THE ULTIMATE GUIDE TO BITCOIN + CRYPTO 2019 RECAPS and 2020 PREDICTIONS.

You asked for it, so here it is - all of the best insights on the year that was and the year to come. Strap in team, this is going to be a good one!

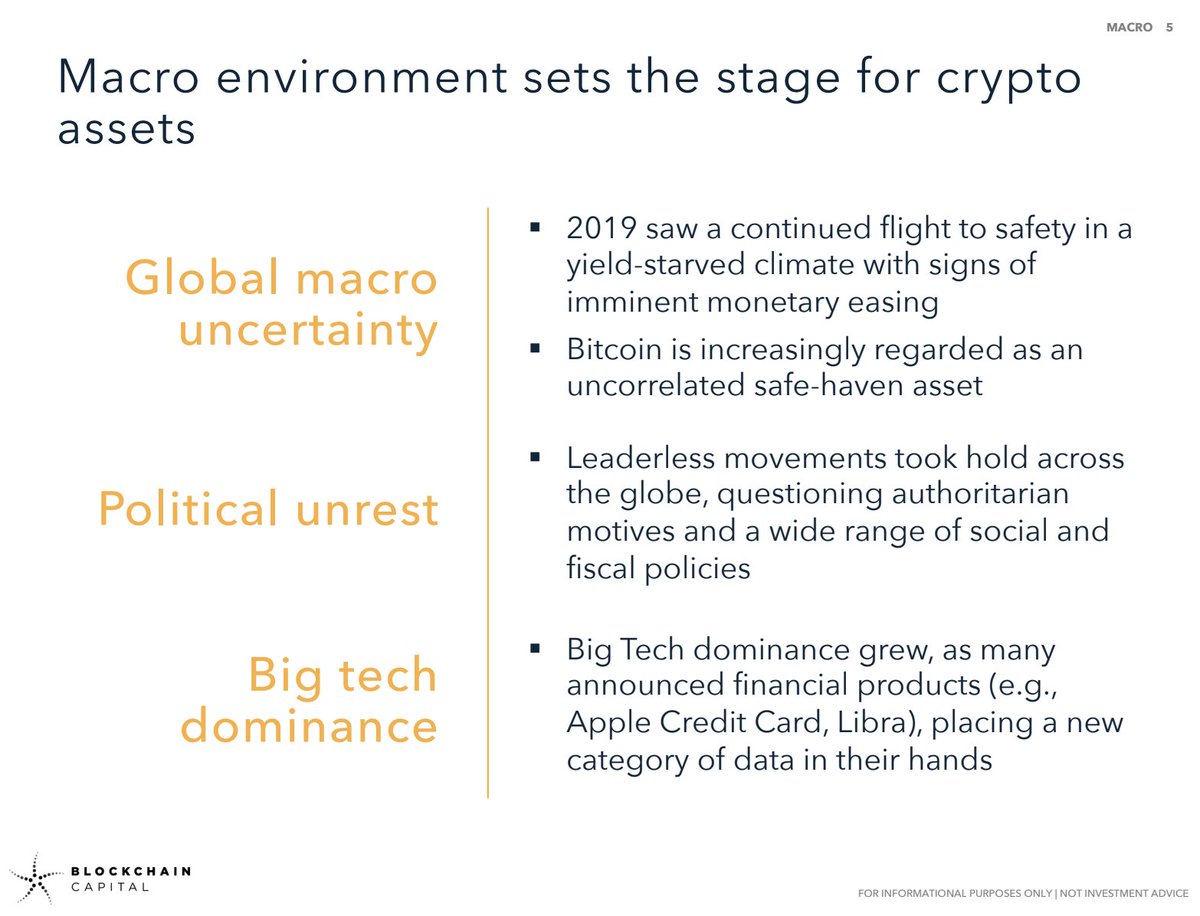

See also: @AriDavidPaul reflation hedge coindesk.com/with-so-much-d… and @jalak on the central bank biz model coindesk.com/the-central-ba…