which brands or sectors are impacted

uk.reuters.com/article/china-…

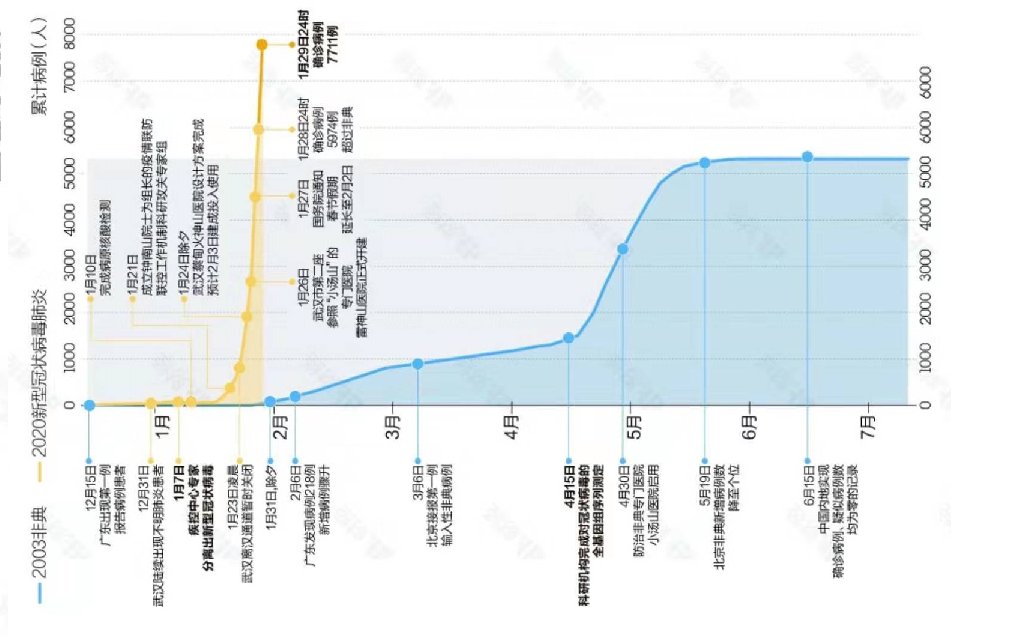

• nCoV is not under control yet, perhaps real numbers are quite different

• global supply chain is disrupted

• money flights into US

• global dovish central banks

• cost of money (and cost of protection) is cheap

2019 threads

threadreaderapp.com/user/MacroTech…