A lot of chatter on my TL about the #edge in #OptionsTrading, specifically #OptionSelling.

A lot of good information but some mis-information being spread as well.

A #thread.

First off, #OptionSelling by itself is NOT an edge.

Simply by selling an instrument that decays in value over time, doesn't give one an edge towards profit. It is accompanied by short gamma and rising #volatility working "against" you.

#OptionsTrading

The #volatility #edge or premium expresses itself when the underlying moves "less" than the move that is priced in the options.

#OptionsTrading

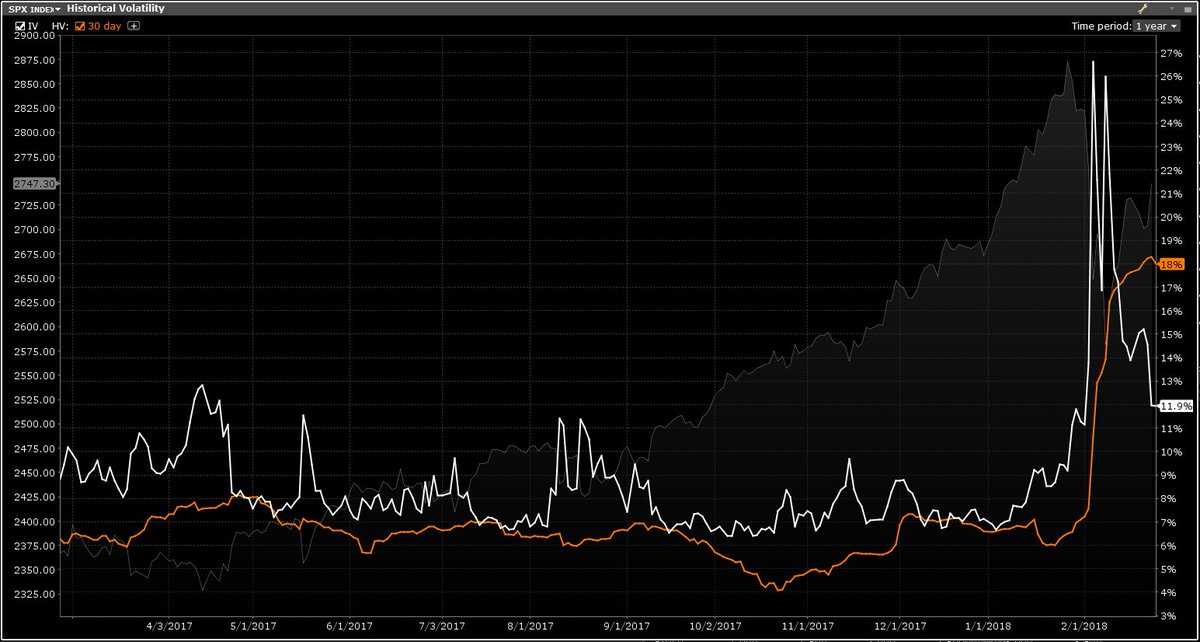

Historical Volatility (HV) quantifies the actual moves of an underlying

Implied Volatility (IV) quantifies the expected/implied moves of the underlying over the period of expiration.

#OptionsTrading

When over a time period the values of IV consistently stay above the HV, you can say that there is a #volatility #edge to be extracted.

