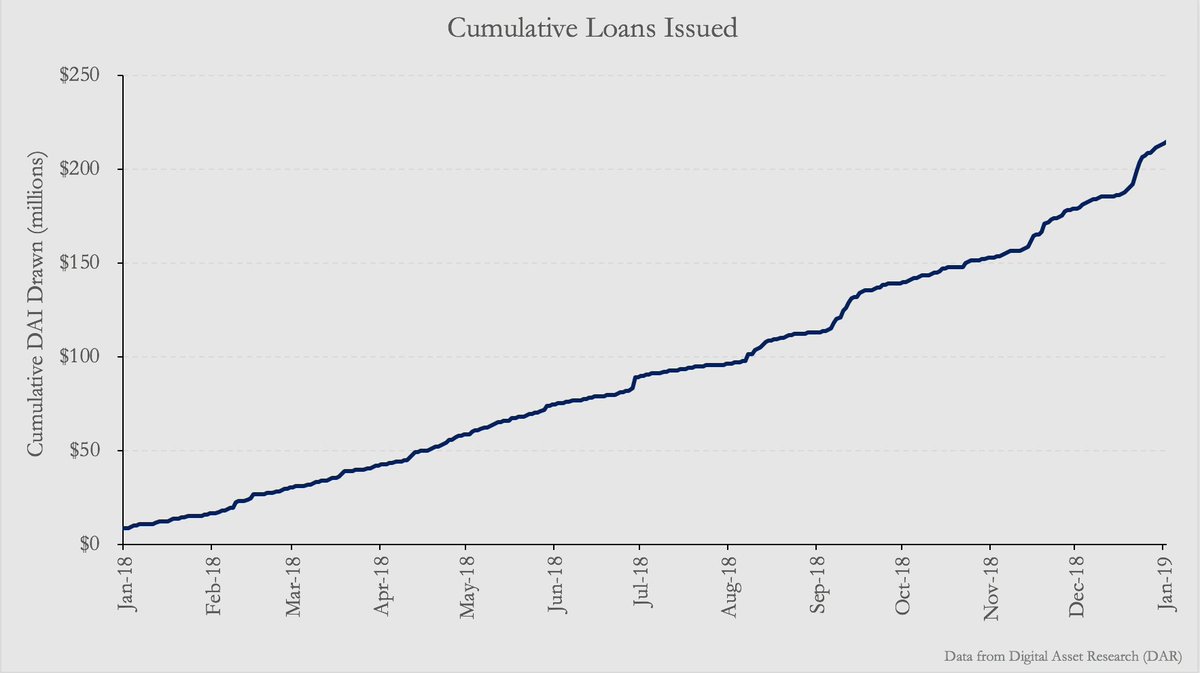

In its first year, Maker issued roughly $200 million in loans. For perspective, it took @LendingClub five years to originate $250 million in loans.

