Well, sure. Eventually. The key is knowing when. Here is my guide to the numbers to watch:

nytimes.com/2019/07/28/bus…

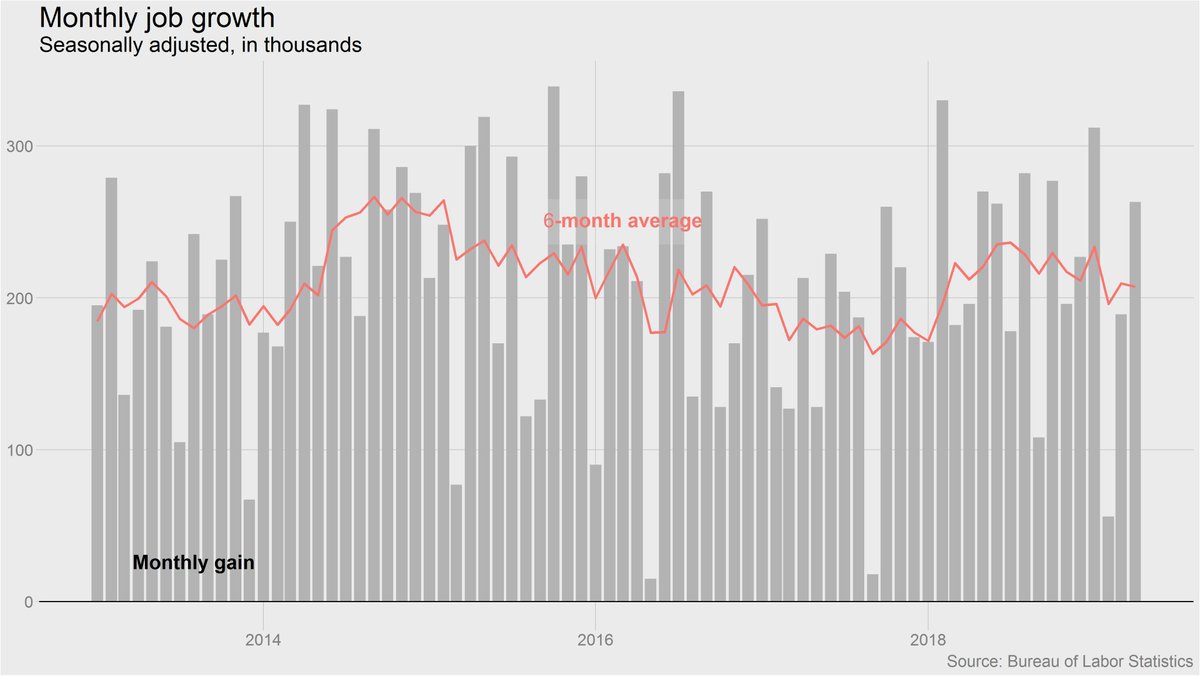

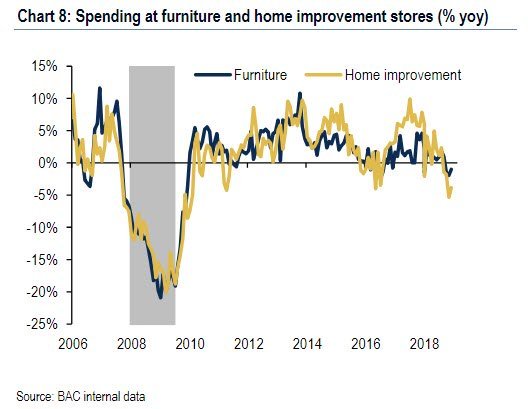

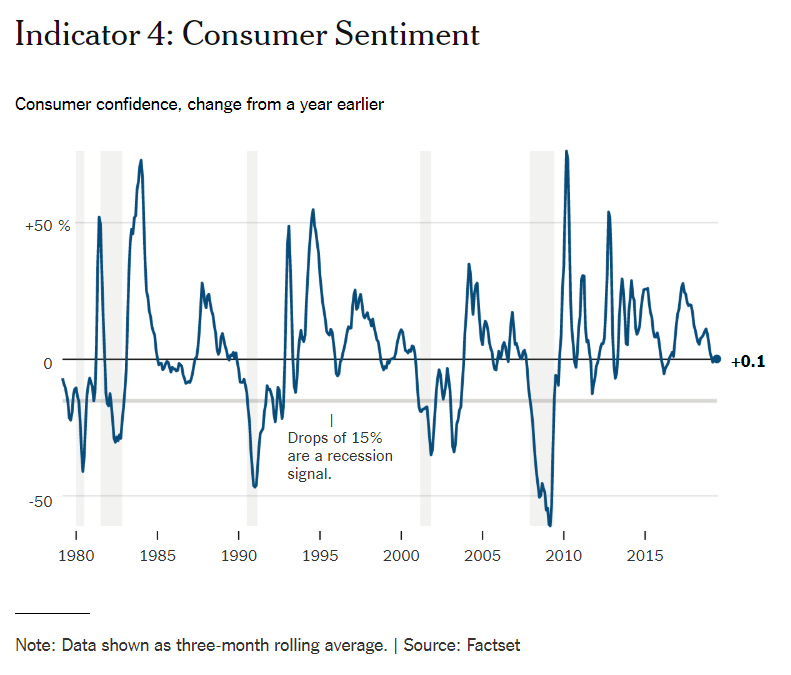

