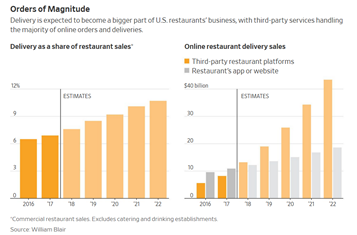

IMO, data seems suspect due to my informal polling.

#delivery $uber

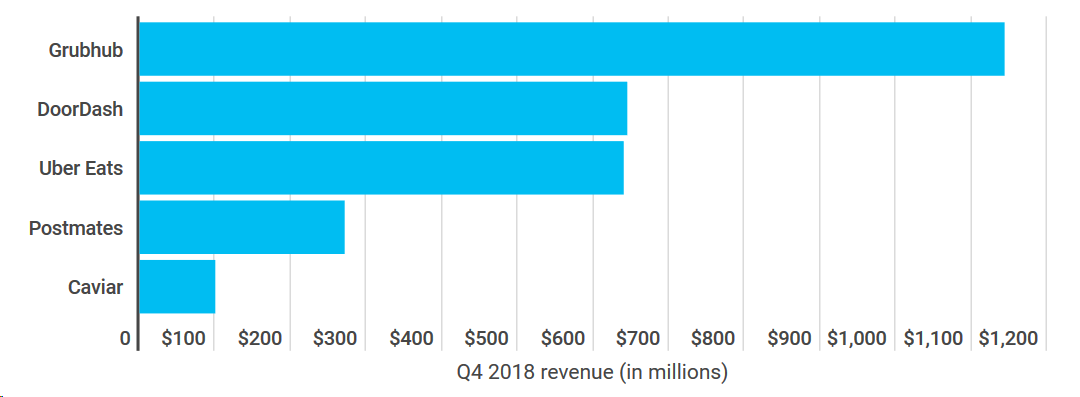

2. Restaurant give delivery co too much power. Contrasts $GRUB & $UBER mentions vs no mentions of $SYY Sysco

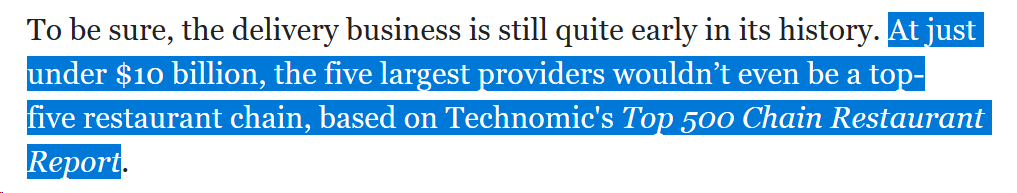

3. Shouldn't $10B delivery rev be / by 15% take to get correct rev comparisons w/ restaurant

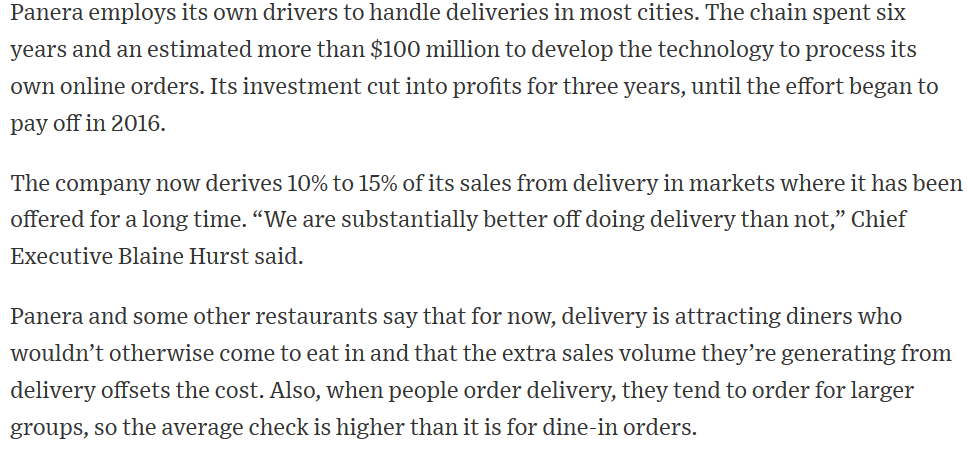

2. Avg check per delivery 2x dine-in check; offsets $ to $GRUB

3. $PNRA spent $100M + $2 net variable exp for own delivery

@WSJ wsj.com/articles/consu…

1. Pizza+Chinese popular-> $GRUB to benefit w/ $YUM Pizza Hut launch this year

2. $WTRH (southern delivery app) gets $1,500 upfront fee + lower (15%) rate

wsj.com/articles/food-…

$GRUB CEO says "there is no chance that $AMZN Prime pricing construct works in food delivery"