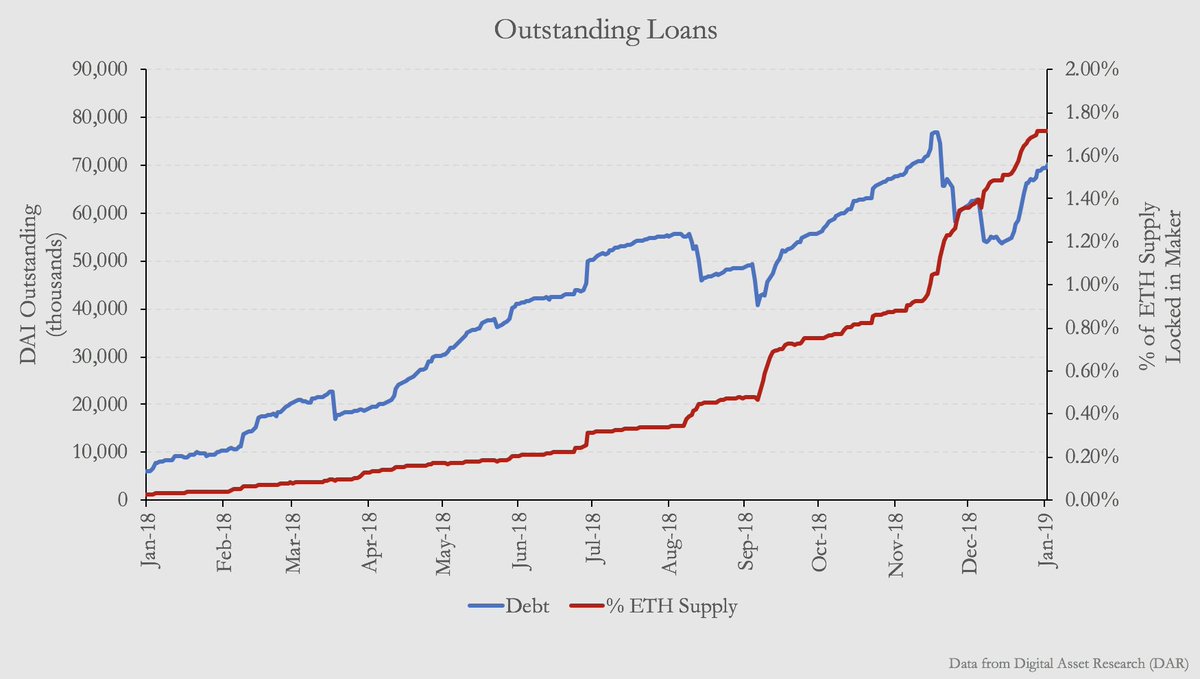

We saw it with #Bitcoin, we’re seeing it with @MakerDAO.

Loans outstanding = current market cap of $DAI: coinmarketcap.com/currencies/dai/

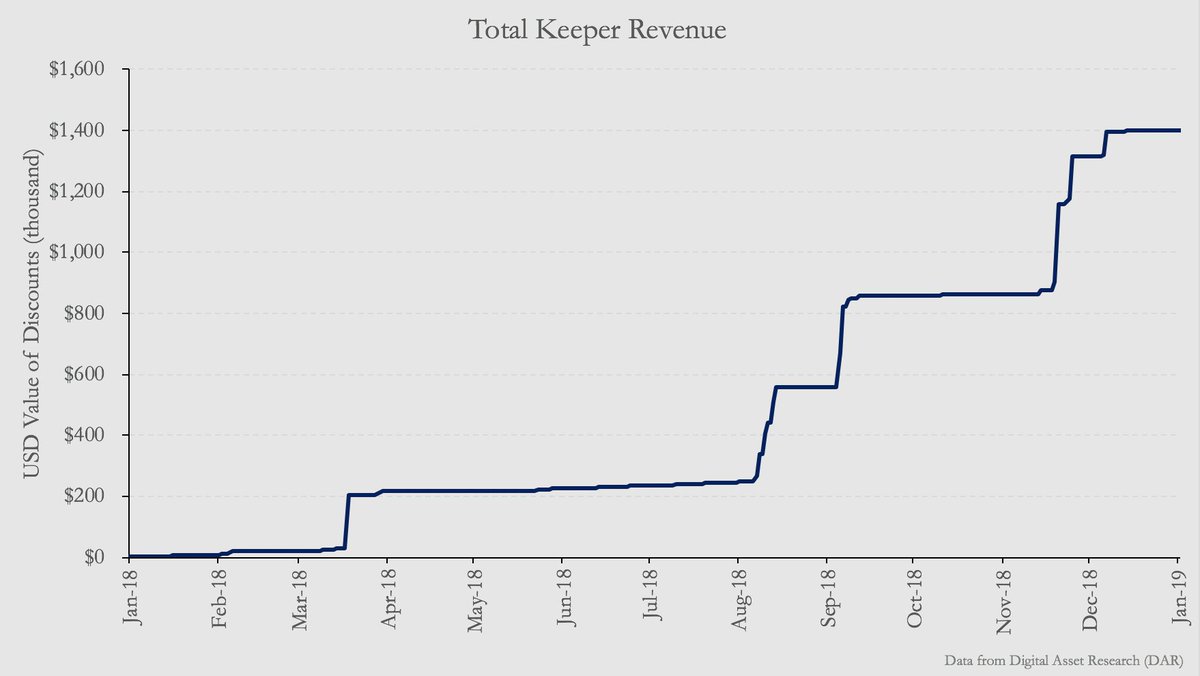

Thus far keepers have made $1.4M in nearly risk-free profit from their efforts.

Now, non-Maker affiliated keepers are doing the majority of the work.

Alex will put out an in-depth @MakerDAO report (more graphs!) in the coming weeks on placeholder.vc & someone will tweet it out 😄