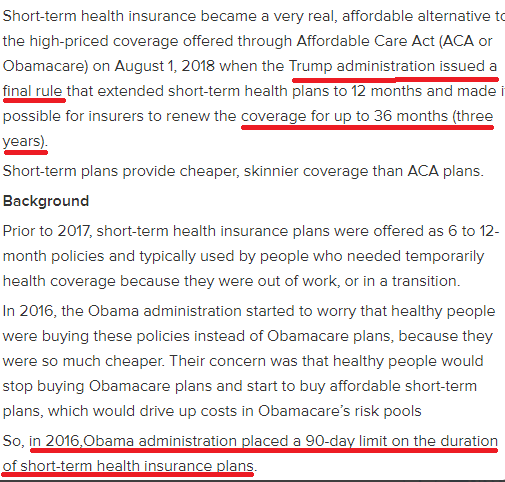

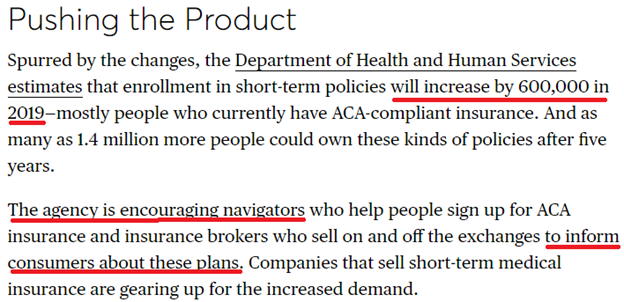

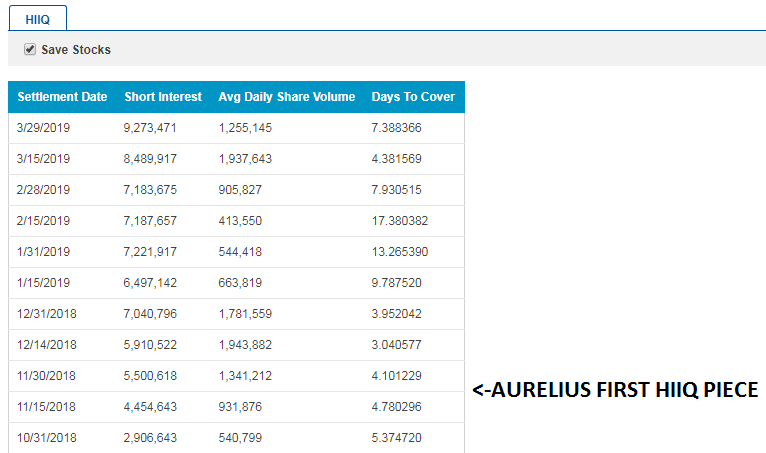

1) ST Medical plans (allowed under ACA) are shady & while cheap, cover almost nothing

2) HIIQ sells ST Medical Plans (25% of 2018 revenue) thru their marketplace

1/

4) FTC and many regulators reviewed the Dorfman situation and none accused $HIIQ itself of wrongdoing

2/

3/

4/

5/

nytimes.com/2018/11/05/us/…

ftc.gov/system/files/d…

$HIIQ

6/

$HIIQ overall GM was 31% in 2018, which trended down from 50% in 2018 from 50% in 2013 - not clear why or what this may have to do with a mix shift towards or away from ST Medical plans.

7/

- $HIIQ has current liquidity of $39M ($9M cash, $30 unused credit facility)

8/

- $HIIQ is forecasting +24% revenue growth and +$15M in EBITDA Y/Y in '19 (even with the "headwind" of dropping Dorfman entities as disty's who were still associated until Nov ''18

9/

Conclusion is bulls 1) are overly-conflating scam-artist Dorfman with $HIIQ, 2) don't realize ST Medical (what's at issue) 10/

$HIIQ he following multiples (while growing 20%+ expected in '19:

13x T12 non-GAAP P/E (P/E)

8x T12 NG EPS (NG P/E),

10x T12 FCF

Est 2019 NG EPS is $3.28, FWIW

12/

- They already settled with 43 states in Dec '18 for $4.3M so that's been accrued and reflected on their B/S as well as settling case with the states

-

latimes.com/politics/la-na…

16/ (sorry, I finished prematurely "that's what CVC said!")

17/

latimes.com/politics/la-na…

latimes.com/politics/la-na…

18/18 (LA Times link again below)

1) These ST plans are legal within the rules of (though not compliant with) ACA

2) Young people esp feel the need (btwn jobs etc) to need ST coverage 19/ $HIIQ

$HIIQ

21/

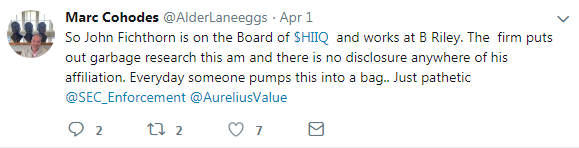

Yeah, i'd say that's who you want on your board:

1) meaningful shareholder

$HIIQ

22/

$HIIQ $TSLAQ

23/

24/ $HIIQ $TSLAQ $TSLA

I'm done with this thread for now I think, @AureliusValue & @AlderLaneeggs. Holster your weapons guys; they were filled with blanks anyway. BOOM.

25/25 /END