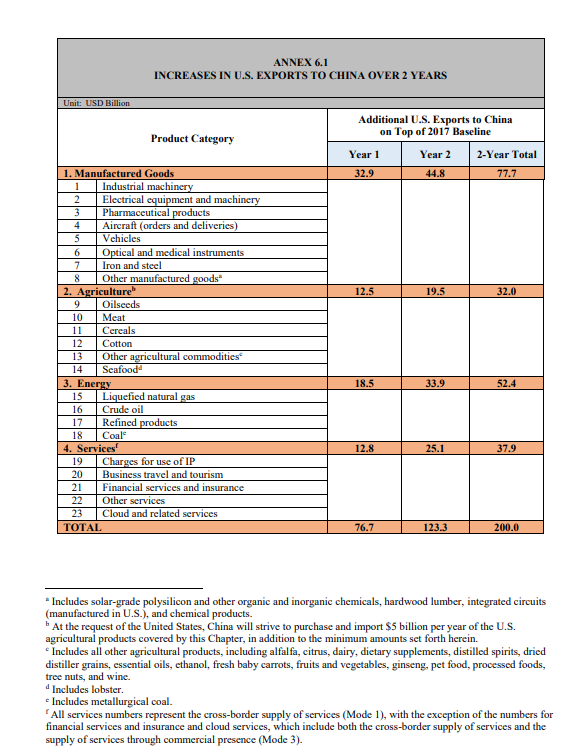

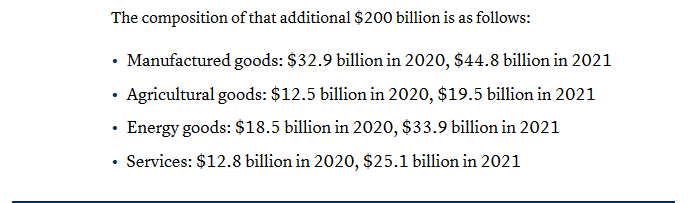

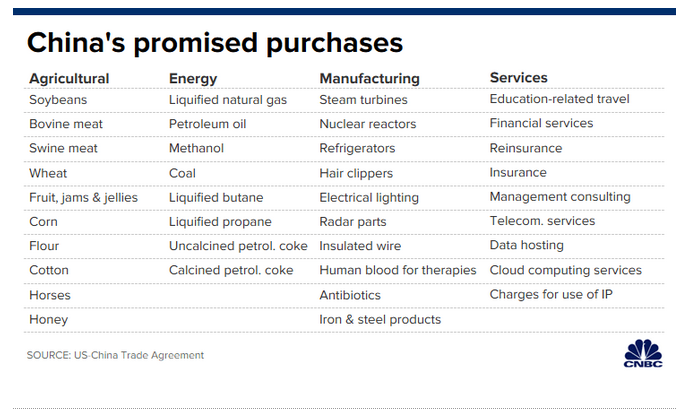

1/ To purchase at least an additional $200 billion in U.S. exports over the next 2 years (base: 2017).

2/ To do more to crack down on the theft of American technology and corporate secrets by its companies and state entities.

4/ To bring forward the planned opening of its capital market.

5/ To set up a system to resolve conflicts over drug patents.

6/ To endorse an enforcement system.

➡ #China’s Ministry of Finance published both English and Chinese versions of the text - Statement

*Link (Chinese): bit.ly/3aivKcX

➡ Annex: bit.ly/2uOyBtT

➡ CNBC details: bit.ly/2syjBQi

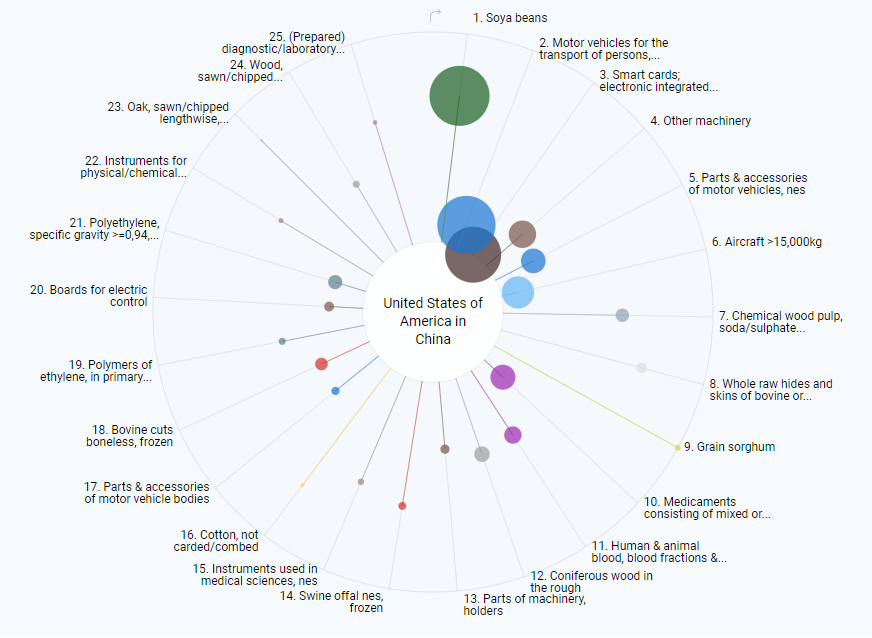

The International Trade Center Export Potential Map suggests that based on untapped potential export capacity, the U.S. could theoretically ship about $88.8Bn of additional goods to #China, including $19Bn of #Soybeans.

*Link: bit.ly/2FR3Hn8

Chinese demand for soybeans could fall as the country deals with a swine fever epidemic that’s shrinking the hog herd and reducing the need for commodities used in livestock feed.

*Link: bloom.bg/2QZnx63

reuters.com/article/us-chi…

➡ Looking at manufactured goods, like several economists I’m cautious for both 2020 (+32.9B) and 2021 (+44.8B).

China trade deal has new provisions to safeguard US #tech secrets - CNBC

cnbc.com/2020/01/15/us-…

U.S.-#China Pact Reaffirms Vow to Avoid Competitive #Devaluation - Bloomberg

bloomberg.com/news/articles/…

#China Speeds Up Opening of Market to Investment Banking Giants - Bloomberg

bloomberg.com/news/articles/…

China Agrees to Tweaks on Drug Patents as Part of Trade Deal - Bloomberg

bloomberg.com/news/articles/…

In U.S.-China Phase 1 trade deal, enforcement may end in 'We quit' - Reuters

reuters.com/article/us-usa…

*Link: papers.nber.org/tmp/65749-w266…

➡ The agreement between the U.S. and China will be an encouraging sign that a pause (and even an easing) in the trade tensions will continue through the 2020 U.S. presidential election.