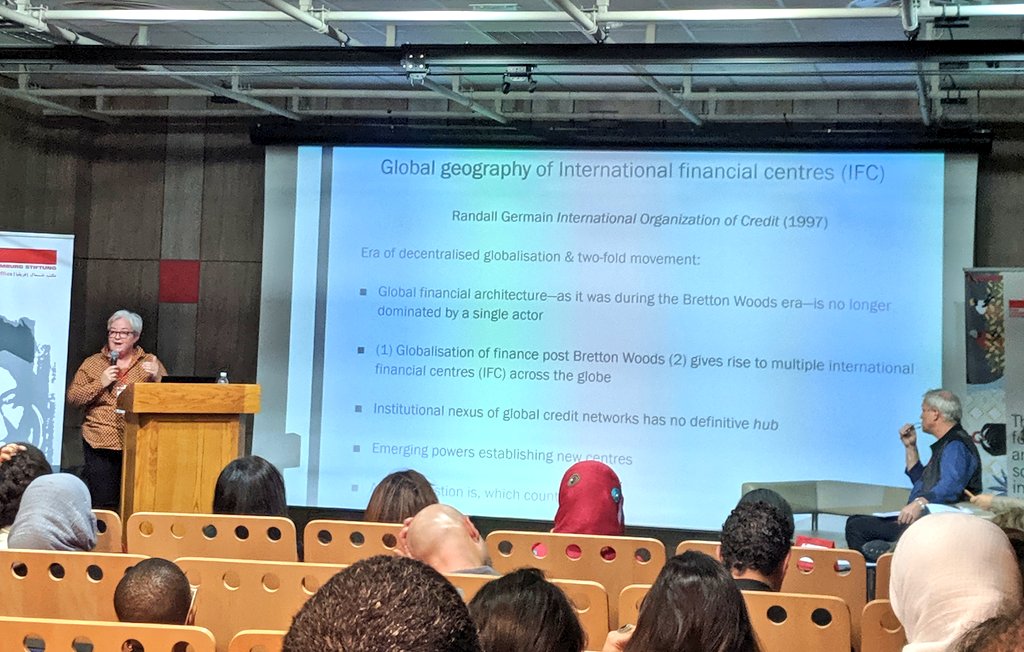

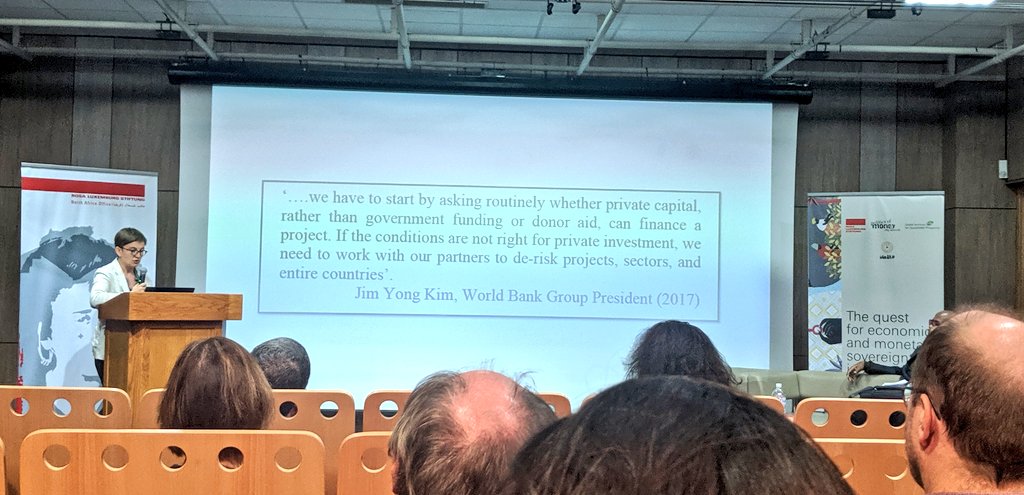

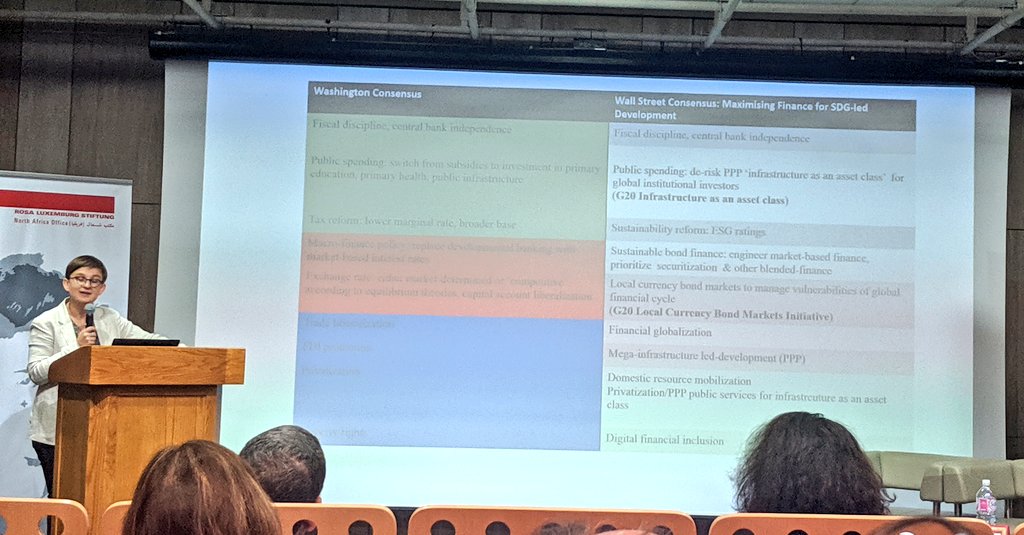

Today someone defined monetary sovereignty as being able to borrow in your own currency. Gabor warns that this may not hold as much "sovereignty" as you might think.

