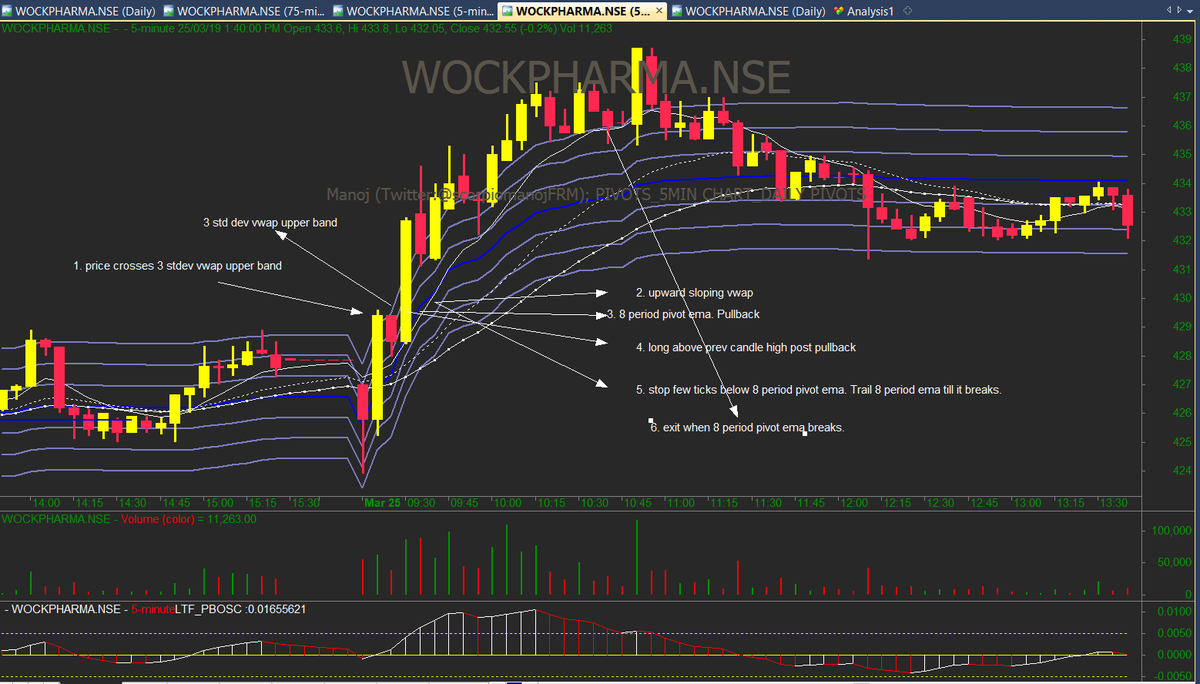

Strong R if 10d SMA also confluent w/

1 pivot/R1/R2

2 fib .38 .50 .61

3 day/wk S/R

4 S/D

5 POC/VAH

6 trendline

7 it's coming😎

10d SMA only works for $SPX for now in a relentless rigged fake trade deal & fake translation period

For highly trending stocks, I found 20d SMA (confluent with other S/Rs) would be good

