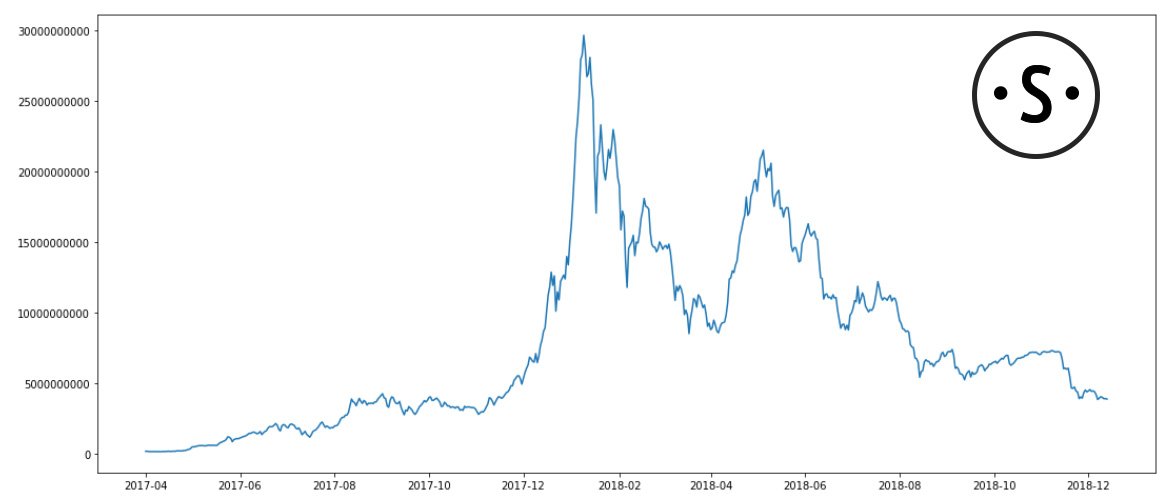

If so, how does trading $BTC only on (historically) the best days compare to simply #HODLing?

Check out our full analysis here! tinyurl.com/y6z55ulw

[explanation continued in comments]

