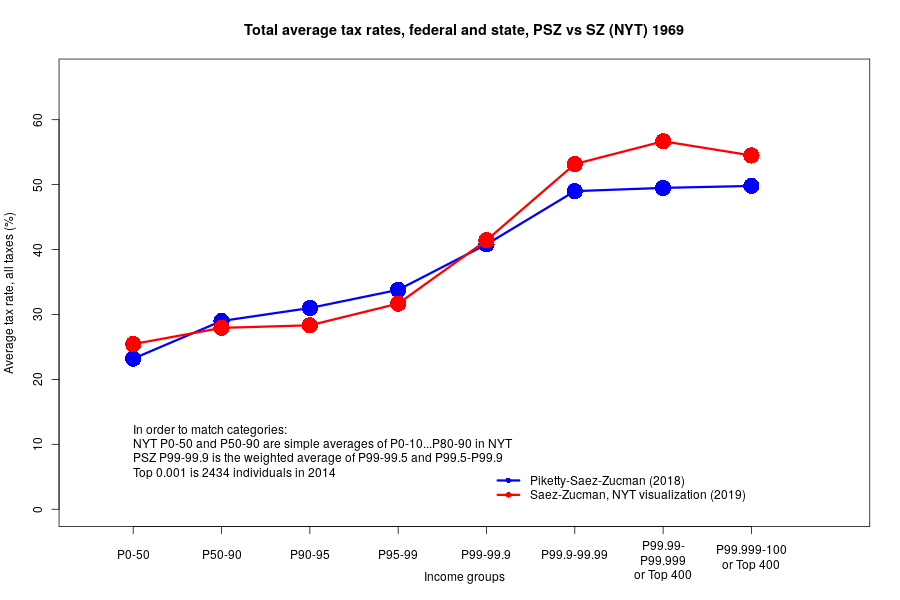

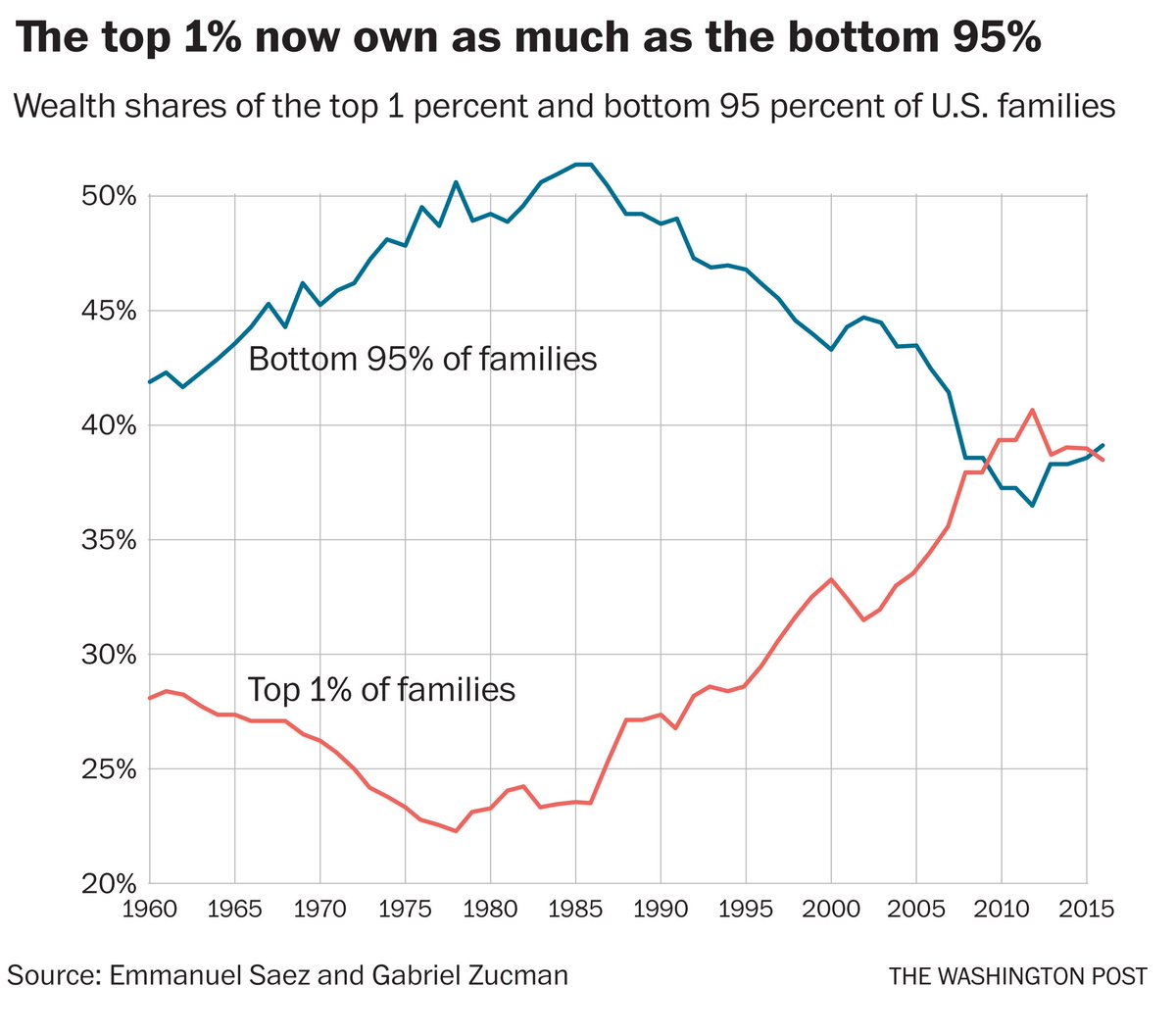

1) Measuring income is hard, many categories both at the top and at the bottom are not easily observed and assigned (pensions, corporate retained earnings, transfers, retirement accounts, tax evasion etc.)

