( bea.gov/iTable/iTable.… )

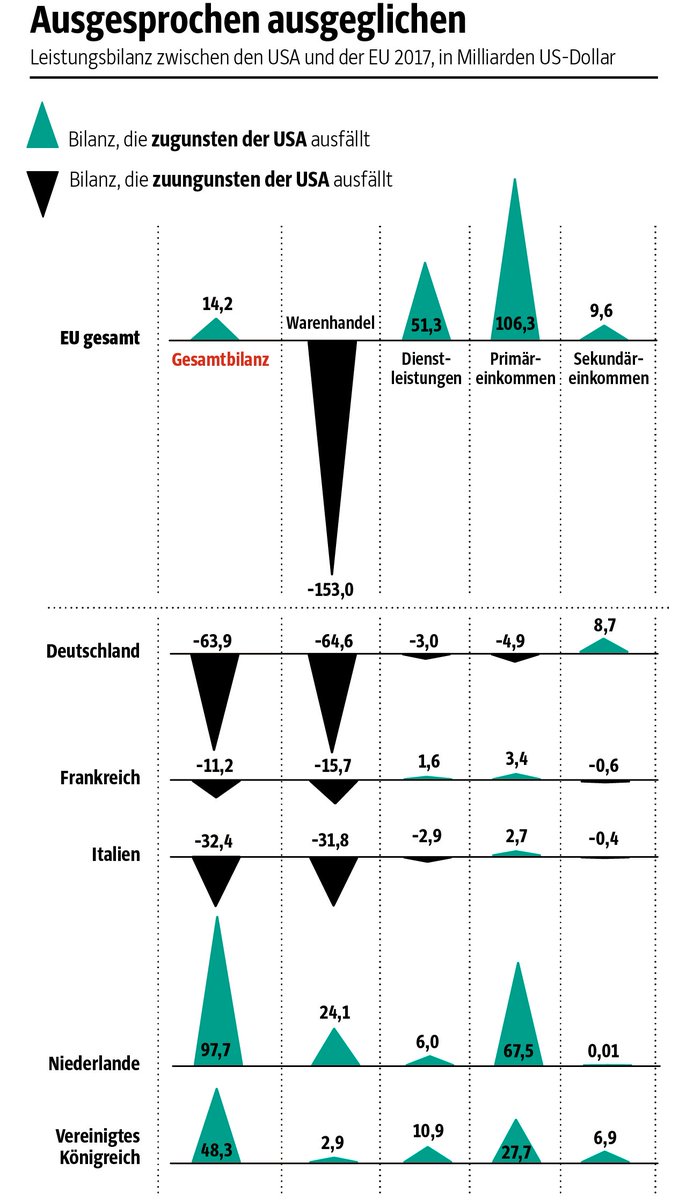

But it was somehow under the radar of many economists, me included.

@GFelbermayr and @MartinBraml unearthed in Germany and wrote a report @CESifoGroup /2

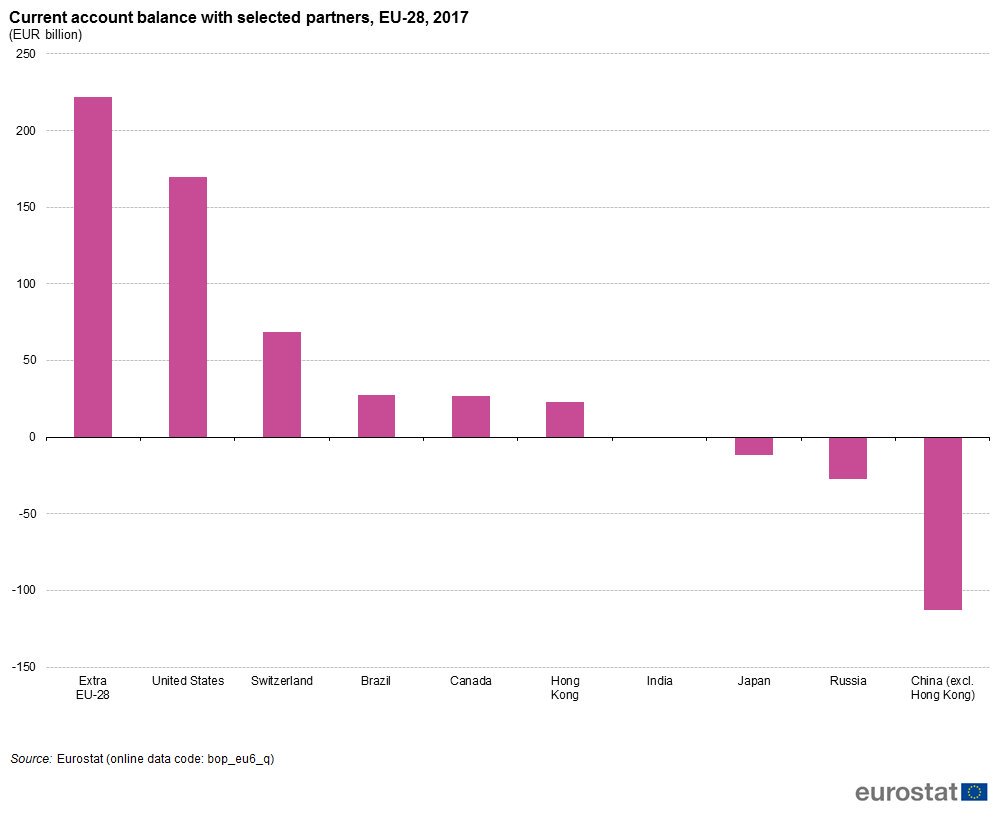

econpol.eu/publications/p…

reuters.com/article/us-usa…

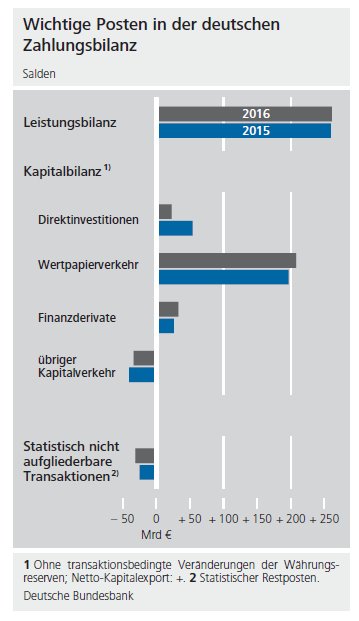

bundesbank.de/Redaktion/DE/D…

kurier.at/wirtschaft/dro…

en.wikipedia.org/wiki/Belgium

faz.net/aktuell/wirtsc…

makronom.de/schwerpunkte/w…

The discussion of the last week – about the allegedly closed US-EU current account - has not changed this even a single bit. /END

faz.net/aktuell/wirtsc…