‘Lolz,’ they say, ‘It’s a loan, not a hand-out!’

Here’s why they’re wrong & we’re right. 1/20

Within capitalism, there are three basic economic tools:

• Fiscal Policy (gov spending/taxes)

• Monetary Policy (increase/decrease money supply, interest rates)

• Statutory Policy (min wage laws etc.) 2/20

They can be used in such a way that they can increase economic injustice.

OR they can be used in such a way that decreases economic injustice. 4/20

They can uplift the economy from the bottom-up, or further exasperate the wealth gap between the 1% & the rest of us. 5/20

Are policies moving us closer to the values we hold dear or moving us further away? That’s what matters: 6/20

But until then, these sets of tools are all we have to mitigate its worst effects. 7/20

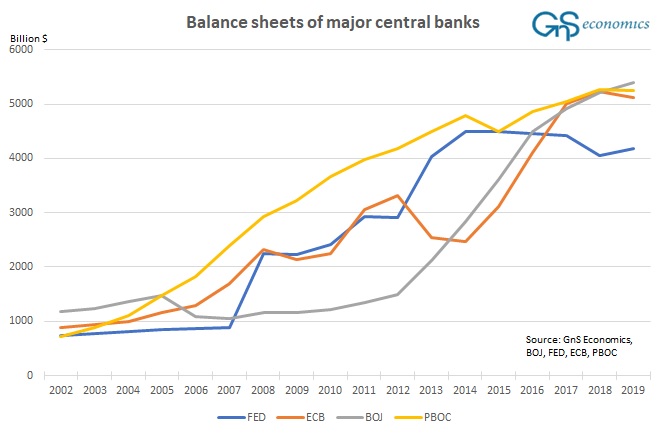

In January, before coronavirus was a concern, the Fed started expansionary monetary policies (recall Monetary Policies are one of the 3 types of tools related to increasing or decreasing the money supply). 8/20

Since January, the Fed has injected a total of about $5 trillion this way 9/20

Under certain circumstances, it may help bring an economy from the brink. 10/20

In fact, the only REAL economy effect was likely NEGATIVE for most people, explained here: 12/20

After the panic? Check out Rule #3 below: 13/20

It will do next to nothing for the real economy. 14/20

It’s a handout that vastly benefits the 1% at the expense of the rest of us. Explained here: 15/20

But with when it comes to basic needs of everyone else, like M4A, who steps in for the most vulnerable? 18/20

Here are 5 tangible policies to start now: 20/20