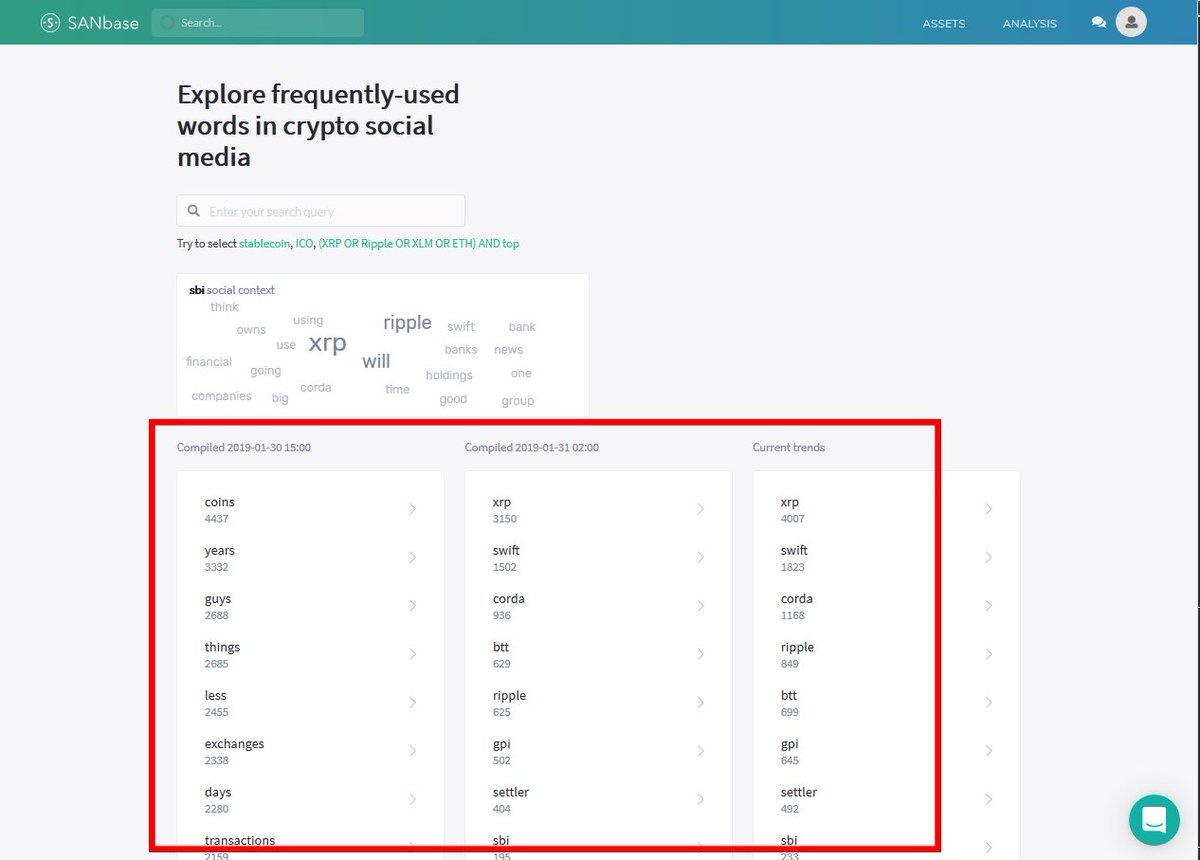

Monday and Saturday emerge as clear winners, with average returns of +0.69% and +0.5%, respectively.

Wednesday, Thursday and Sunday all returned neg. values for the past 2 years. To date, Weds proved to be the worst performing day.

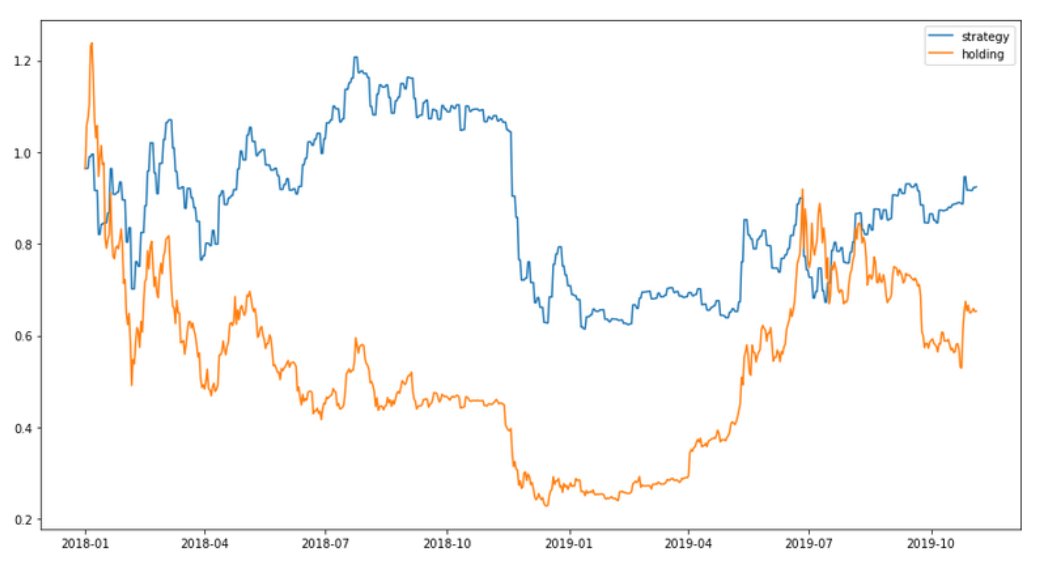

Here’s how our $BTC portfolio would have performed if - starting in 2018 - we only bought @Bitcoin on Mondays and Saturdays and sold at the end of the day:

Unfortunately for our model, the infamous drop at the end of 2018 happened to be on a Monday, making the comparison a bit tighter than it would’ve been otherwise.

Annualized Sharpe ratio of our strategy was 1.65; for holding, it was 1.35

The strategy reduced volatility substantially and improved risk-adjusted returns.

To eliminate it, instead of testing our day strategy back, let’s try and test it ‘forward’ - starting in 2018, and using data from the previous 2 years (2016-2018)

Here are the results of that day strategy from January 2018 onwards:

That’s why we created a ‘daily performance’ template, where you can find the best trading days for any coin in the Santiment database - docs.google.com/spreadsheets/d…

Those costs would chip away at the projected returns, narrowing the gap between the outlined strategy and our benchmark in reality.

If you’re already an active trader, it could help offset some of #crypto’s volatility, and warn you of days when odds have been stacked against in the past.