Chancellor says Treasury will be publishing more details on the Coronavirus job retention scheme later this evening

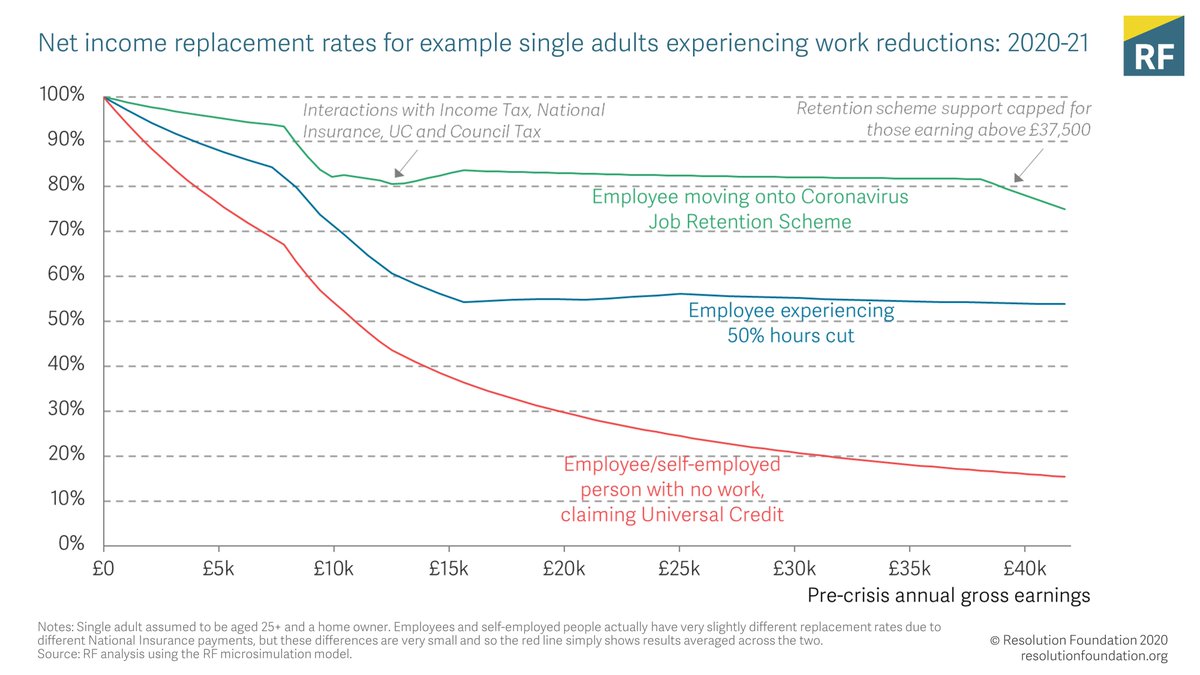

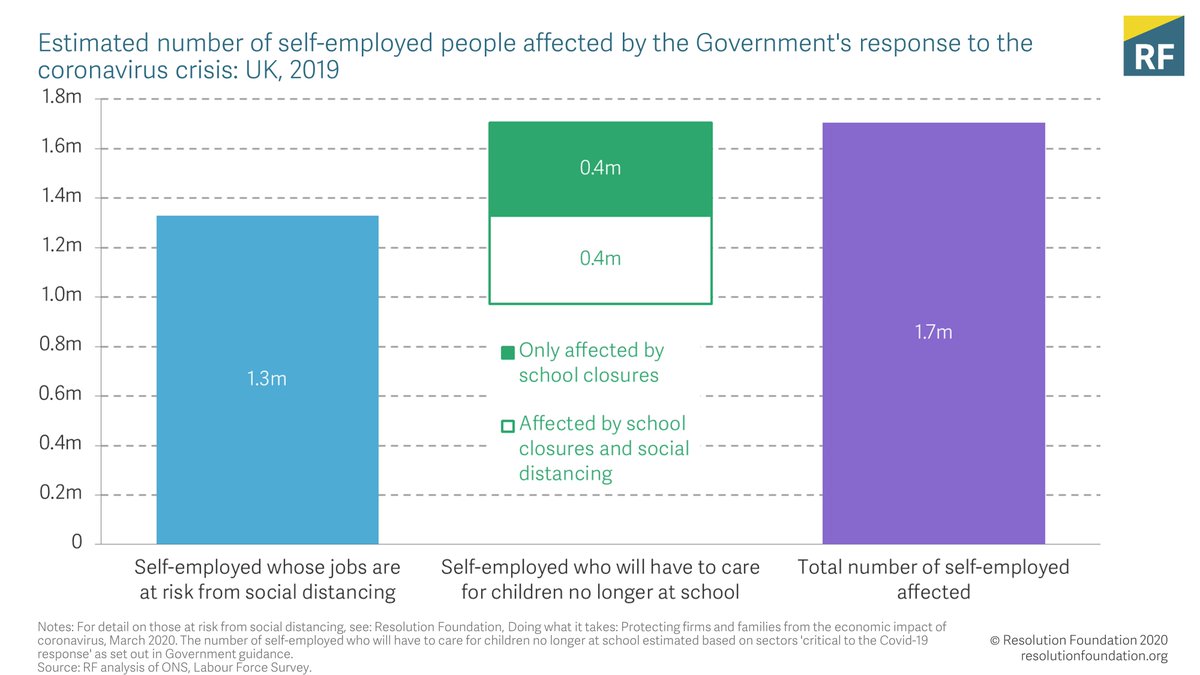

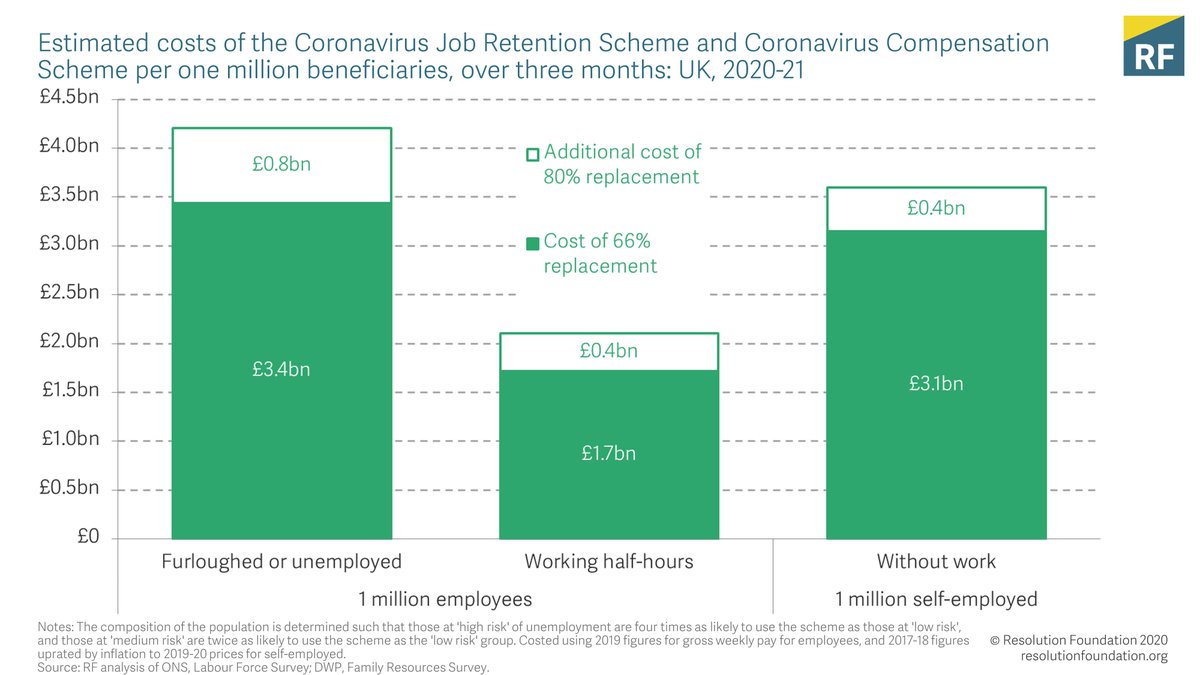

Govt will pay self employed a taxable grant worth 80% of their average monthly profits of the last 3 years, up to £2500 a month. Scheme will be open for three months, possibly longer.

Well that’s it then. The Treasury is basically paying the nation’s wages.

-open to anyone with trading profits of £50k

-available to anyone who makes maj of income from self employment

-only open to people with tax return in 2019

-Sunak says 95% of self employed will benefit

That’s what got Philip Hammond in trouble...

But as I was reporting last night, the system is overwhelmed, just registering is proving a nightmare for many and then there’s the five week wait...

But shouldn’t lose sight of the big picture either. The Treasury will be paying the wages/subsidising the profits of a big proportion of the British workforce in a way which would have been unimaginable...2 weeks ago.