(Optionality is one of those great financial lenses which you can apply to *so* many things fruitfully.)

There is deep, rich literature and experience on pricing these.

In particular, true options are *durable.*

They can e.g. buy them back from you at a mutually agreeable price or otherwise offset exposure, but can't default.

A bank (or other lender) which offers revolving lines or credit facilities keeps track of both all draws and all notional exposure.

This is true for consumers and businesses alike.

But those limits "mean less" than many people might assume they do.

Back in I think 2012, when I was also a pretty good credit risk, they were uncomfortable giving me any more than $X of total exposure.

Their messaged appetite for exposure to it is something like 3~4 times more than $X, and $X wasn't a small number either.

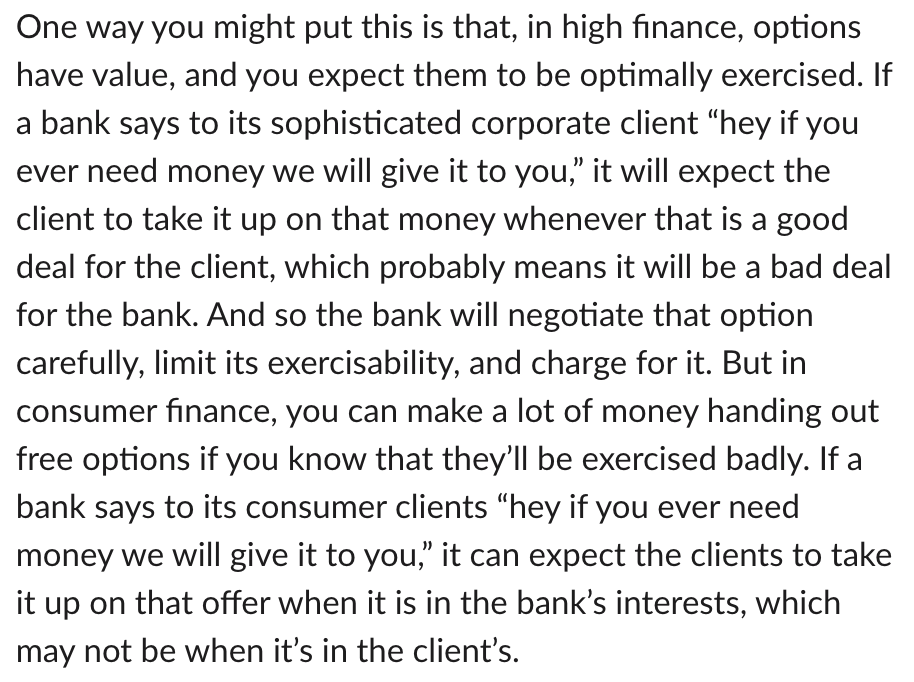

I mean, to make money, but the mechanisms are more interesting than that.

One is to protect their share of wallet.

The expectation is all other cards are a short distance away in wallet.

Your "next card" isn't on the system charging you money and probably isn't on *you* either!

This is false as stated.

If you consume a lot of financial services, and banks are eagerly courting your business, it is *probably not* because they're bad at math.

A: Spends $10k. This strains them; they can pay back the minimums, but it will take them years to pay off, at a 15% APR the whole while.

B: Spends $10k monthly. Never pays a cent in interest.

A contributes about ~$1.3k of revenue per year (plus $200~$300 in month 1).

B contributes about $2.5~$3k annually.