For choppy stocks, 50d SMA

Use MTF for trend detection - trend is your friend

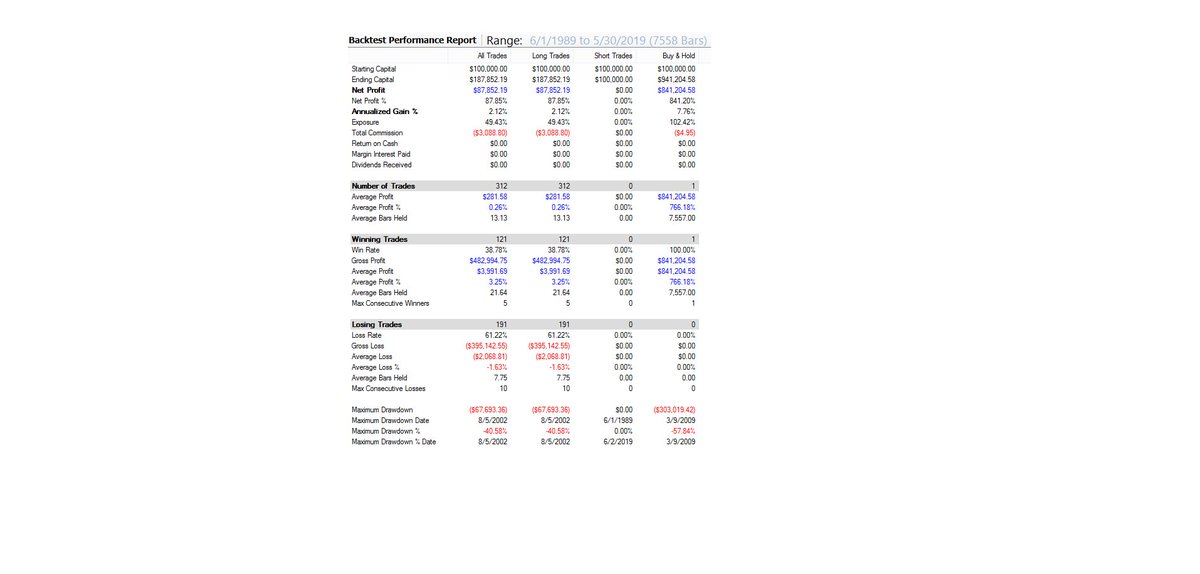

So before each trade, set your profit target & stop loss making sure R/R>2 for short-term day/swing

Even you only have 50% win rate, you're still way ahead

Of course, you will have at least 80% win rate if rules are followed😎👍Emotionless

1 probability

2 psychology

3 discipline

4 confluence

If one lacks an edge in trading, forget it

Probability has to be on one's side from past data analysis

Discipline & risk mgmt are must with controllable emotions, no fear & greed; just data dependent

Be contrarian to these advises

If everybody tell you the same, hmm blow-off top & #Volmageddon is around the corner; all-in one sided trading like record short VX

The greatest contrarian indicator

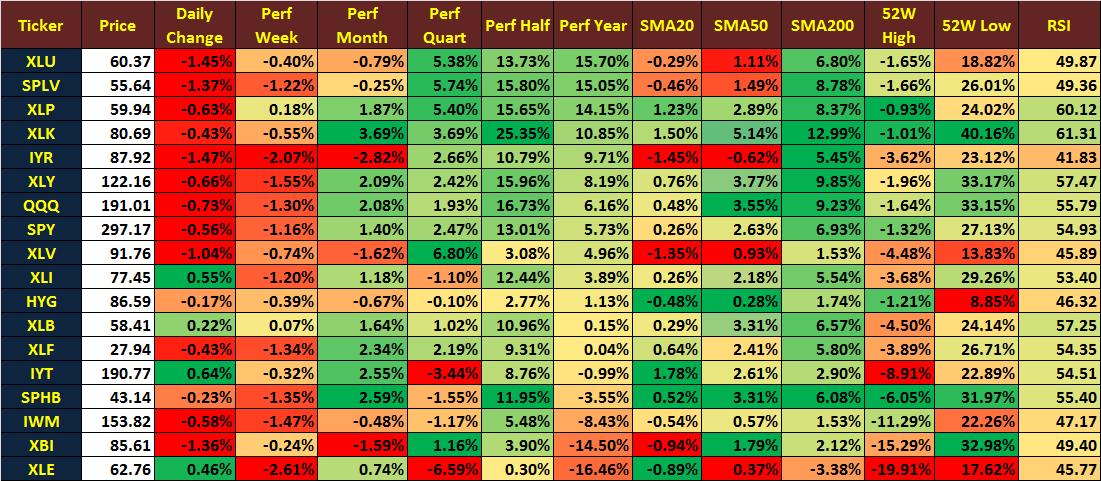

Today's $SPX 10-day SMA is around 3070.

Trade accordingly. 😎