I'm chilling out for the next few tweets as @DinaPomeranz gently suggested and @dynarski demanded.

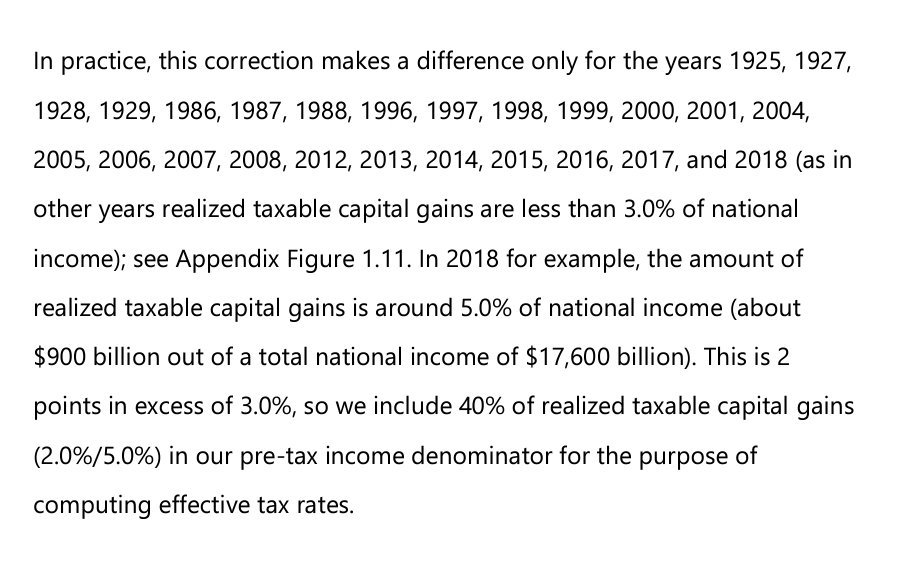

1. the original QJE paper stops there too

2. 2018 is a projection, tax filing deadline for individual taxpayers who requested an extension (common) is tomorrow