No sign of trouble here right now.

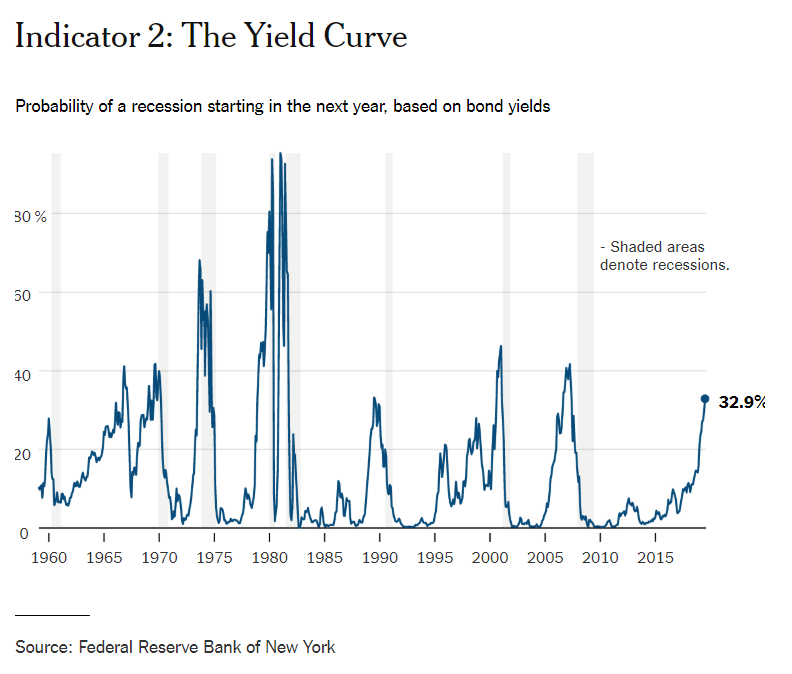

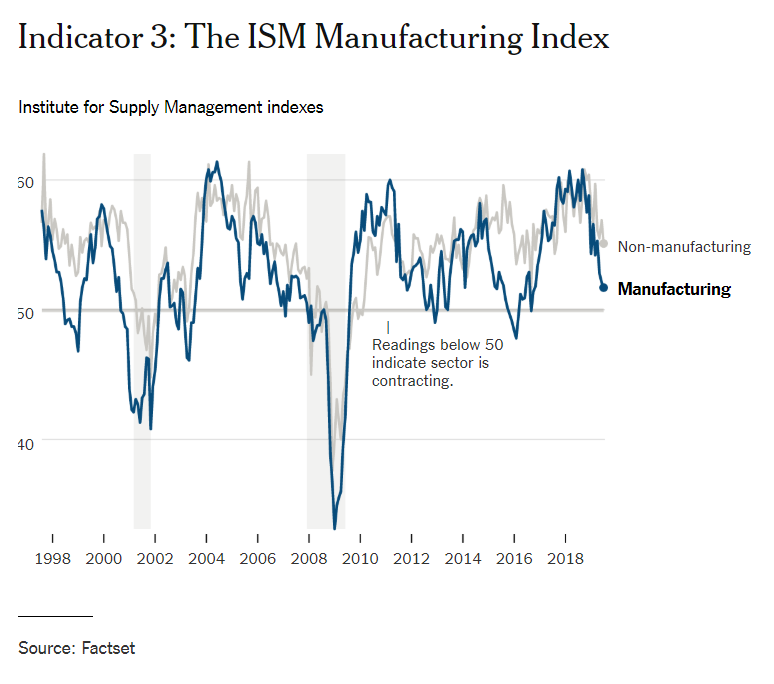

(It's still just over 50 right now, though.)

nytimes.com/2019/07/28/bus…

nytimes.com/2019/07/28/bus…