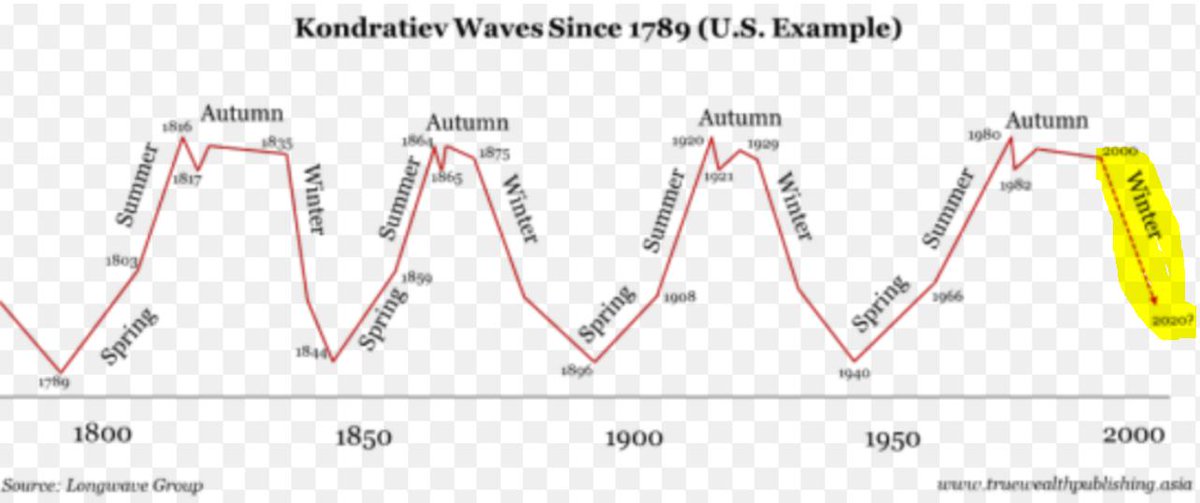

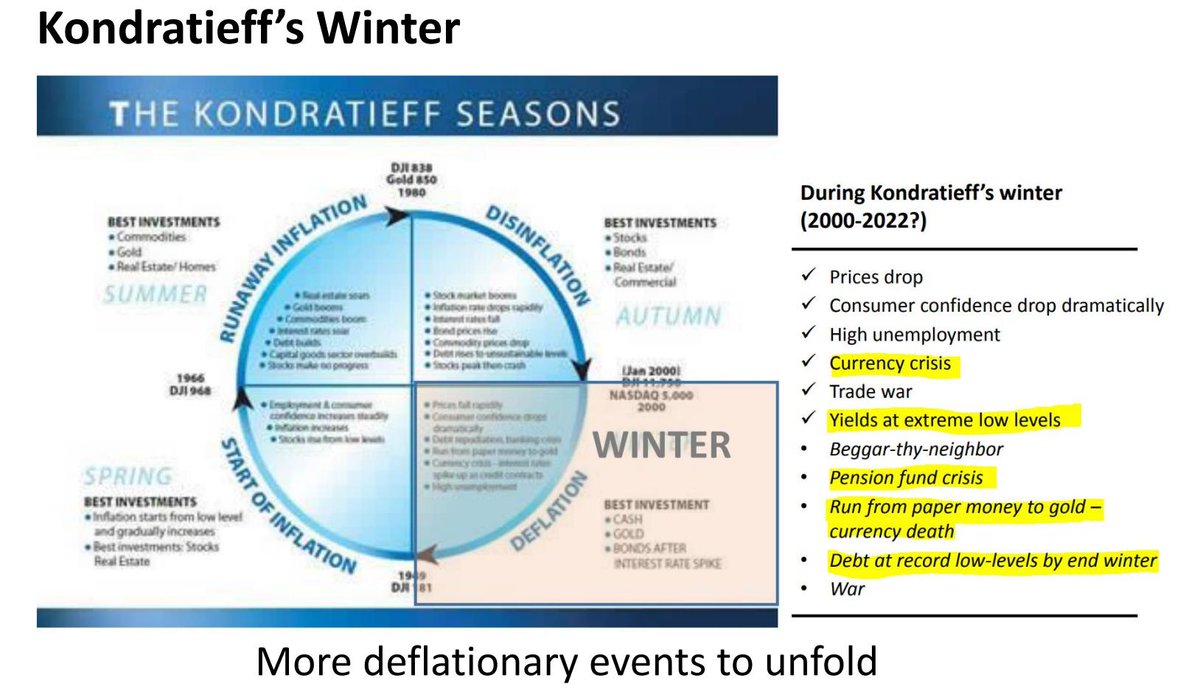

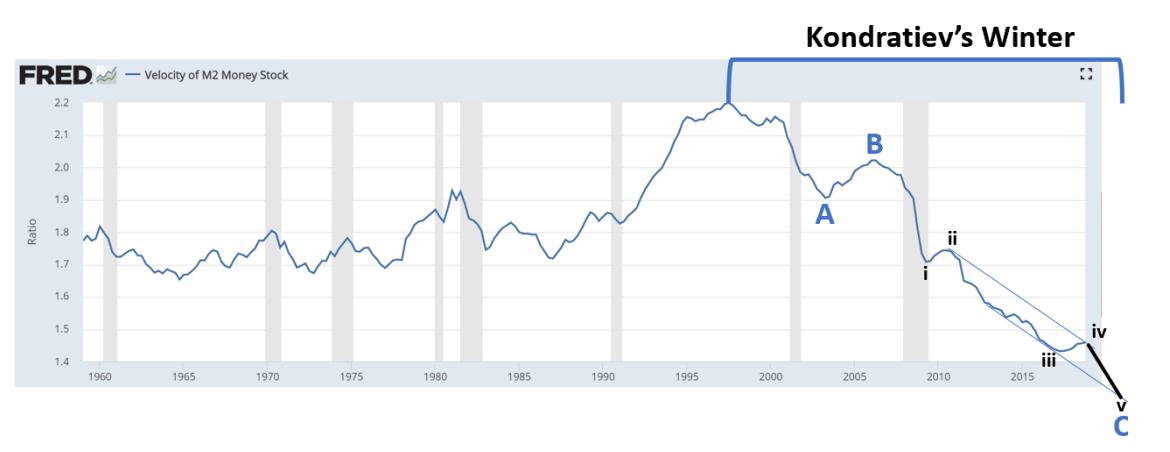

In English, UK Government can currently borrow from markets more cheaply over a decade than it can over 3 months or two years... Rare - normally signals market expectation of weak growth/ recession.

Also seen in US today for first time since 07...if these signals are right, a storm is brewing in global economy, just at the very time UK political crisis resumes: (via @business )