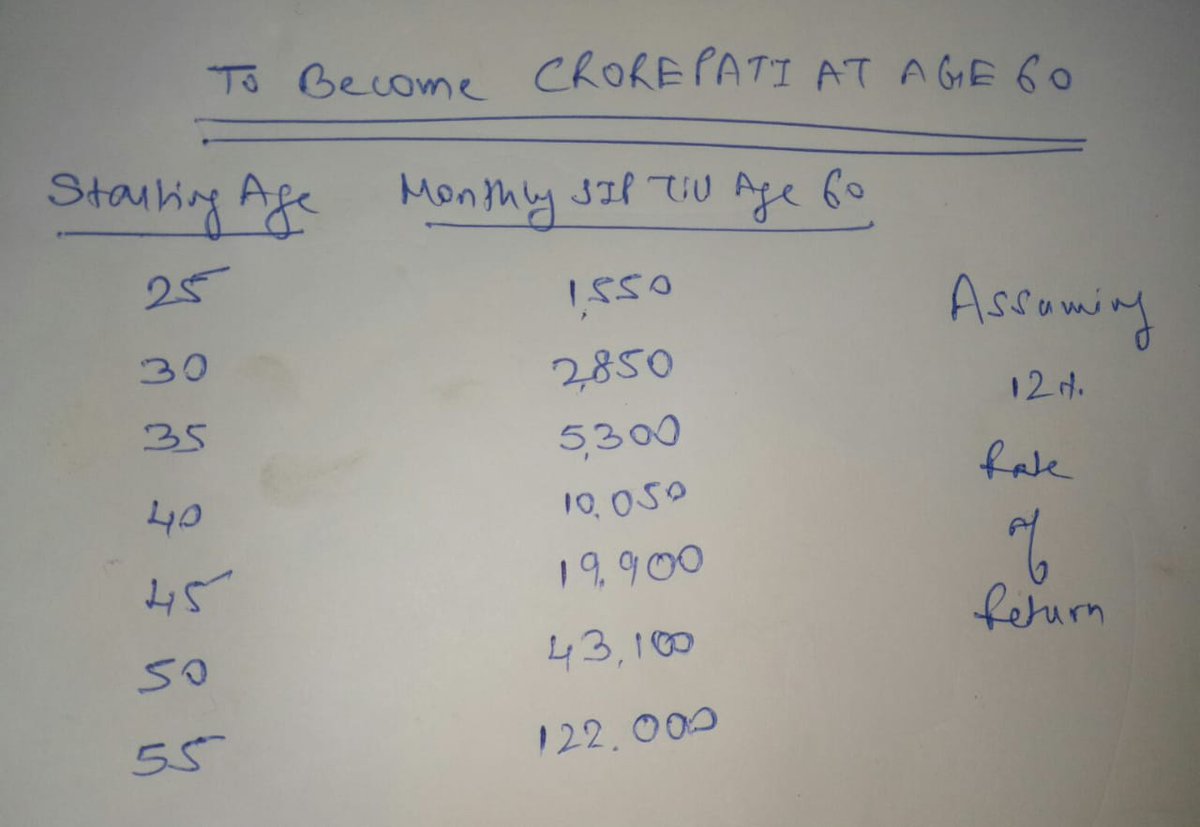

Every delay in 5 years of starting sip makes us invest almost double. Let Compound interest work in our favour and not against us.

Every delay in 5 years of starting sip makes us invest almost double. Let Compound interest work in our favour and not against us.