this is not a done deal

Stephen Moore and Herman Cain were supposed to be nominated ... never were

Marvin Goodfriend was nominated ... never confirmed

There are 2 open seats - one goes until 2024, the other goes until 2030.

Shelton has huge monetary ambitions, already lives in Virginia and is financially secure. She could serve until 2030.

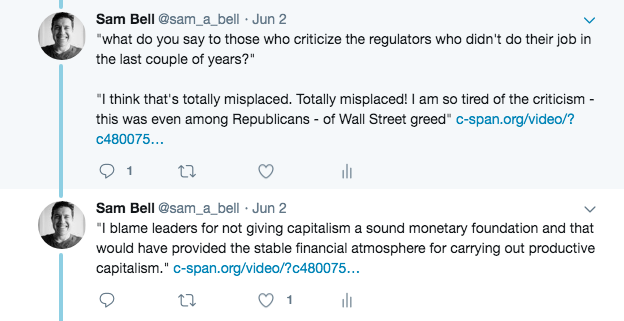

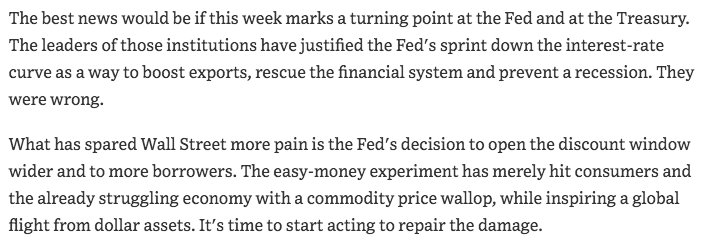

a spot opens up on the Fed and all of a sudden she's talking about cutting rates to 0 as a way to eliminate IOER.

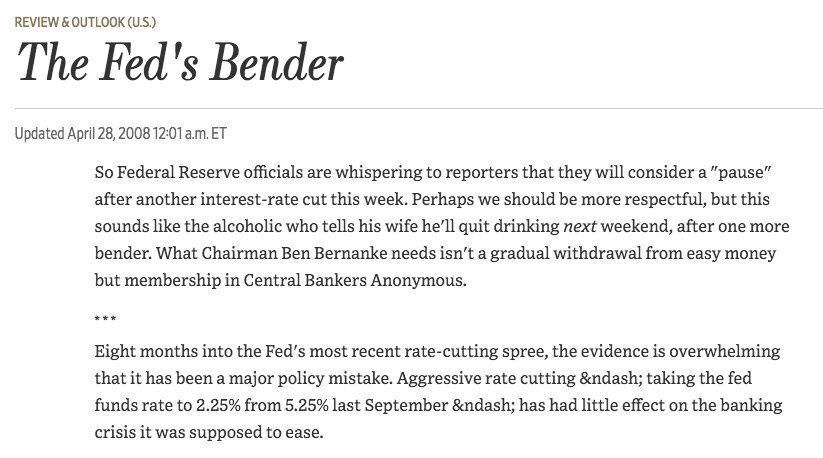

"...it comes as no surprise that Ms. Shelton is often in a minority when the board votes at the European Bank of Reconstruction and Development, although the U.S. is its biggest shareholder." wsj.com/articles/trump…

"But given Trump’s disdain for Powell, Shelton would, if confirmed, represent a potential chair-in-waiting. One administration official familiar with the matter told Bloomberg in July that’s an option once Powell’s term expires, or even before."

Shelton is clearly the Chair-in-waiting. And the wait might not be that long.