We’ve got the latest Tether FUD hot off the presses, investor accreditation debates, Ethereum competition, and some bullish news in what is undeniably a shifting market sentiment.

Buckle up, it’s Long Reads time!

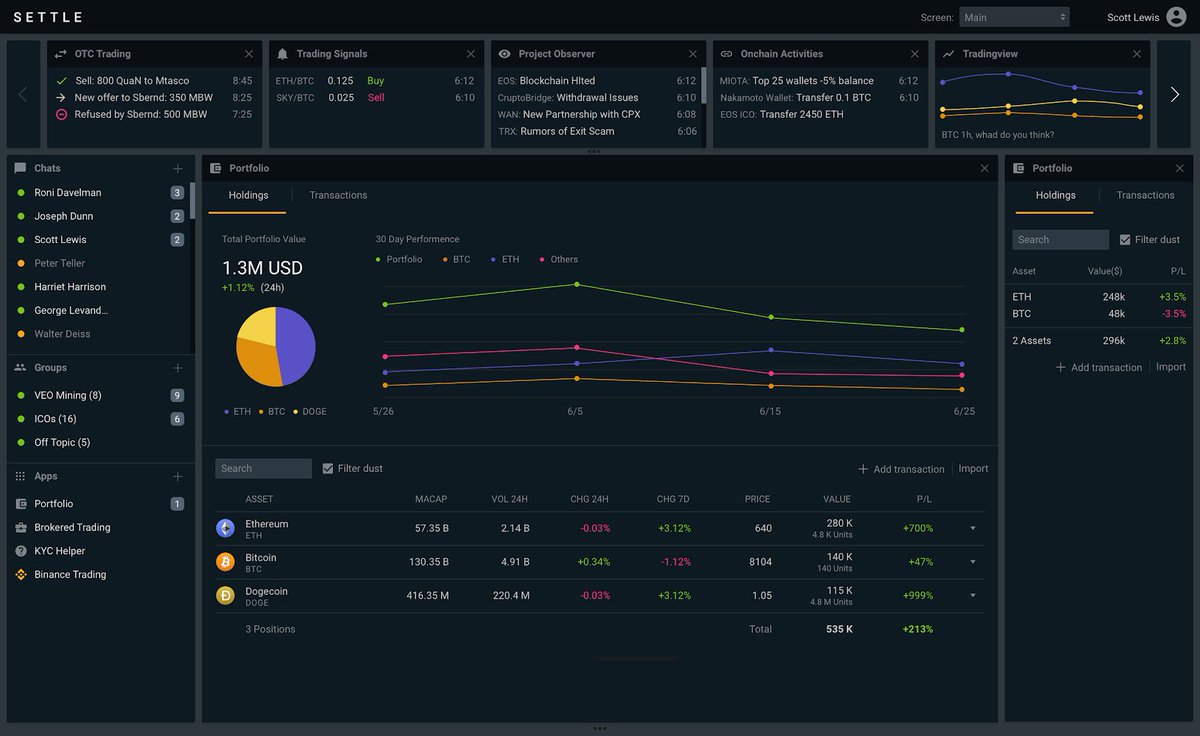

1. The Return of Token Sales

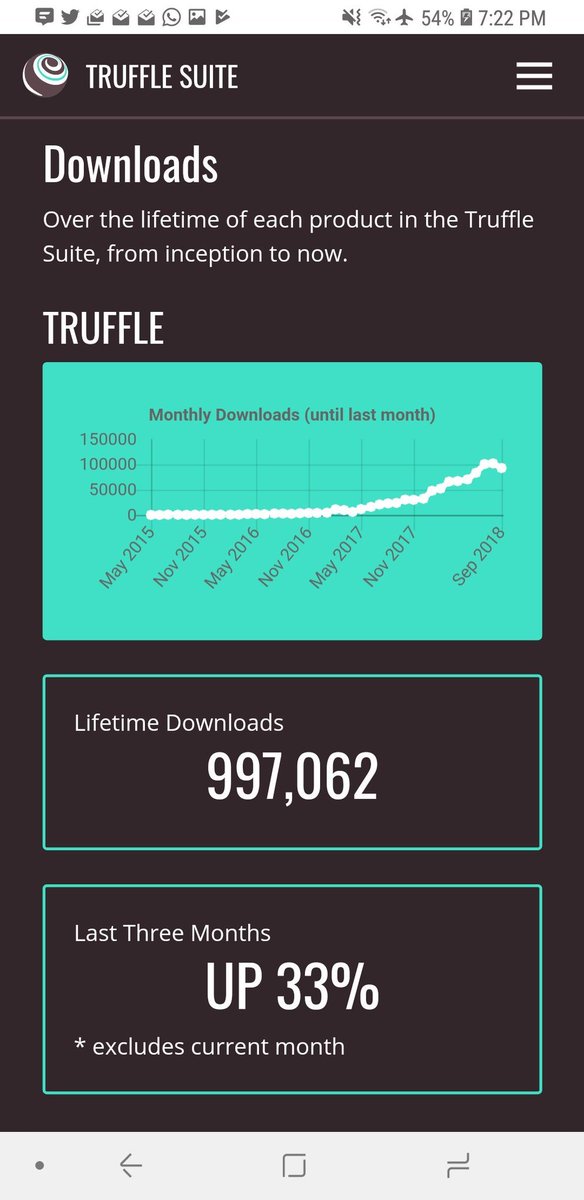

