@AGelpern @MattHGoldmann @astridiversen @mweidemaier @colbyLsmith @RobinWigg @TimRSamples @KPatricio1 @Martin_M_Guzman @ManuelidesY @jzettelmeyer @Brad_Setser @PIIE 1/18

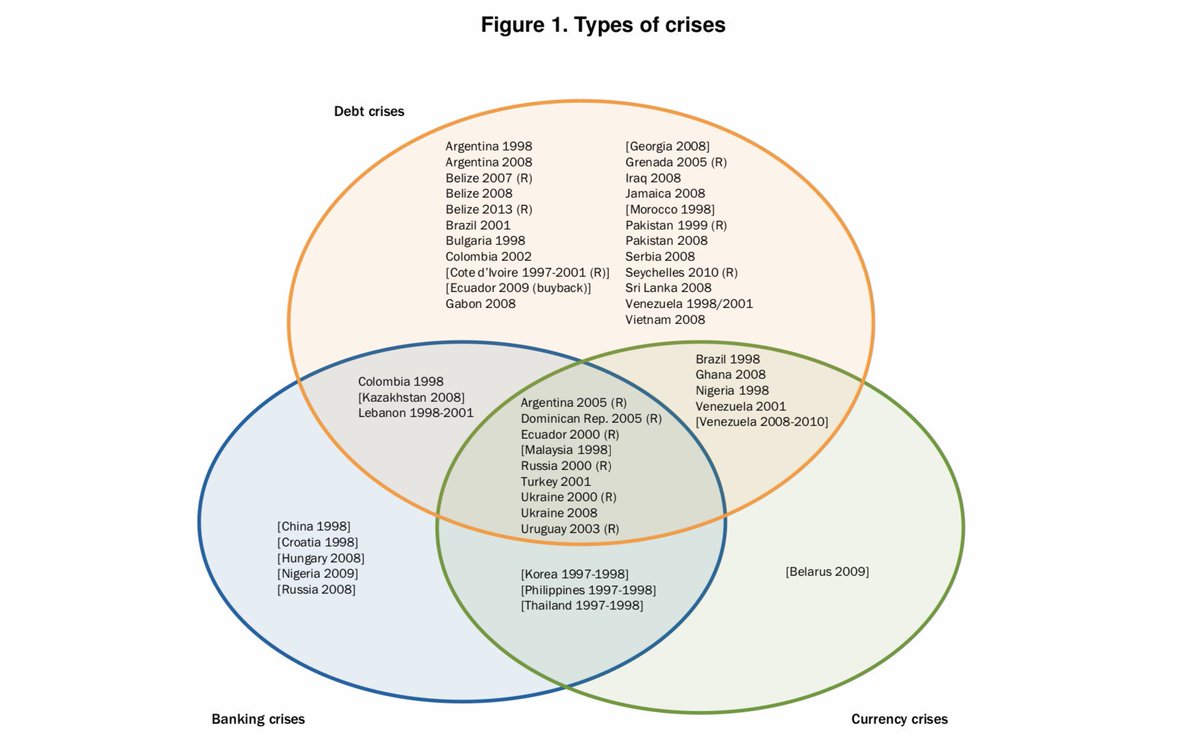

1)Domestic debt,

2)International sovereign bonds,

3)IMF loans, and

4)Credit facilities with multilateral and commercial financial institutions. 4/18

Another legal issue to be considered is that "Kirchner bonds" have almost the same pari passu clauses as the infamous 1994 FAA that was the basis for the NML v. Argentina litigation (see FT article below).

ftalphaville.ft.com/2013/08/23/161… 14/18

creditslips.org/creditslips/20…

creditslips.org/creditslips/20…

creditslips.org/creditslips/20…