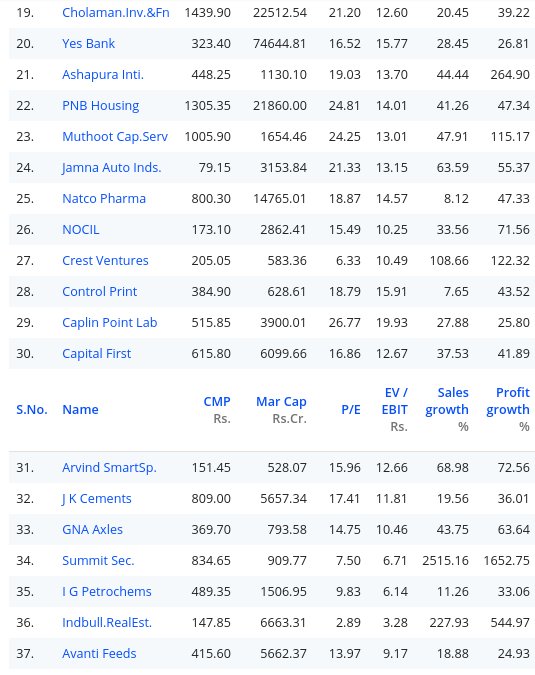

Read on moneycontrol - Ramesh Damani's thumb rule of 24% returns can make you really rich.

List of companies that are making 24%+ CAGR profits. Will add information about each company in this thread...Contribute generously to this thread :)

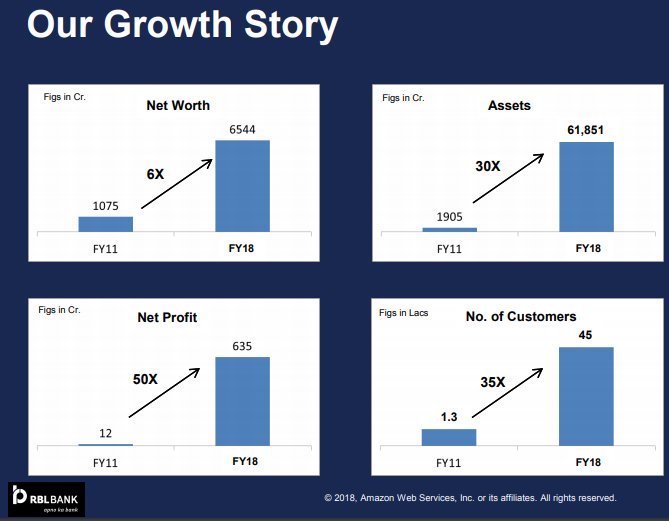

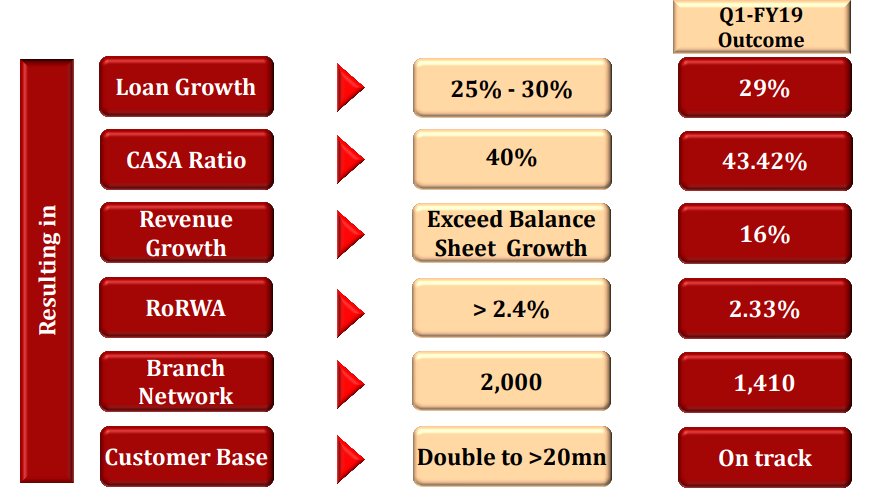

- Rural focuse

- Improving Ratios (CASA, ROA, ROE)

- Great partnerships

- On track for vision 2020

- Business of agrochemicals

- Manufacturer and exporter of pesticides, technical formulation, and its intermediaries

- China shutdown is benefiting the company

- Strong Momentum - chart says everything :)

- Watch to understand the business:

- Retail Boom

- Consumption theme

- Midas touch of RK Damani

- Awesome growth

- Pays suppliers on the 11th day, faster than the rest of the industry, but bargains hard on pricing

