Well, that is a huge success for the media and the Democrats in atrociously promulgating a fake narrative successfully. I will give you that, because this is an atrocious lie, pure and simple.

(a) Democrats, in cahoots with GOP, put them there for their cronies to begin with.

(b) It doesn't create the kind of class warfare which generates votes from the gullible.

The End

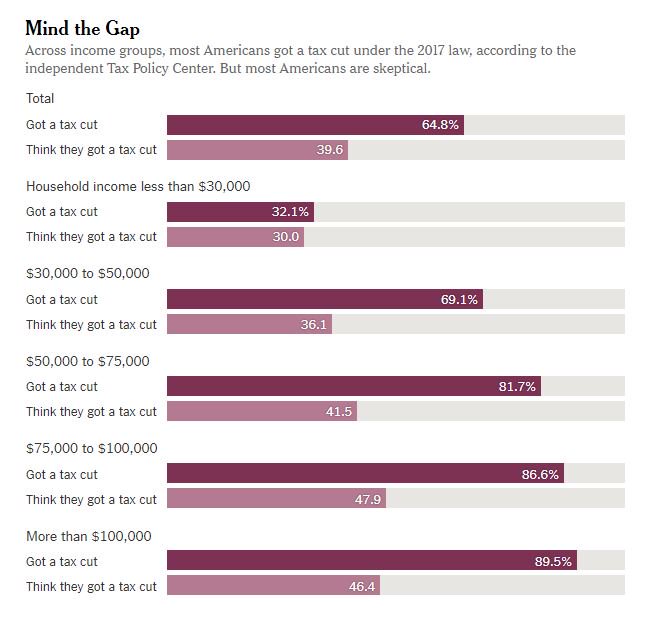

"The Tax Policy Center estimates that 65 percent of people paid less under the law and that just 6 percent paid more. (The rest saw little change to their taxes.)"

Not to gloat, but I wrote this thread on the eve of Tax Reform bill being passed 16 months ago. Read it and see how much of it panned out exactly as I called it.

The high earners in blue high-tax coastal states are definitely suffering from something, but it's not higher taxes. It's envy. You see, they are benefiting less from the tax reform than the rich in low-tax states. And that's why some of them are moping.