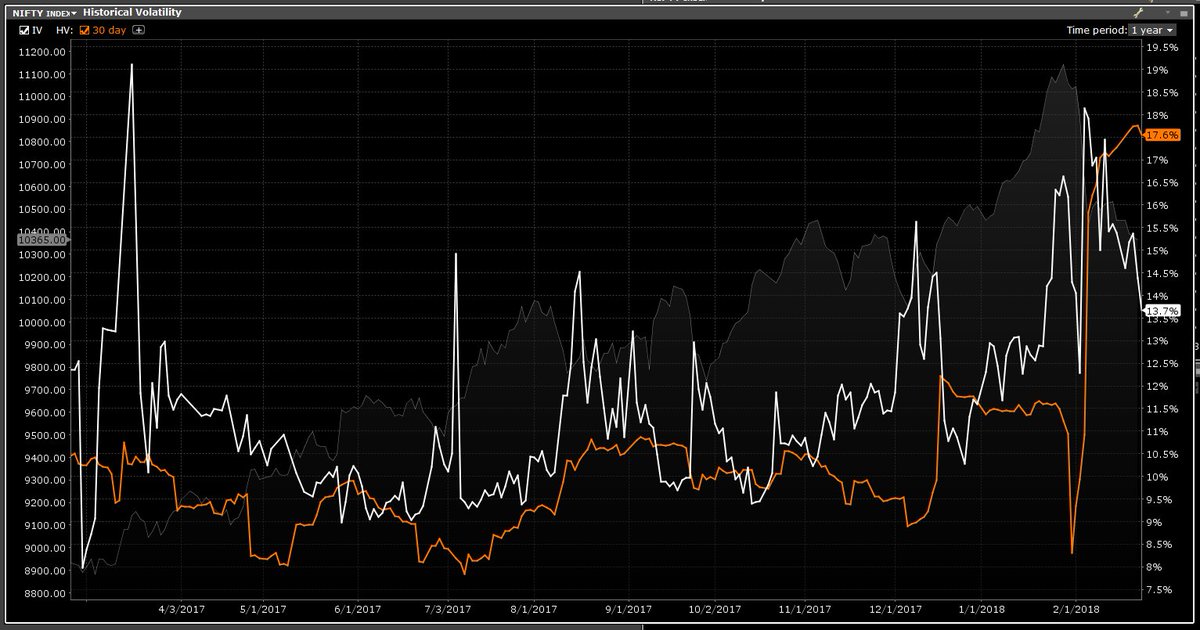

Like in this HV & IV chart of the $SPX or even the $NIFTY.

#OptionsTrading

Diversified indices show existence this #volatility premium.

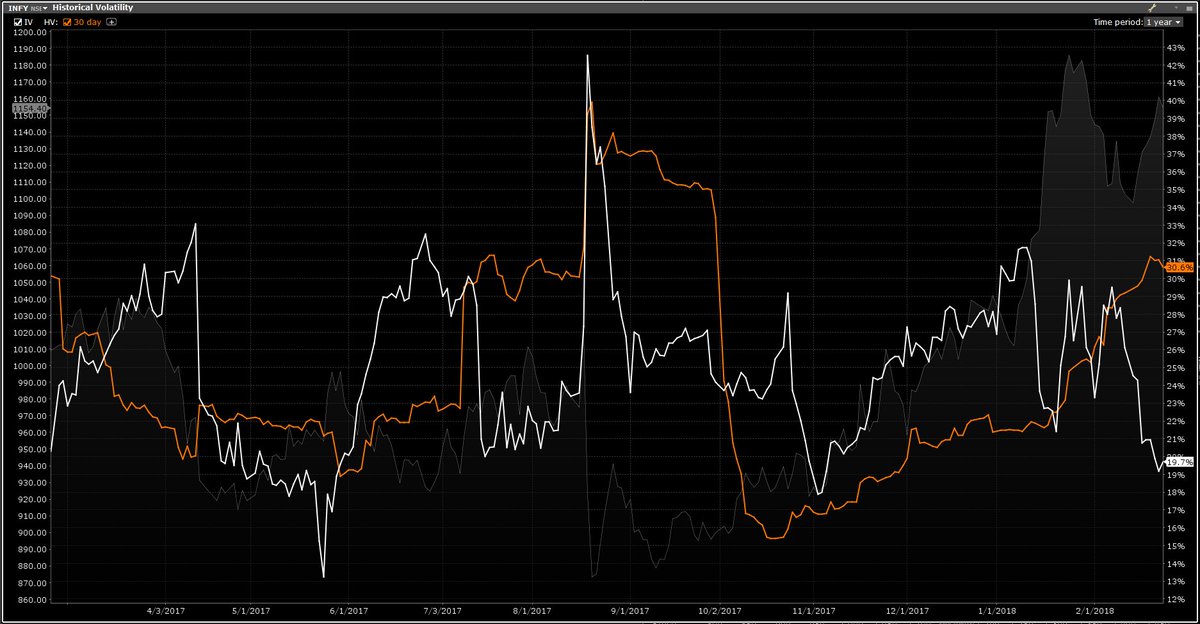

In the Indian markets, some individual stocks show this as well but only over small periods of time (few months of expiration).