#AfricanMonetarySovereignty #MES_Africa2019

#AfricanMonetarySovereignty #MES_Africa2019

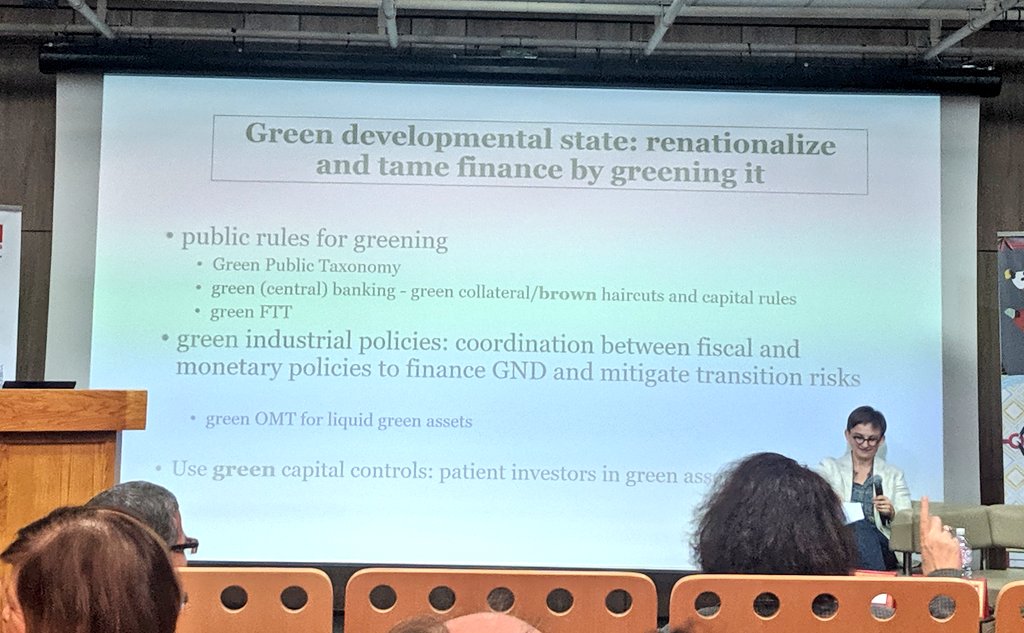

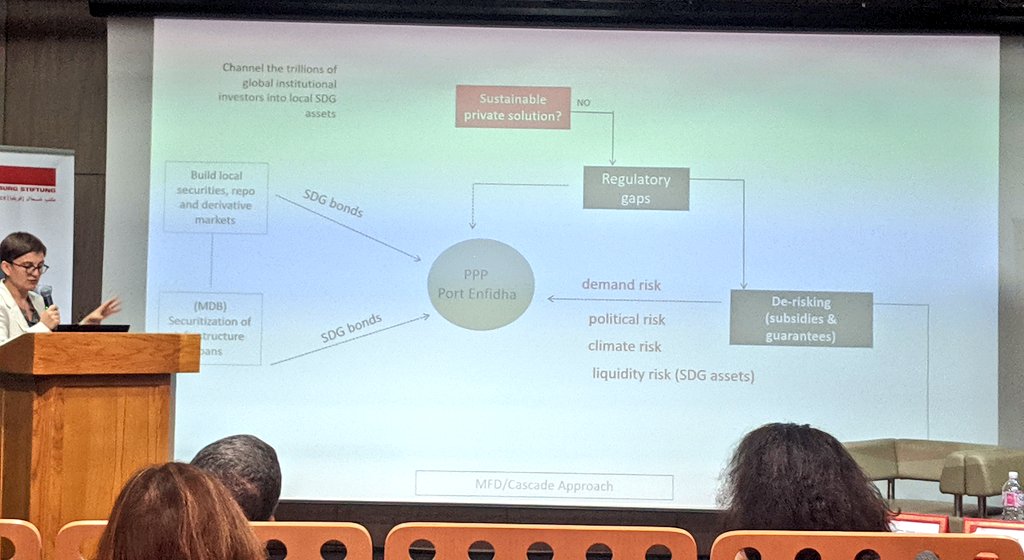

@DanielaGabor calls this a movement "from accumulation by disposession to accumulation by derisking".

