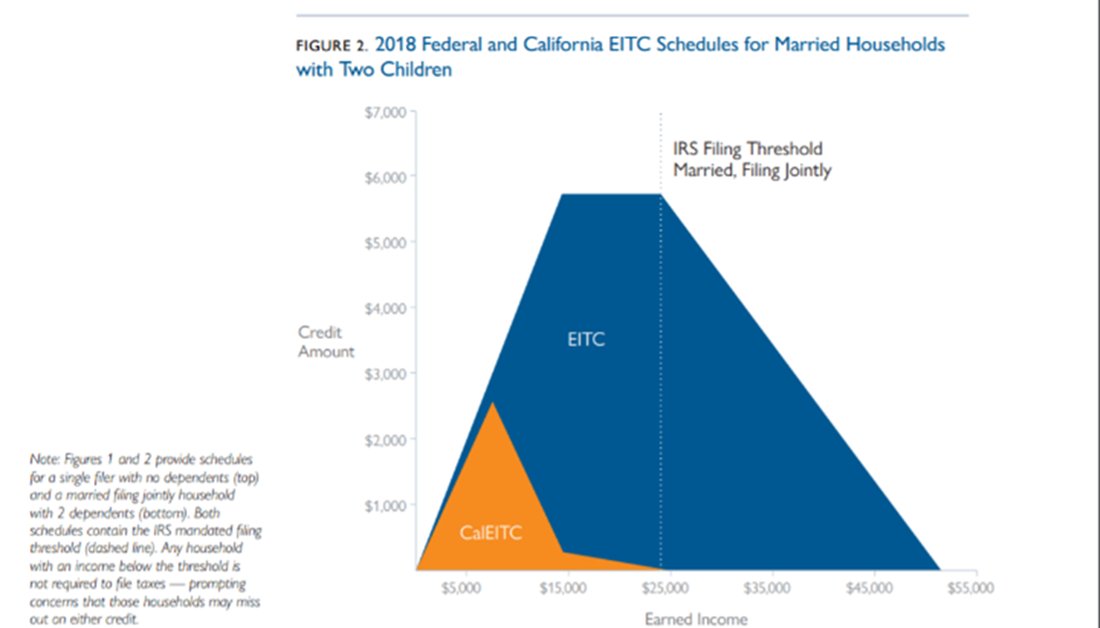

Can informational "nudges" about the #EITC and #CalEITC increase tax filing and claiming rates for the credits?

bit.ly/IncreasEITCs (1)

