At yesterday’s #FOMC meeting, the Committee revealed more expected tightening and further steps toward #tapering #asset purchases than they had previously. We see these as steps in the right direction.

Yesterday’s @federalreserve statement and press conference suggest that the Committee believes progress has been made toward its goals, but that there’s still some room to go to hit the recently re-defined objective of maximum #employment.

Still, it’s now time to set up for the end of this long-running #EmergencyPolicy-focused movie.

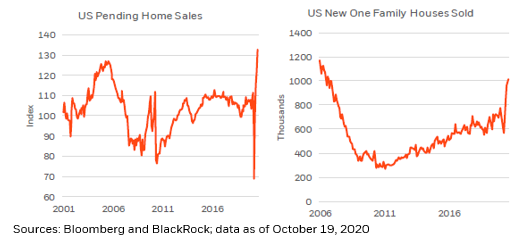

Even with the eventual #tapering of #AssetPurchases, and subsequent moderate increase in interest rates, we think it’s clear that the backdrop for the #economy will generate significant employment improvement.

The #Fed surprised #markets and some commentators revealing the Committee assumes more #InterestRate increases than previously. We think that is the right move, and the assumptions of the appropriate funds rate saw a wholesale upward revision in 2023.

The median participant now assumes two interest #rate increases in 2023, a step in the right direction.

Importantly, we also learned that the #Fed appreciates that its newly set #inflation target of ‘above 2 percent for some time’ is closer to being achieved.

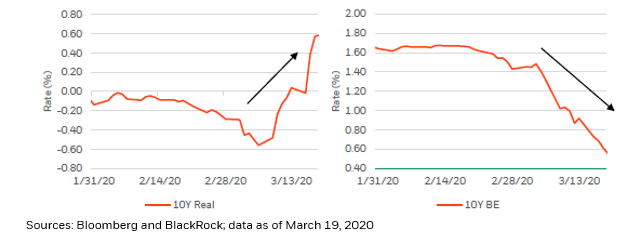

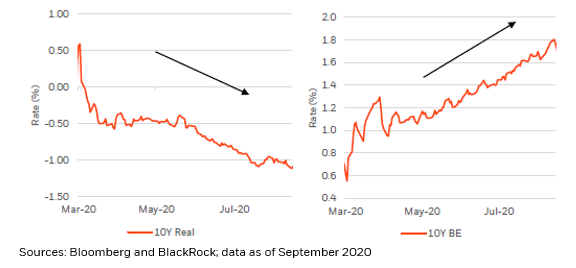

Indeed, #breakeven inflation levels of roughly 2.40% at 5 years and 2.30% at 10 years suggest that longer-term #InflationExpectations seem to be well anchored in the general view of market participants.

As we have described elsewhere, we don’t think that #QEtapering will create tangible stress to the economy or #markets, and in fact think that the biggest risk today would be an #overheating paradigm where it’s hard to predict how high input, or wage, costs could get.

Markets are likely to adjust accordingly in some areas, such as extremely distorted #RealRates across much of the #yield curve, but we believe the #markets will ultimately cheer a return to normalcy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh