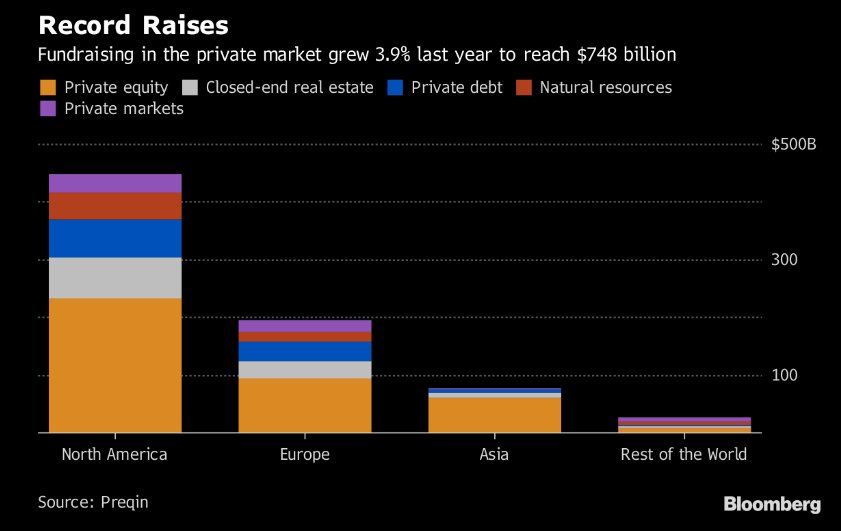

It is chock full of great snapshots of stocks, bonds, commodities, currencies, markets, earnings, valuations, and other good stuff. 1/20

