If you want to deliver $1 million in exported goods with a 25% tariff, you pay $250,000 as a U.S. duty.

YOU, the exporter, pay the duty upon arrival at port.

Right now, the answer is no. China is not transferring the vast majority of the tariff cost to the arrival price of the product.

But that's not happening.

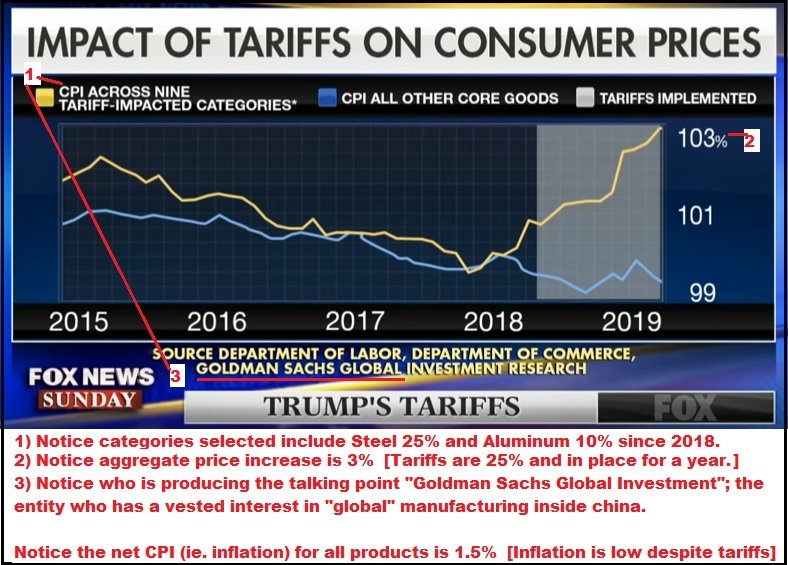

The tariff goods are 2% realized, and non tariff goods are defationary (actually lower prices) by approximately 1%. [We are also importing deflation]

In this example China is paying a 25% tariff and absorbing 23% to keep prices low.

Why and How would they do this?...

First, by directly subsidizing the industry affected by the tariff. The CCP or Bank of China literally pays or underwrites the export cost to the corporation.

Dollars, with higher value, buy more stuff backed by Yuan.

It costs the importer in the U.S. less dollars to buy the same amount of stuff from China.

Note: The EU is now doing the same thing; for the same reason.

However, as an outcome of the devaluing, the non-tariff exported product also costs less. It takes less dollars to buy the non tariff goods also.

As long as there is a trade deficit with the country doing the devaluation, we will import deflation on non tariff products.

washingtonpost.com/business/2019/…

The exporter pays the tariff upon arrival in order to be allowed to offload product into the U.S. market.

In the current situation China is absorbing 23% of that 25% tariff and NOT raising the price.

Because those currencies are pegged against the dollar, the resulting effect is a rising dollar. IMF not happy.

mobile.reuters.com/article/amp/id…

[Note I use the term *exfiltration* because it better highlights that American mfr corporations paid tariffs to access EU and Asia markets]

Name one other individual who could take them on simultaneously and still be winning.

Pretty friggin' remarkable.

"complicated business folks, complicated business"...

Incredible.