from @WSJ wsj.com/articles/super…

1. 15% take-rate; 10% of $MCD sales come from delivery

2. $MCD wants to end 2-yr exclusivity w/ UberEats

3. $MCD currently gets 4% royalty from franchisees on full (not net) value of delivery -> cause avg franchisee FCF to decrease $30K

restaurantbusinessonline.com/financing/mcdo…

1. Cost restaurants $100M to build internal digital order software; LevelUp as white label alt

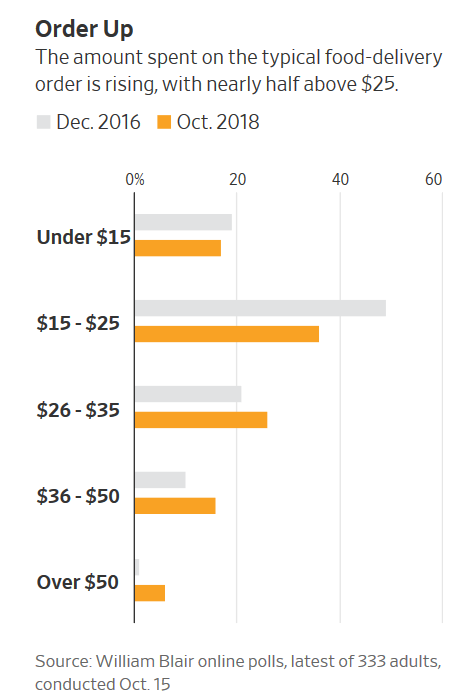

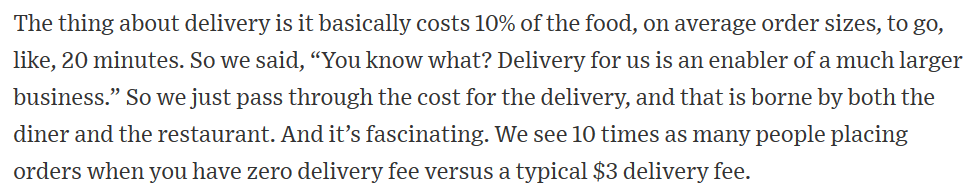

2. Consumers price elastic: 10x increase in ppl ordering w/ $0 delivery fee vs. $3. So key is operate delivery at break-even

wsj.com/articles/grubh…

1 Trough 4.5x EV/S valuation for A- quality biz

2 $YUM partnership to drive rev growth this year w a) new diners in current areas b) new mktg to up frequency c) new markets

3 $DOOR mkt share include non-food (eg $WMT delivery)

1. Up 60% from '18 financing round

2. Reads like leak from $DOOR to get valuation up

3. $SFTBF in a pickle. If it leads, hurts $UBER but can mark up gains on $DOOR

theinformation.com/articles/doord…?