- Strong growth

- Improving ratios

- Interesting Investor presentation: 2020 Plan indusind.com/content/dam/in…

- Amazing management

- Risk Management first approach

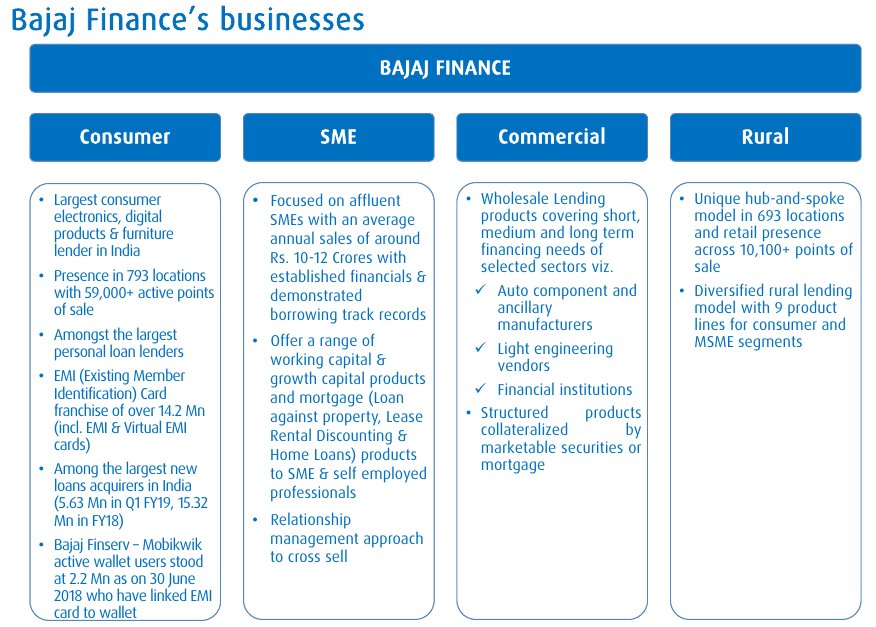

- First mover advantage in consumer lending

- Consistent growth

- Presentation: bajajfinserv.in/finserv-invest…

Stock & Example:

Pvt Banks: RBL

Retail: Dmart

IT: TataElxsi

NBFC: Bajaj

Paper: NR

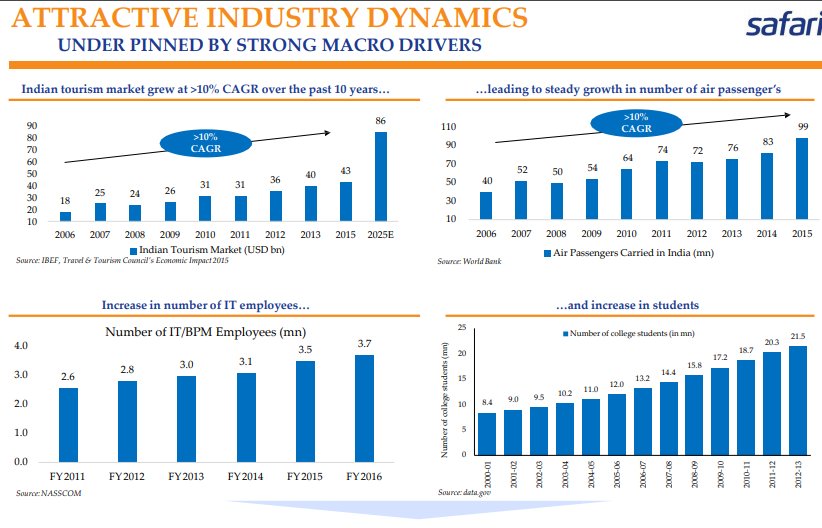

Consumption: Safari, Dollar, Ashapura

Graphite: HEG

Infra: KEI

AutoAnc: Minda

Pharma: Natco

Chem: NOCIL

#SuperExcited

- manufacturer of quality finished paper products by recycling of waste paper

- China shutdown

- Paper industry boom

- Reducing Debt

- Cyclical and not a long term bet

- Specialized IT focuses on 4 domains automotive (60% rev), media & broadcast (30%), communications & medical (10%).

- Auto: connected cars, autonomous cars and electrification

- Media: Telecom, Set-topbox, Android

- Comm: Cloud

- IOT, AI & Robotics

- INR Depreciation

- Graphite electrode demand

- Low supply in the world

- Huge entry barriers

- Crazy Price action (stock up multiple times)