#AfricanMonetarySovereignty

#MES_Africa2019

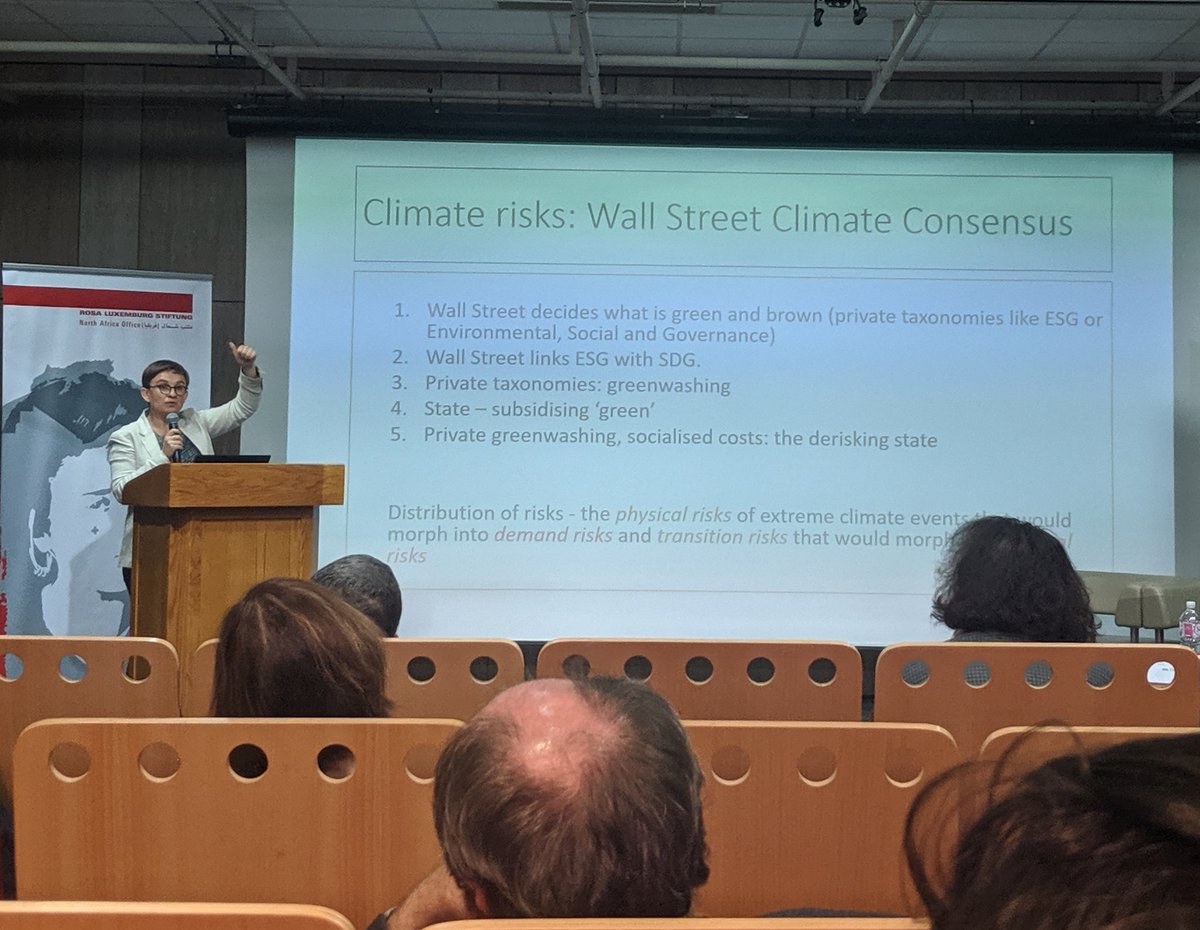

#AfricanMonetarySovereignty #MES_Africa2019 #wallstreetconsensus

#AfricanMonetarySovereignty

#MES_Africa2019

#AfricanMonetarySovereignty #MES_Africa2019

#MES_Africa2019

us.boell.org/2019/10/11/sec…