This has made me feel like I'm a failure or that I can't even manage basic financials...

Maybe it's how I was raised (my parents aren't great either with it) but I consider myself pretty savvy.

Living in places like SF and NY and never saving, living basically paycheck to paycheck. Then I did a coding boot camp and funded most of it off credit cards. Then I moved to NY.

Spending on my CC and thinking I'll figure it out later.

I've always been proactive in TRYING to save. But never found a good long-term solution. Mint.com and things like that don't work.

The only thing that works (for me) is sitting down and having a HARD look at my financials, and doing this often.

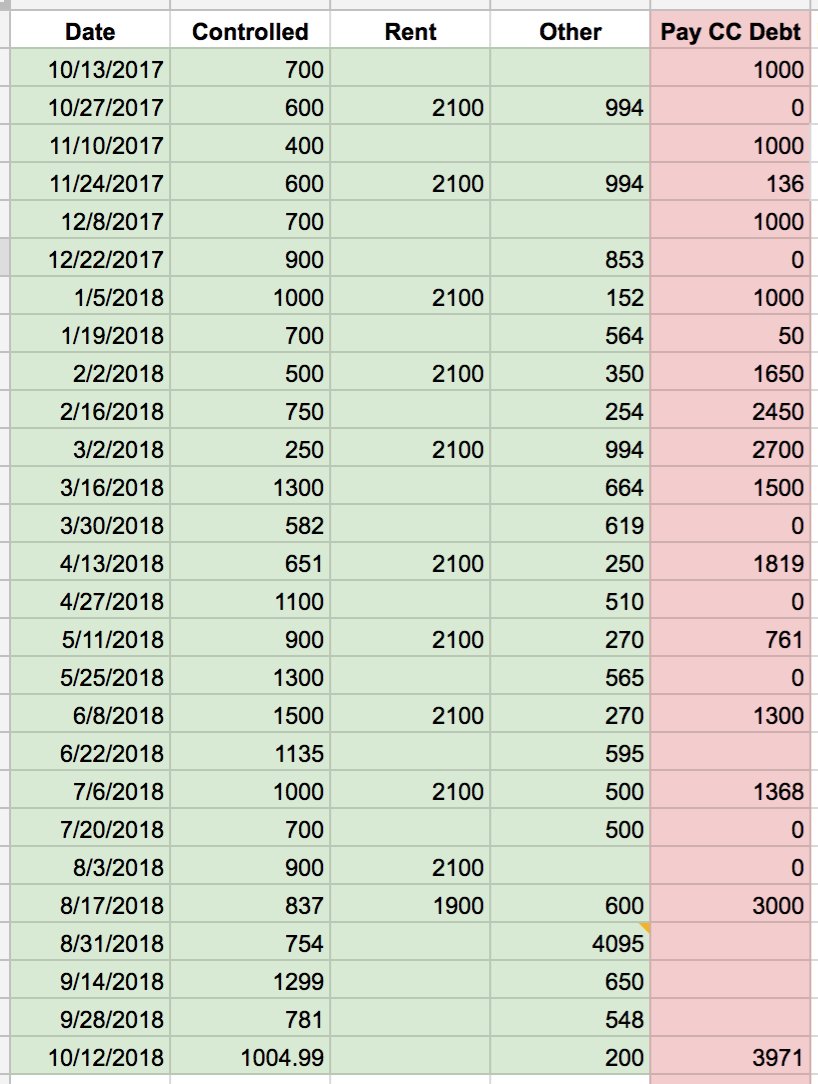

Controlled - Food, drinks, fun, travel, etc.

Uncontrolled - Rent, utilities, payments.

I aimed to spend $500 on controlled/week. I rarely hit that, but having it as my baseline helped a lot.

So no matter what I was at least breaking even.

Any extra money I had in my bank acct I poured into paying off the principal.

It wasn't just saving, I was also making money.

Spending less == going out less == more time to work on important things (like my business) == more money & less expenses.

It's a compounding effect.

But it started to become sort of fun. Because I was tracking everything so meticulously in my spreadsheet, it was like a game.

I looked forward to Fridays and logging all my income/expenses and seeing my progress.

I still have ~35k in student loan debt so hopefully I have an update for you soon on that.

But it feels amazing to be CC debt free! Thanks for reading as always 😁