See data for $ITC and $INFY.

#OptionsTrading

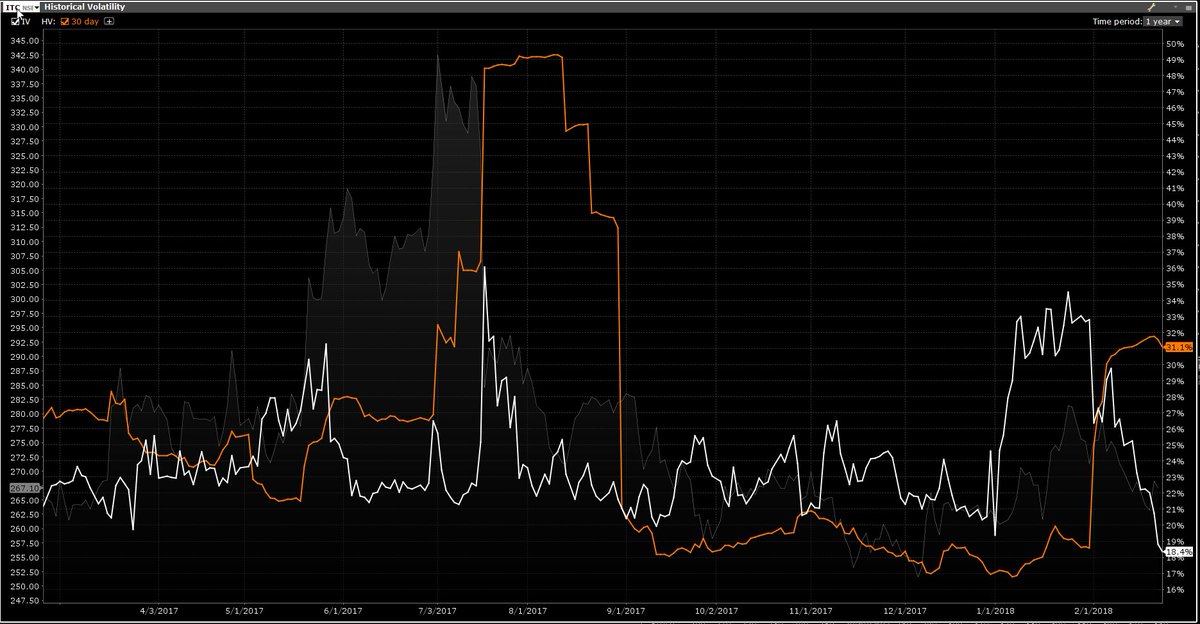

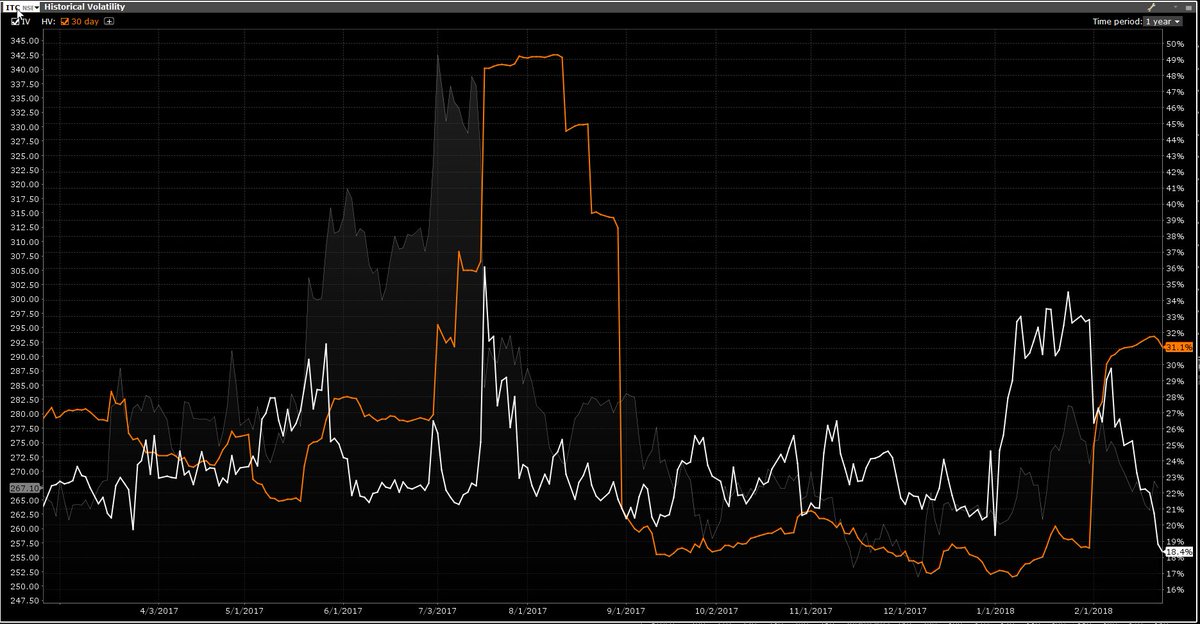

Specifically, take a look at the chart for $ITC.

Enough periods of time where the HV is much higher than the IV.