- Management confident prices will sustain

- steel-360.com/stories/graphi…

- Travel ancilliary

- 2nd largest in IND

- Robust growth 7x in 7Y

- Shift from unorganized to organized

- Experienced & passionate mgmt

- Growing numbers of travelers bcoz growth in income

- Mgmt expects revenue wl double in 2Y

- Operating leverage wl kick in aft volumes

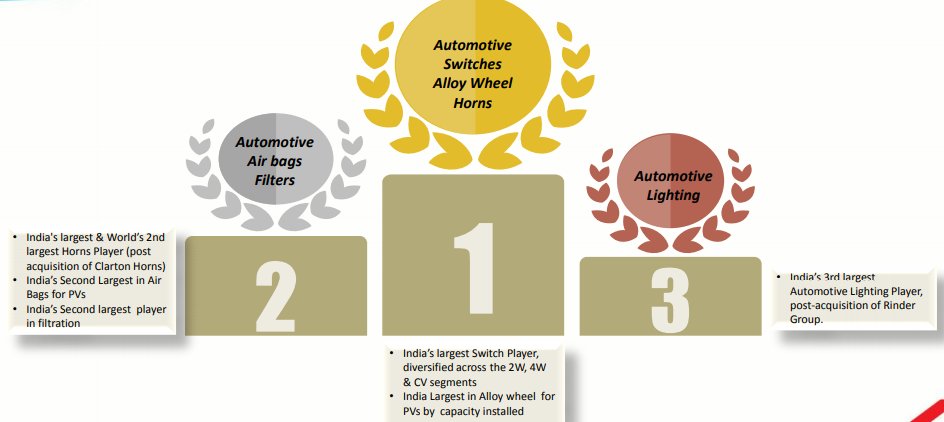

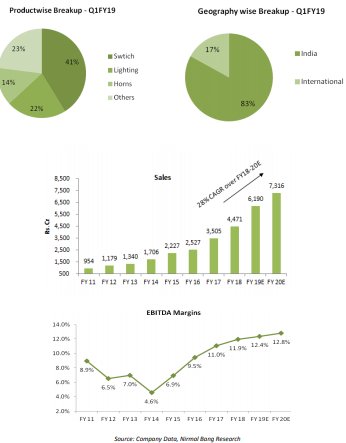

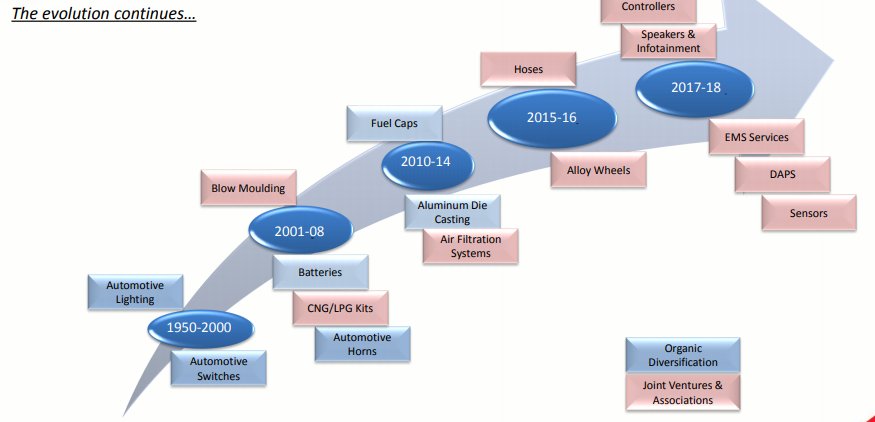

- Big Product Line

- Robust revenue and profit growth

- Products ready for electric cars

- World no.2 in Horns

- India’s largest Switch Player

- India’s 3rd largest Lighting

- Many excellent JVs

- Improving & Best Margins in the industry

- Organic & inorganic growth

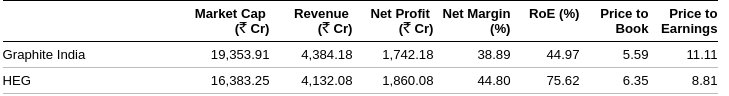

- Graphite electrode demand

- Low supply in the world

- Huge entry barriers

- Crazy Price action

- Lollapaloza effect

- Amazing NPM for HEG and Graphite Ind twins

- 46% stake in US-based General Graphene Corporation

- AA+ Credit Rating

- Brands: Bigboss, Missy, Force, Commando

- Segments: Innerware, Casuals, Thermals

- 10% revenue invested in Branding

- Backward Integration

- Fast growth

- JV with Pepe Jeans - Gymware, tracksuit, Sleepware under Pepe Jeans brandname

- Pepe jeans JV business High Margins

- Focus on Rural: most stores in Tier 3 & 4 cities where competition is low

- Low budget branded fashion

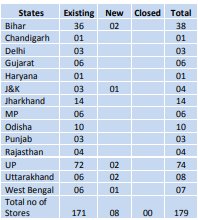

- 180 owned stores

- Most stores in UP & Bihar

- Huge opportunity to be a Pan India brand

- Plans to open total 400 stores by 2023

- Brand Ambasaadors: Ayushman & Bhumi