In the 12 months through January, the CPI rose 1.6 percent, the smallest gain since June 2017. The CPI increased 1.9 percent on a year-on-year basis in December.

reuters.com/article/us-usa…

Money market funds recorded $21.38 billion in inflows to $3.040 trillion in the week ended Feb. 12. That was the highest level since the week of March 9, 2010, when assets totaled $3.067 trillion, according to data firm iMoneyNet.

reuters.com/article/us-fun…

#US mortgage applications declined for a fourth consecutive week even as some home borrowing costs fell to their lowest levels in more than 11 months.

reuters.com/article/us-usa…

The shockingly weak report from the Commerce Department on Thursday led to growth estimates for the fourth-quarter being cut to below a 2.0 percent annualized rate.

reuters.com/article/us-usa…

#US crude oil inventories rose last week to the highest since November 2017 as refiners cut runs to the lowest since October 2017. Domestic crude production remained at peak levels for the fifth straight week.

reuters.com/article/us-usa…

Revisions after the fact...🤣

JPM - 2% Q4 annualised QoQ SAAR, down from 2.6%

Barclays - 2.1% Q4 annualised QoQ SAAR, down from 2.8%

reuters.com/article/us-usa…

“Manufacturing is under real pressure from the slowdown in China and the trade war, and we expect output to drift down over the first half of the year, putting the sector into a mild recession,” said Pantheon Macroeconomics.

businessinsider.com.au/us-economy-fac…

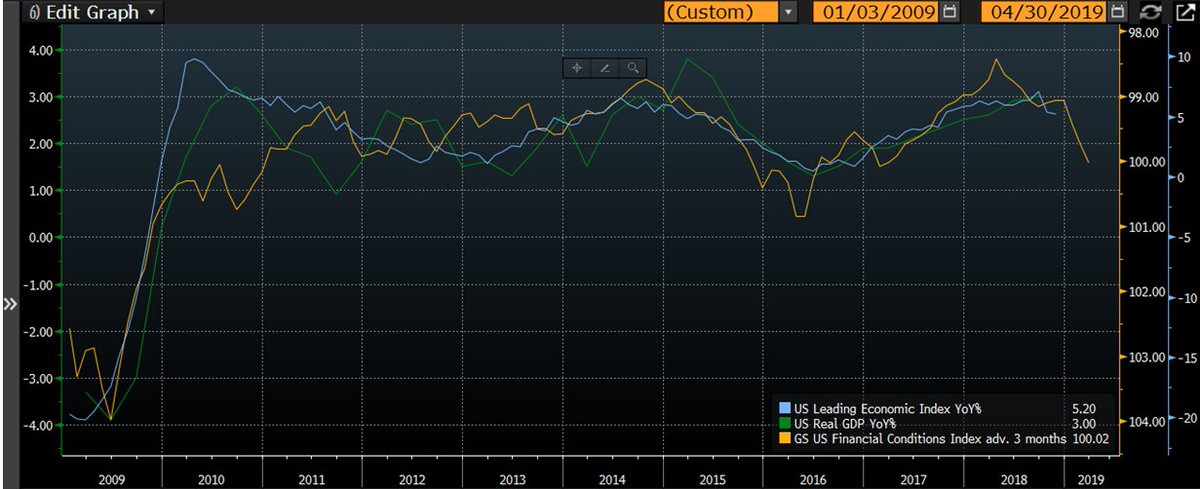

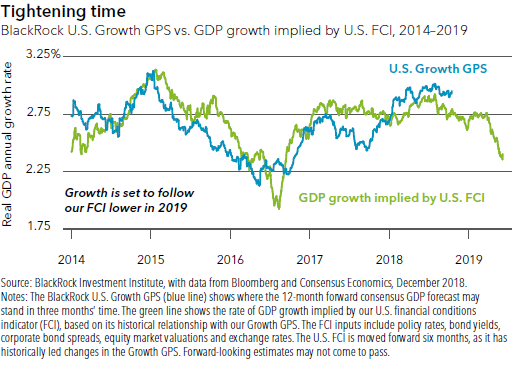

BlackRock - "Moves in our FCI have historically led our growth GPS by around six months. All other things equal, this implies slowing, but above-trend growth in 2019, we believe."