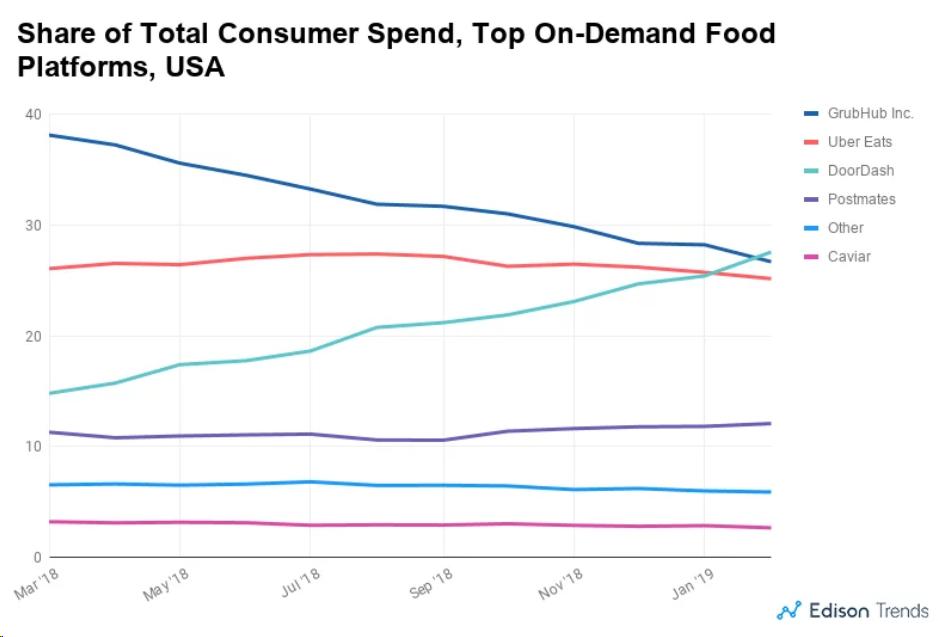

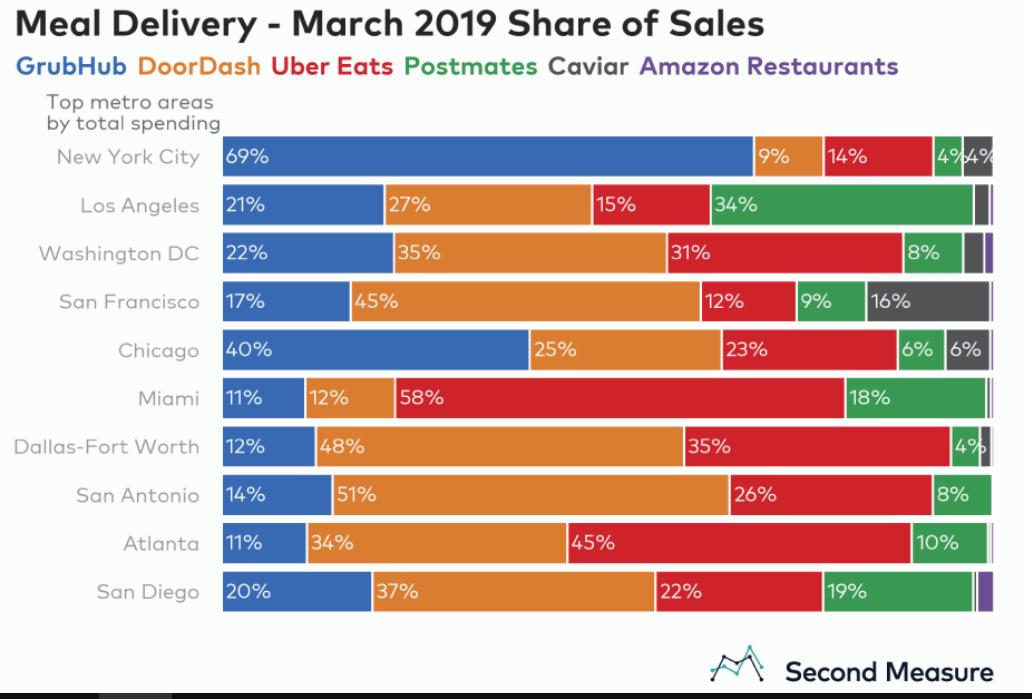

1 Local market share

$GRUB owns NYC (top market, 70%) & CHI

$DOOR top in TX (50%)

