We’ve got regulatory intrigue, Bitcoin declarations of independence, a convergent macro narrative, and the "dystopian af" use of lasers to avoid facial recognition.

That can only mean one thing...it's Long Reads time! 👇

1) This is still all about Big Tech and Libra

2) calling BS on “banking the unbanked”

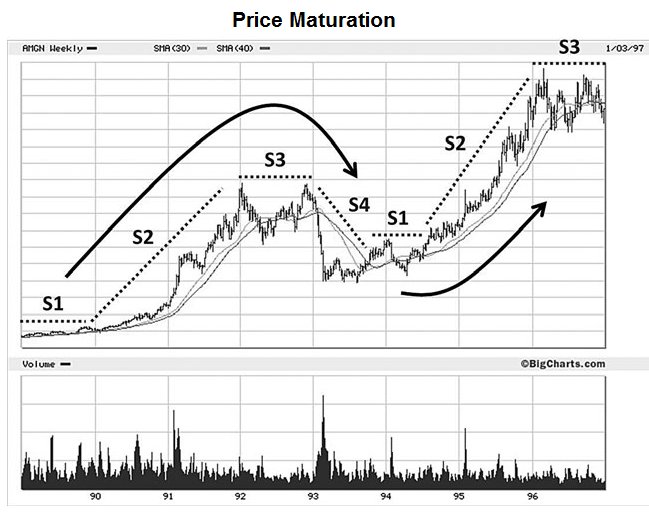

3) the emerging sense of inevitability.

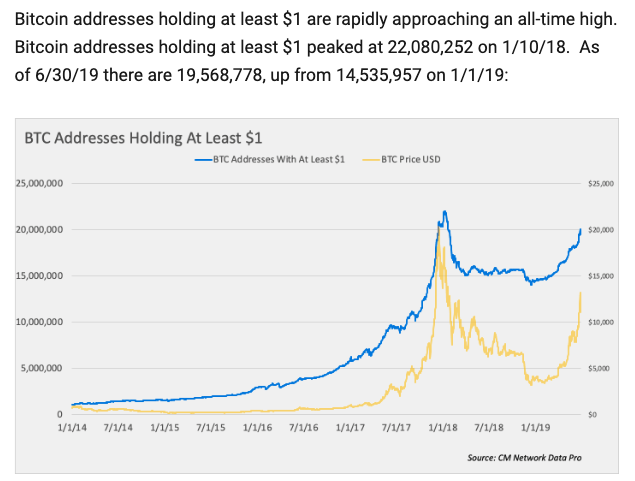

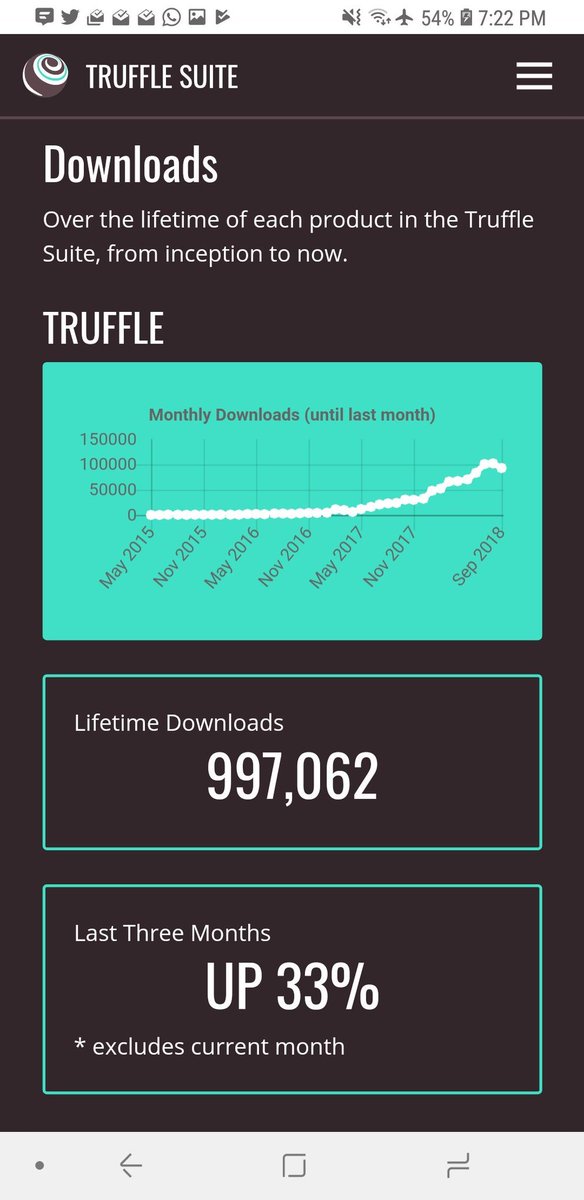

First, that Bitcoin and what it unleashed are an unstoppable force.

Second, that Zuckerberg and Facebook are likely to do whatever the hell they want, so we better adapt.

Start with @HiddenForcesPod for the wider view

Then zoom in to Bitcoin specifically with

See

And