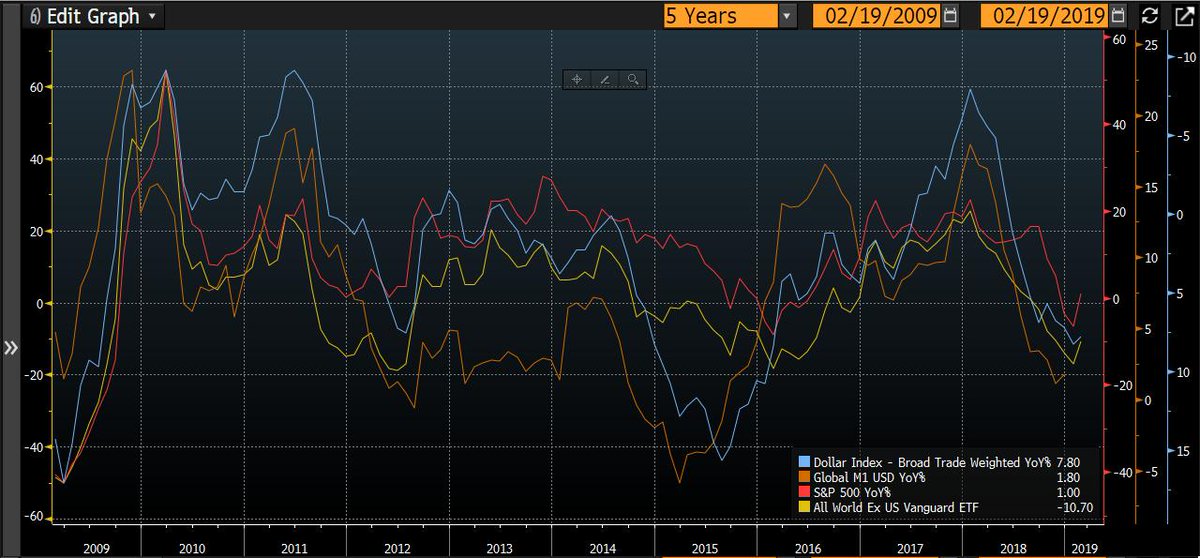

Divergence between #US & ROW can bee seen between the YoY% spread of $SPY & Vanguard Ex US All World ETF and key data points such as PMIs. The key question is how long does the relative strength of the US continue for.

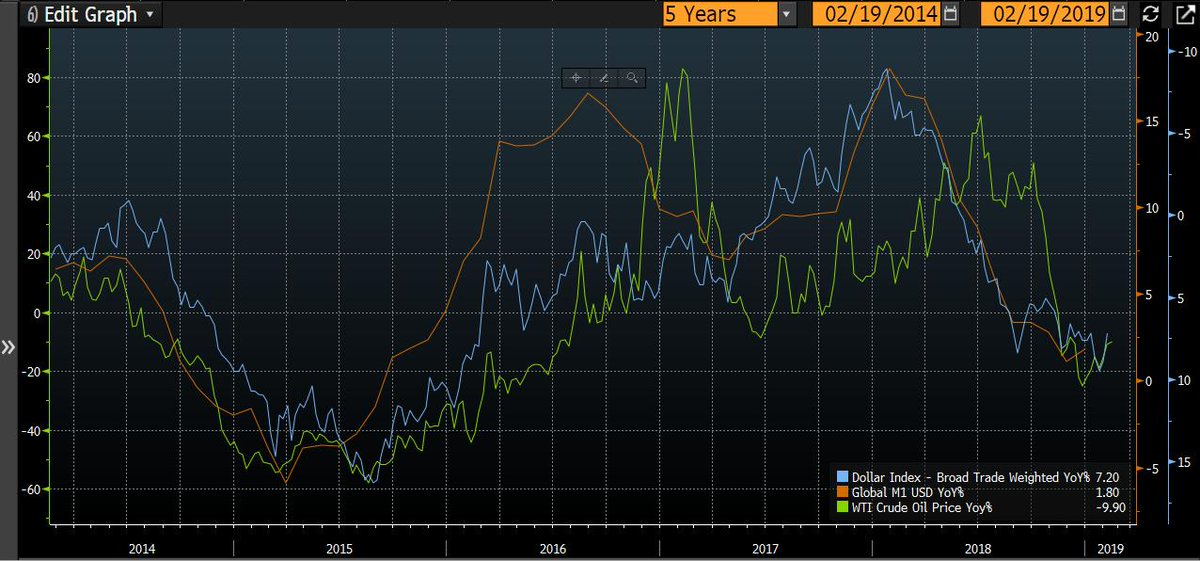

Tight #liquidity = stronger $USD = slower economic growth = lower oil demand.

Chart below looks at the YoY% rate of change of WTI, trade weighted USD Index & global M1 in USD.

January shipments, at 1.128, slipped 0.3% YoY and 1.2% compared to December and expenditures, at 2.792, were up 7.8% annually and down 4% compared to December.

logisticsmgmt.com/article/cass_f…

Based on the construction spending data, economists expect the government will pare its fourth-quarter gross domestic product estimate by at least one-tenth of a percentage point to a 2.5 percent annualized rate.

reuters.com/article/us-usa…

The ISM New York Current Business Conditions index in the United States decreased to 61.1 in February of 2019 from 63.4 in January, pointing to a new-low growth in the New York area since June.

tradingeconomics.com/united-states/…