How is the underlying Fund - JP Morgan US tech fund different from Nasdaq 100 Index?

Strategy-

Nasdaq 100 includes top 100 non-financial cos listed on Nasdaq. A diversified index.

1/2

These are technologies that are being adopted rapidly by consumers. (eg. Online streaming, cloud computing, autonomous cars, Artificial Intelligence)

Nasdaq 100:

Technology - 55%

Consumer Discretion - 24%

Healthcare - 7%

Telecommunications - 7%

Consumer staples - 5%

This is a diversified index with high allocation to Technology. Just like in India we have allocation to Finance in our indices.

has entire portfolio allocation to Technology theme.

Sub-Sectors in this fund are -

Software - 38%

Semiconductor - 31%

Internet - 16%

Hardware - 5%

The fund has 100% allocation to Tech hence, not comparable to Nasdaq 100 index which has 55% into Tech.

Nasdaq 100 has almost 100% allocation to largecaps.

JPM US Technology Fund is a multicap portfolio with

64% to Largecaps

16% to midcaps

20% to smallcaps

Nasdaq 100 Index

Apple ~12%

Microsoft ~11%

Amazon ~8%

Alphabet ~8%

Facebook ~4%

It has approx 43% exposure into top 5 richly valued large tech companies.

Synopsys ~3.5%

AMD ~3.5%

Microsoft ~3.3%

Analog Devices ~3.1%

Alphabet ~2.8%

Essentially this fund has exposure to emerging tech companies.

Both are very different and serve entirely different purpose in PF.

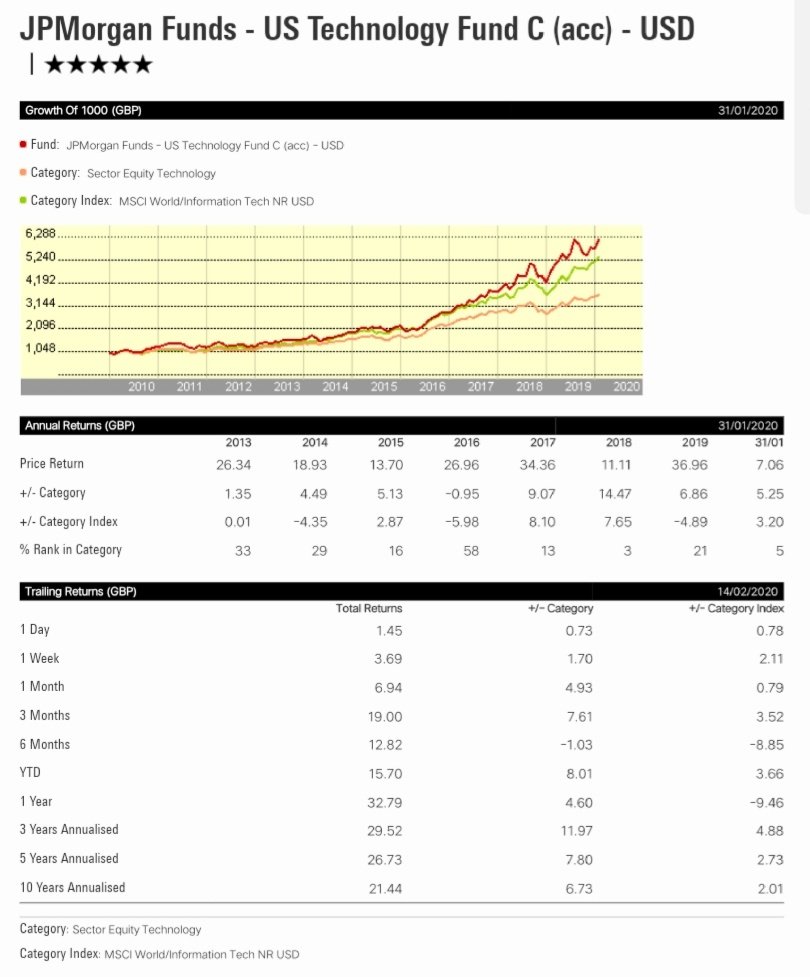

Since both are very different in terms of strategy, sectors amd stocks there also a huge deviation in performance.

Nasdaq 100 index / JPM US Tech

1yr: 38.6/42.5

3yr: 22.9/29.9

5yr: 18.1/20.2

10yr: 10.1/21.1

USD performance as on 10th Feb 2020.

Technology today is a very well diversified theme. Netflix is new age entertainment company, Uber and Lyft are new age transportation/Auto companies.

Technology is a truly diversified theme which has exposure to various sectors where new age companies are disrupting old age companies.

Happy Investing!

***End***