2. Ethereum Competition

3. Governance

4. Fair Launches vs. Dev Incentives

5. Fund Consolidation

First published by @Delphi_Digital

medium.com/@nlw/narrative…

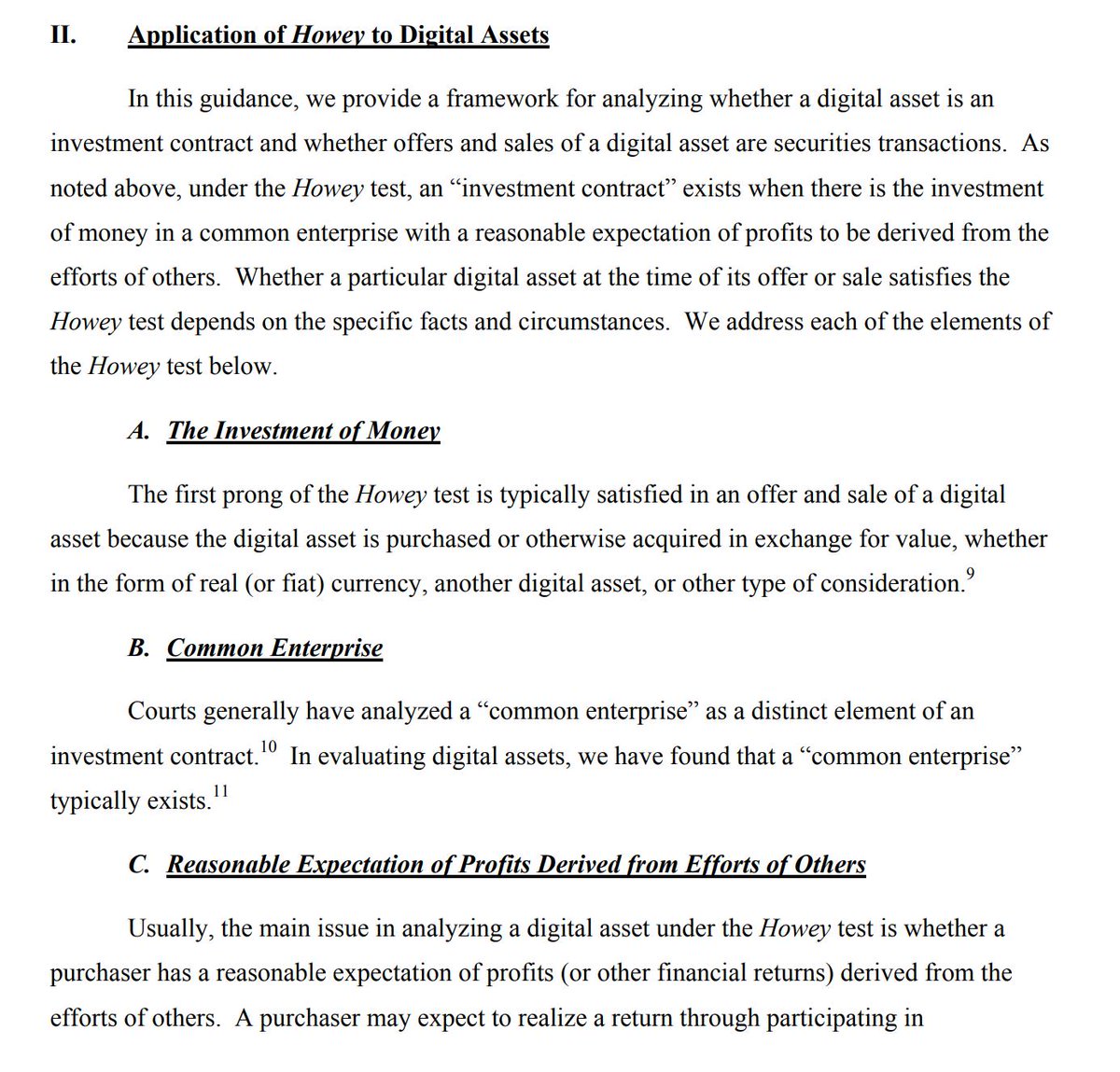

1. Early control of chain might make tokens more likely to be labeled securities

2. Composability and systemic risk

3. Counter party issues