#OptionSelling here in this zone (Feb-Sep 2017) would be a nightmare.

#OptionsTrading

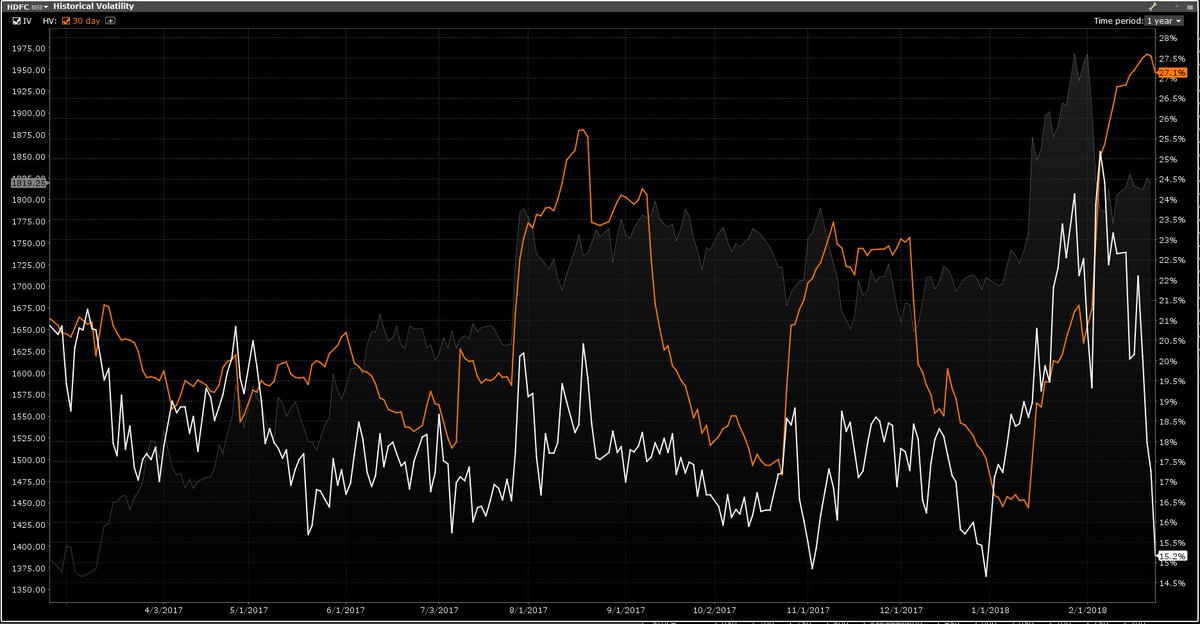

Things can get even worse with even an underlying as large and widely traded as $HDFC.

