1/ Most important: prioritize your health and family. It's clearly stressful as the world feels like it's falling apart. If you are healthy and have your loved ones, you will be fine long term.

Maybe it's different this time...more likely we have a long way to go. And it will feel a lot worse than it does right now.

Do not negotiate at the expense of long term relationships and integrity. But if you need something, ask.

A correction accelerates behaviors, i.e. share economy scaled in 2008 b/c people needed extra cash.

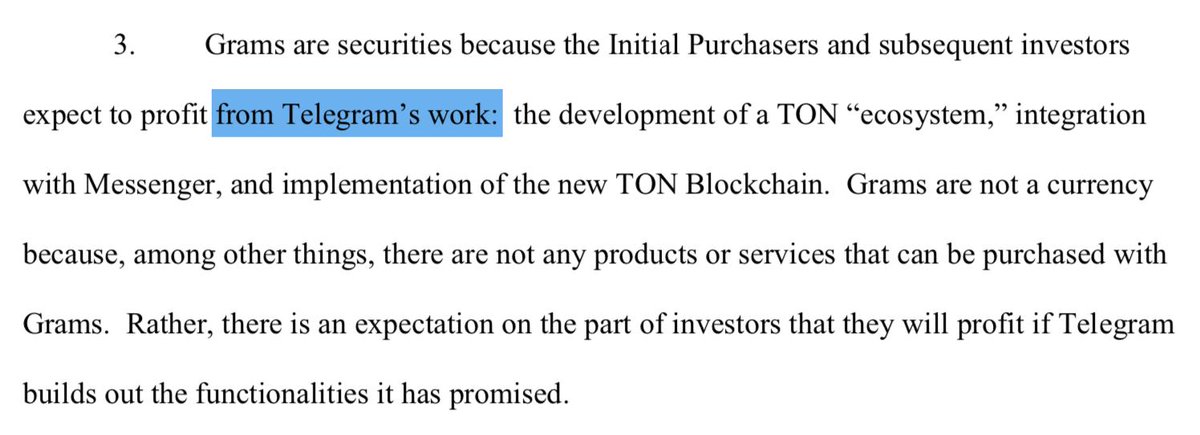

Remote work & crypto are my bets for this one