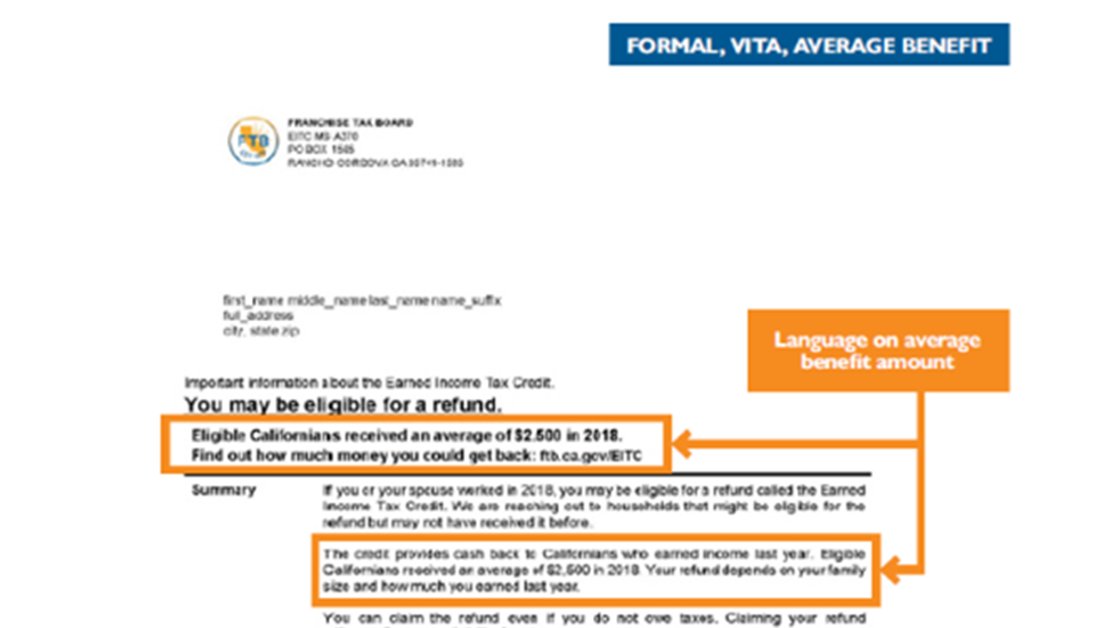

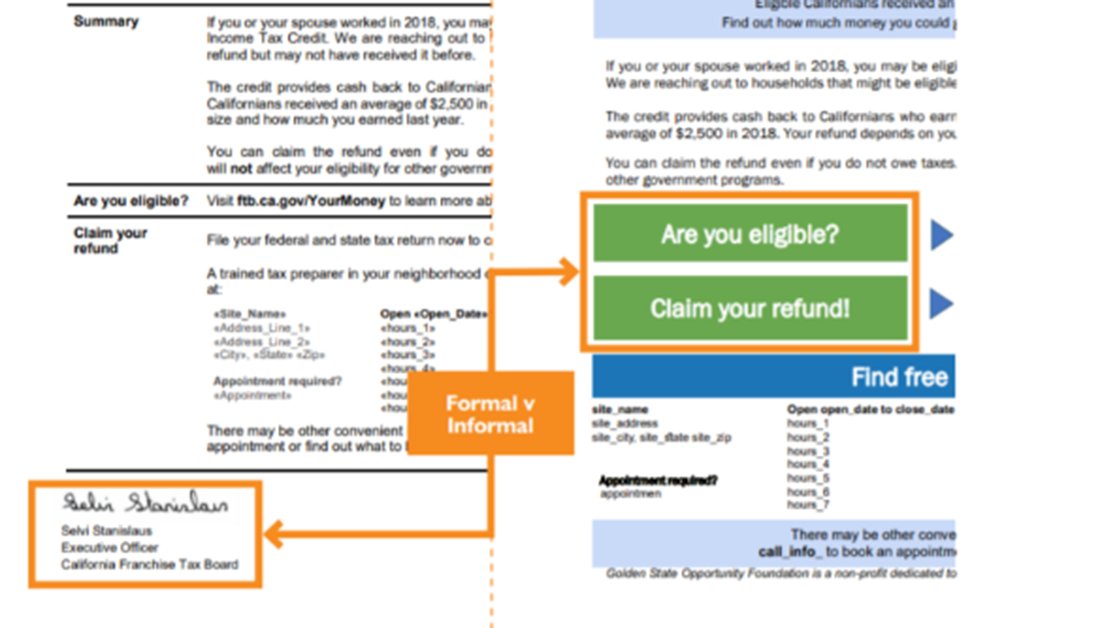

-Letters vs. text messages

-Government vs. non-profit messenger

-Formal vs. informal letters

-Info on how to file vs. value of credit

-Average vs. personalized credit amounts bit.ly/IncreasEITCs (4)

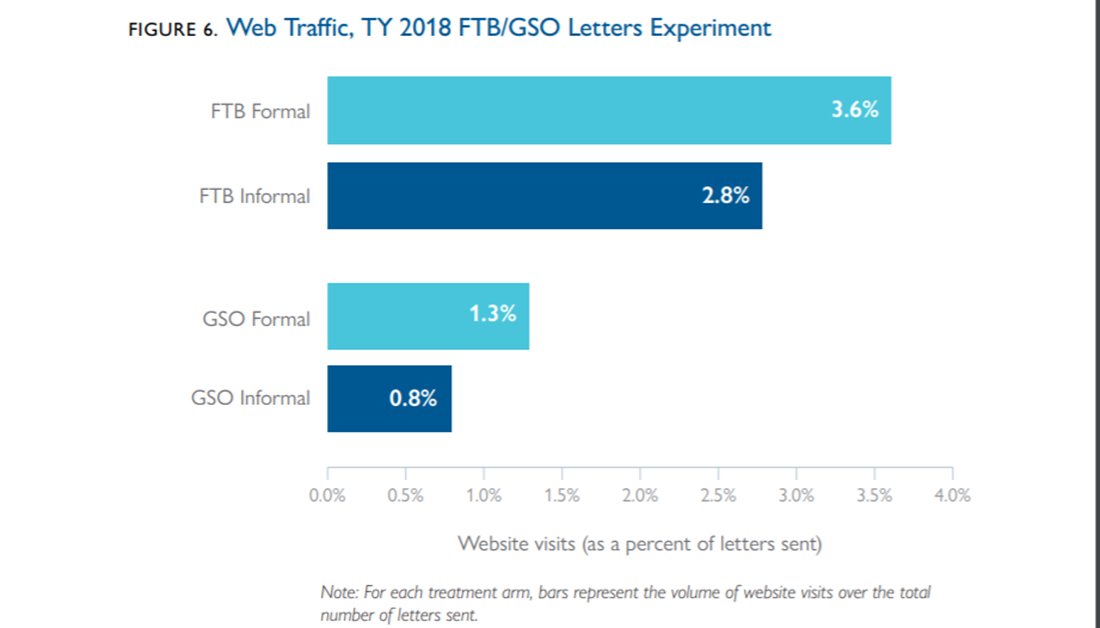

Formal letters from Franchise Tax Board generated more traffic than informal ones. bit.ly/IncreasEITCs (7)

1. Nudges should not be sole strategy to get non-filers to claim EITC

2. Gvt + researchers should use admin data to connect eligible Californians to EITC + other prgrms

3. Future efforts could see if simplifying claiming increases take-up bit.ly/IncreasEITCs (9)