$UBER top in MIA & ATL

2 Total growth of 56% YoY; penetration up frm 16% to 22%

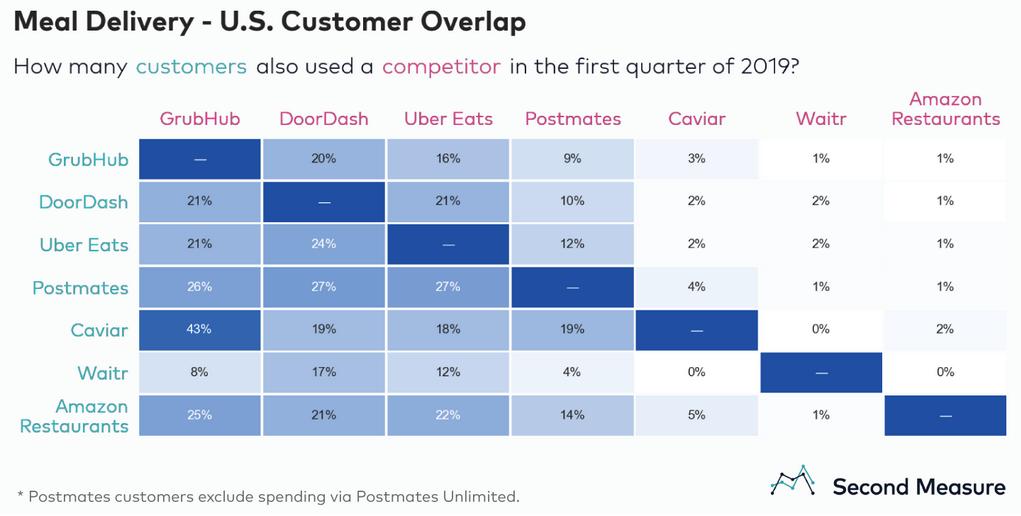

3 Diff chain restaurant deals->less loyalty on delivery

secondmeasure.com/datapoints/foo…

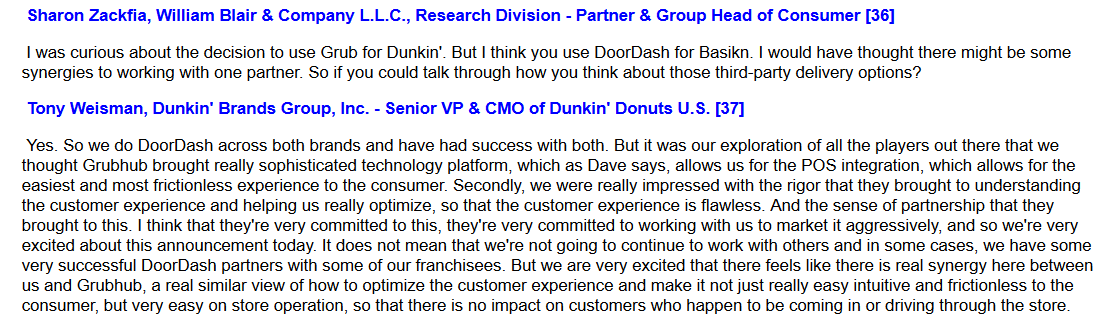

1. $GRUB makes restaurants setup new phone #'s on its app to track GRUB's generated demand

2. Statistic model to determine if call led to order + transcript

3. Old ppl call

4. Bad optics though

nypost.com/2019/05/19/gru…

Led by Darsana Capital

Heavy on topline KPI

1 GMV of $7.5B; growing 280% YoY, fueled by

2 Geo expansion to 4K cities

3 1M subscription Dashpash customers

4. Partnership w/ $WH to unlock traveler cust segment

blog.doordash.com/fueling-the-la…

1. Subscription accts 33% of rev; these users spend $3k annually

2. Rev 2x YoY

3. Annual plan cost $96; eliminates delivery fee

4. Supply of 44,000 restaurants

5. Postmates Party test (like UberPool, but for food)

theinformation.com/articles/what-…

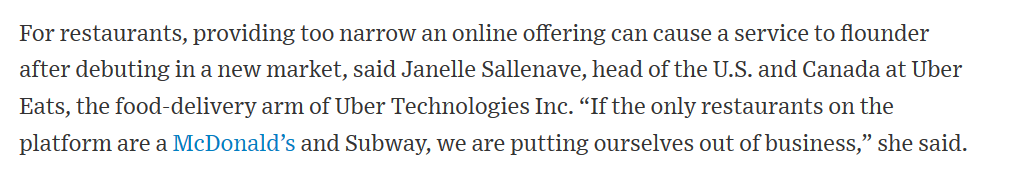

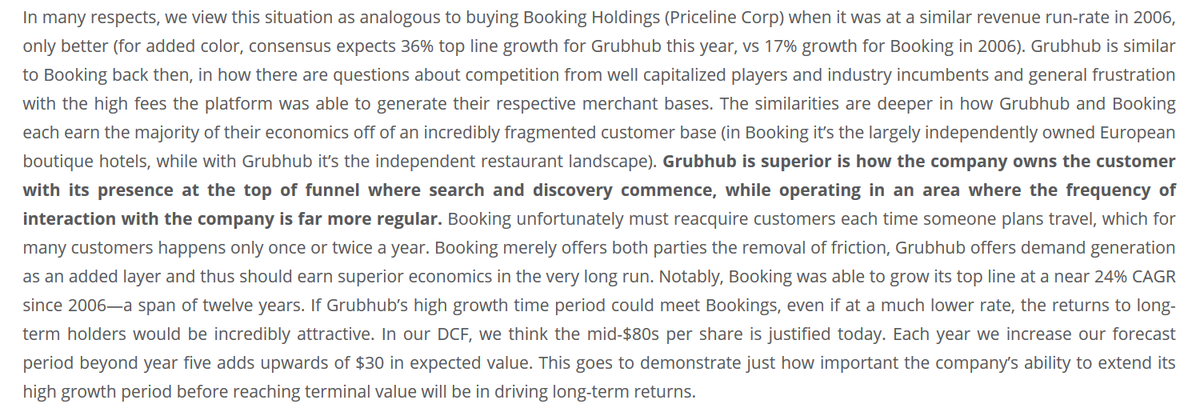

Less of a problem w/ $GRUB due to its long tail of independent restaurants, similar to $BKNG 's independent EU hotels mix

wsj.com/articles/resta…