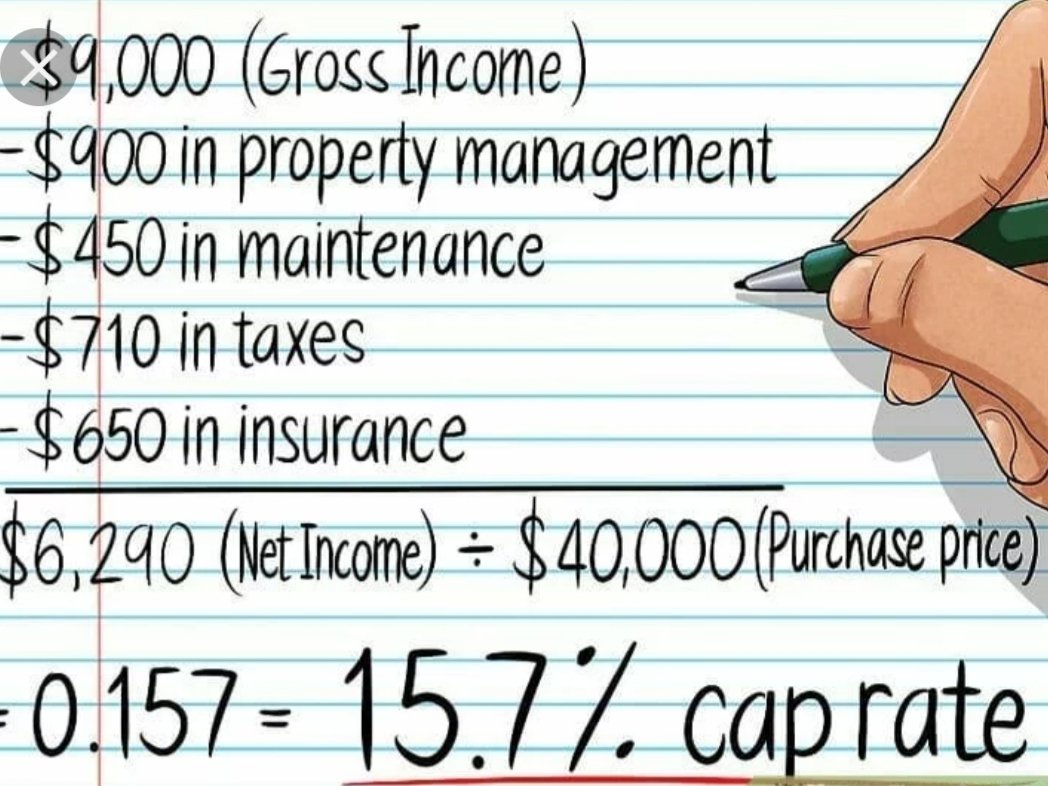

Net Operating Income/

The current value of asset

For real estate acquisitions this means your total cost of acquisition plus rehab/repair expenses (if applicable)

* personal goals and income tax strategies

* the condition, location &/or potential added value

* &/or appreciated value of an income property.

Total asset value

650 × 12 = 7800

I like to take 30 percent off to calculate a conservative net( for closing costs, management, taxes,insurance & maintenance)

7800x.70 = $5460

Next...

Still crazy high. Anything in double digits is highly attractive. Now...

5460/16500 = 33% Cap Rate

Crazy high.