But data totally upbeat in December for China trade!!!

a) Cancellation of tariffs Trump escalated in August 2019 in tweets - yep, he did that - of consumer goods that he didn't have to stomach to raise👈🏻

b) Floor to deterioration of US-China relationship & put trade-war behind it in 2020👈🏻

Plus, Trump was credible in escalation so better not leave to chance. What it gets is what we've seen in Q4 - improvement of sentiment 👈🏻

a) A trade-deal for 3 Nov 2020 to show progress (see details above)

b) Not having to raise tariffs on consumer goods that'd hurt his base & hurt his 2020 chance

c) Having a dovish Fed + trade-war fading

d) Tariffs ON & supply chain reshuffling ON👈🏻

FED CUTTING RATES BY 75BPS & EXPANDING BS.

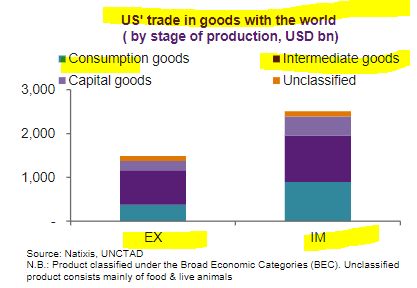

Yes, & my thesis has always been that trade-war has a lot of bark but less bite than the Fed, e.g. the USD. Fed wire is ~700-800trn per year! Trade-war is what? 320bn?

As I said, Phase 1 trade-deal in Jan 2020 looks like H2 2019 so no change except Fed rate cuts 👈🏻👈🏻