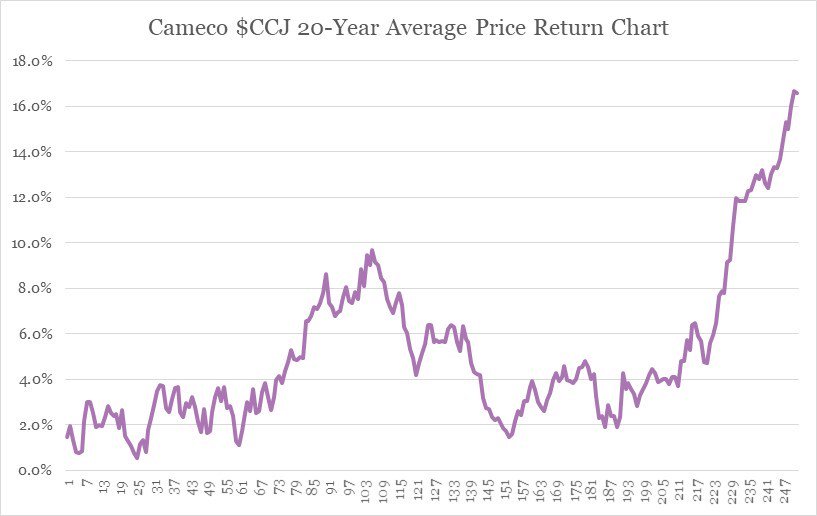

Some might have seen a @cameconews seasonality chart based on the last 20-years of trading. Like the one included here.

Looking at this chart, one thing stands out: buy $CCJ just ahead of the Q4 rally $URA

The thing about averages, however, is that they reveal less than what they cover.

$URA #uranium

#uranium

#uranium

#uranium $CCJ $CCO $URA