The entire year of 2017 presented almost no #volatility #edge in selling options.

#OptionsTrading

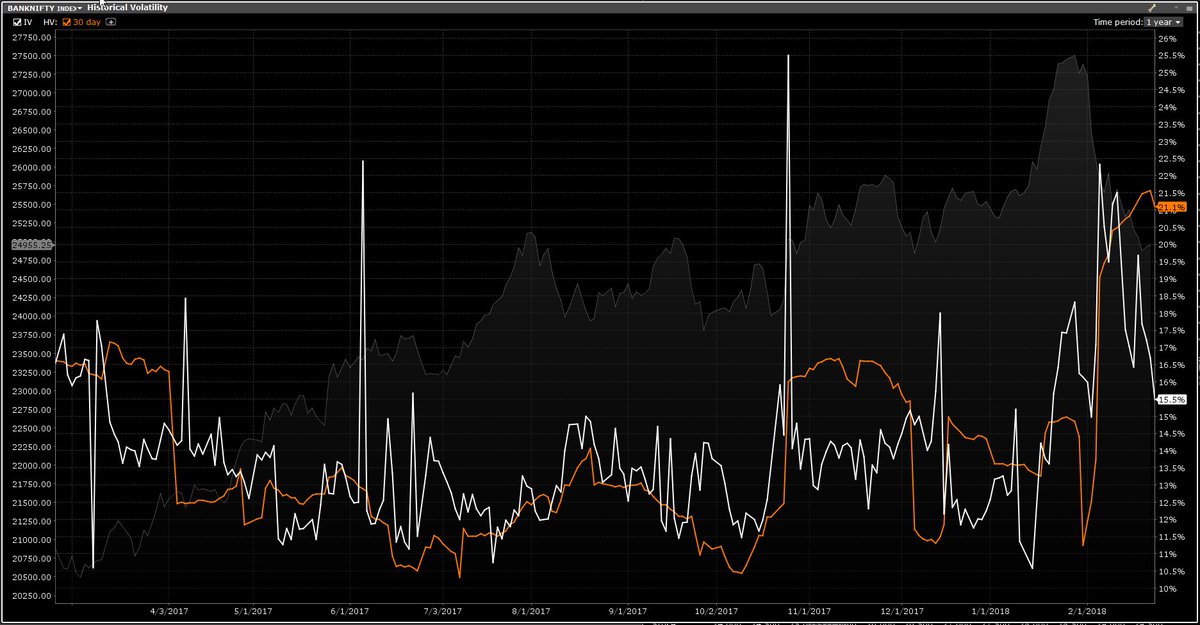

Coming to the favorite underlying of them all, the $BankNifty, also the topic of discussion due to its popularity created by the presence of cheap weekly options.

Can you see any premium of the IV over the HV even with this one?

#OptionsTrading

So what makes so many traders rush in to trade the $BankNifty weeklies?

Weekly expiration cycles presents unique trading opportunities in itself.

With a one week life-cycle, pretty much the entire monthly expiration can be traded in super fast forward. ⏩

$OptionsTrading

Any trading strategy needs to be tested for its ability to survive or allow the trader to survive the range of various market movements.

Taking on the #blowup risk with #ExpiryTrading doesn't make the cut for us.

#OptionsTrading

Coming back to the bad rap on #OptionSelling this weekend, most of the flak faced is due to some trader's talking up #ExpiryTrading naked cheap OTM options as a means to build an investable trading portfolio.

#OptionsTrading

Instead, here is some good reading on #ExpiryTrading that will keep most traders in good stead, especially those who value risk.

amazon.com/Trading-Option…

#OptionsTrading

I certainly do not recommend #ExpiryTrading to new #OptionsTrader.

I will recommend they start with #OptionSelling after they've taken the time to understand the math behind #OptionsPricing.

So finally, instead of being enamored by fat +ve MTMs, skip that lure and supposed adrenalin rush and work on understanding how #OptionsPricing works.

#OptionsTrading

#OptionsPricing

It is boring work, and you might spend a few long nights at it. But once you come out to the other side, you just might thank me for it.

#OptionsTrading