am.jpmorgan.com/us/en/asset-ma…

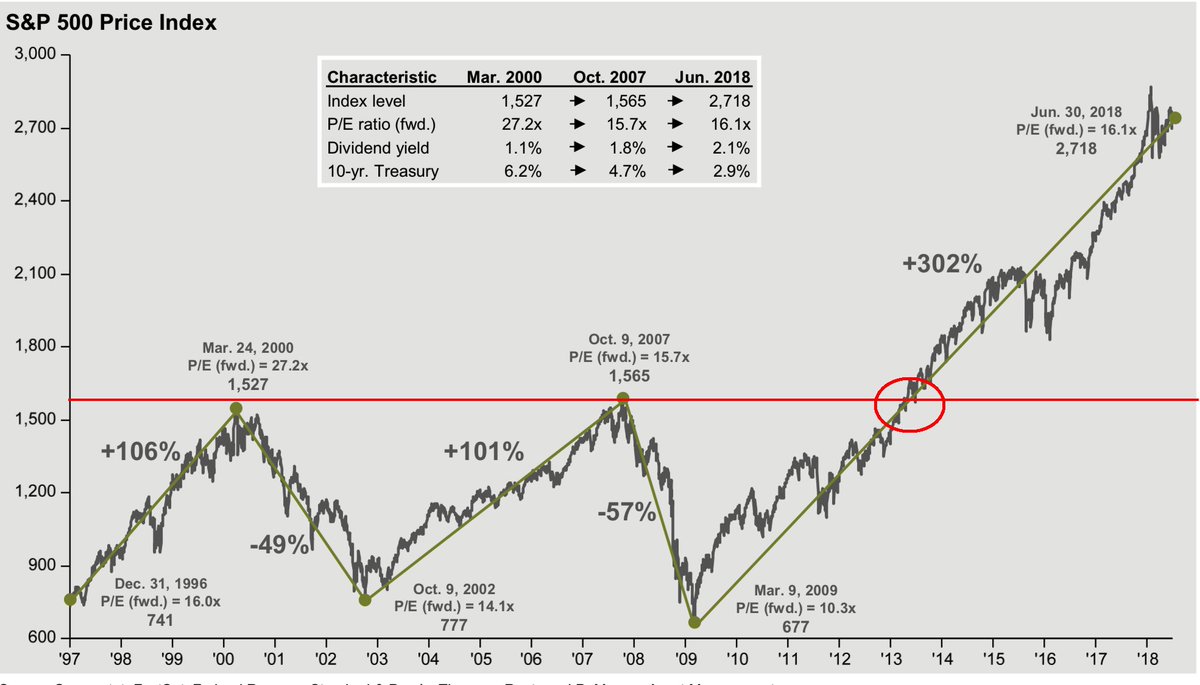

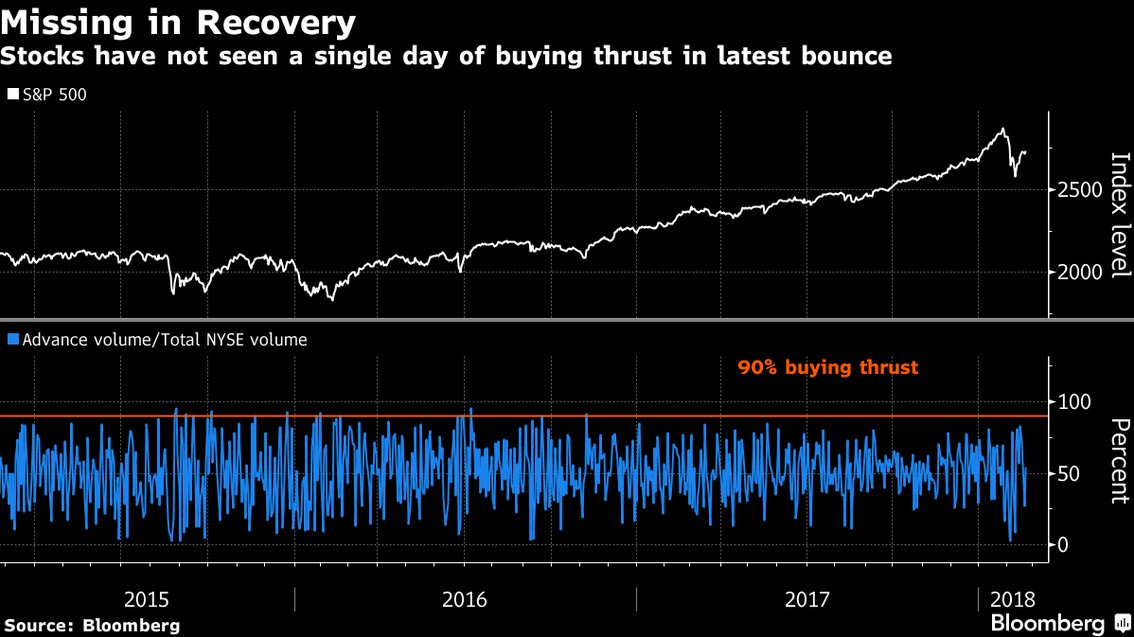

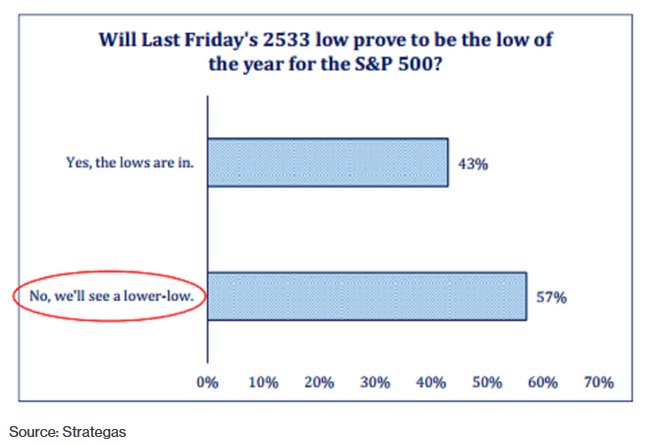

I pulled some charts, annotated them, created a narrative about where we are in the economic & market cycle.

Ready? Let’s jump right in: 2/20

ritholtz.com/2012/10/market…

All good things come to an end; we simply do not know when that will be. Nothing in the JPM chart book suggests it is any time soon.

20/20 END