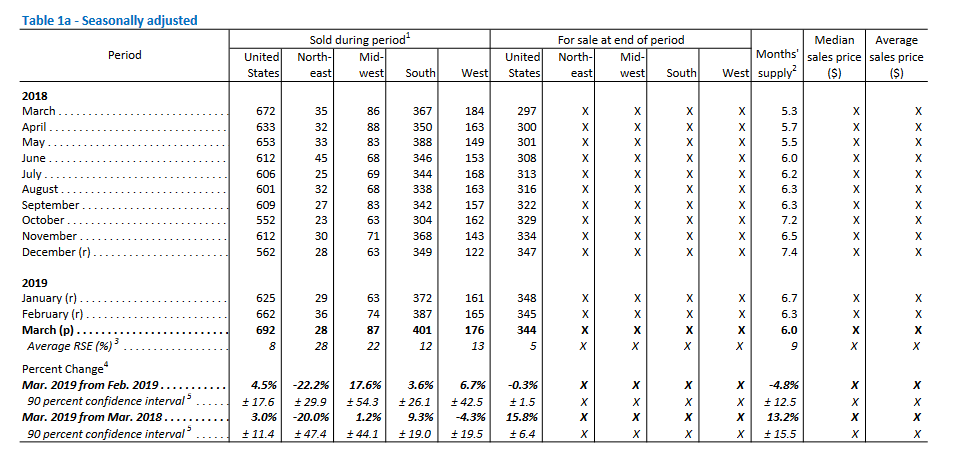

Econ data for this wk: 🇩🇪 IFO, 🇺🇸 New home sales & consumer confidence & durable goods order; 🇳🇿 NZ &🇹🇭 rates decision; 🇲🇾 CPI.

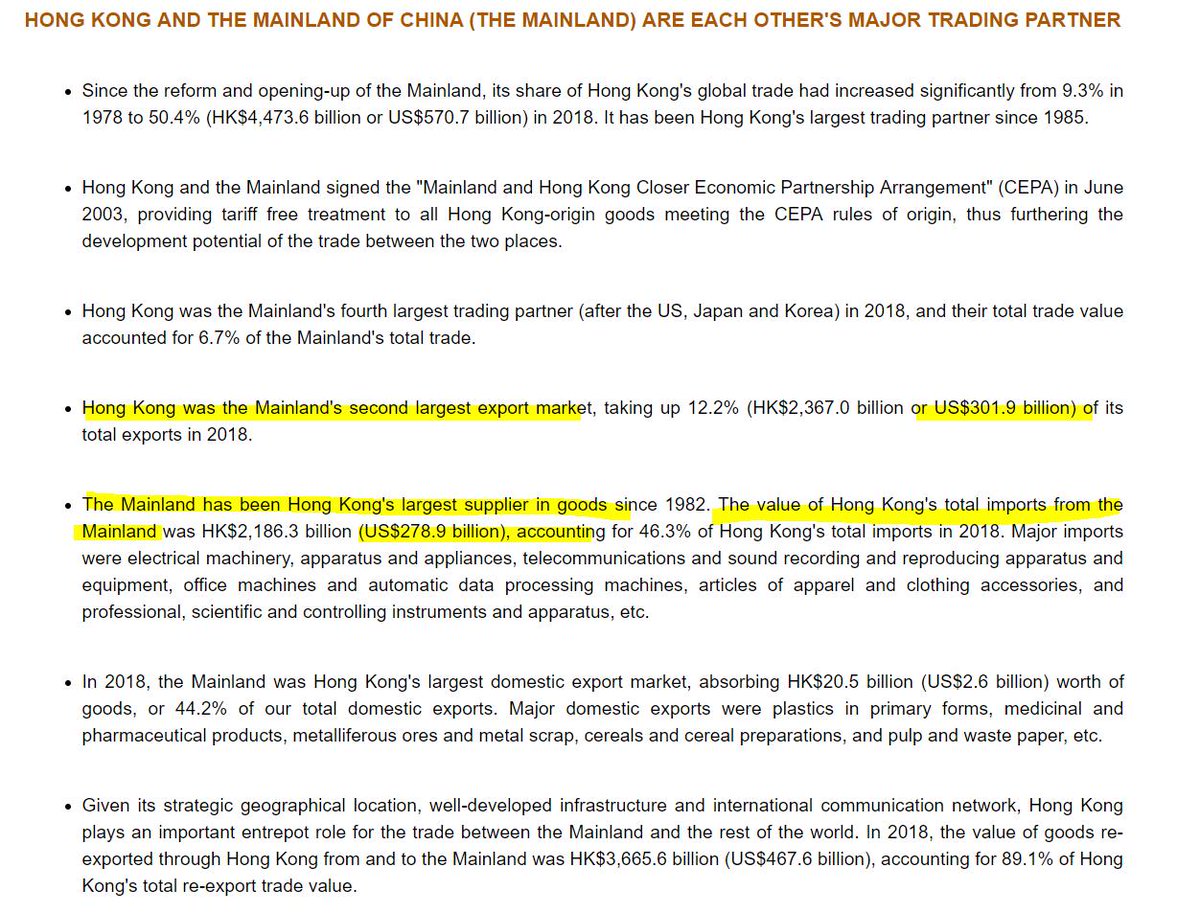

We got G-20 Xi & Trump meeting & trade-deal hope/hopelessness 🇺🇸🇨🇳

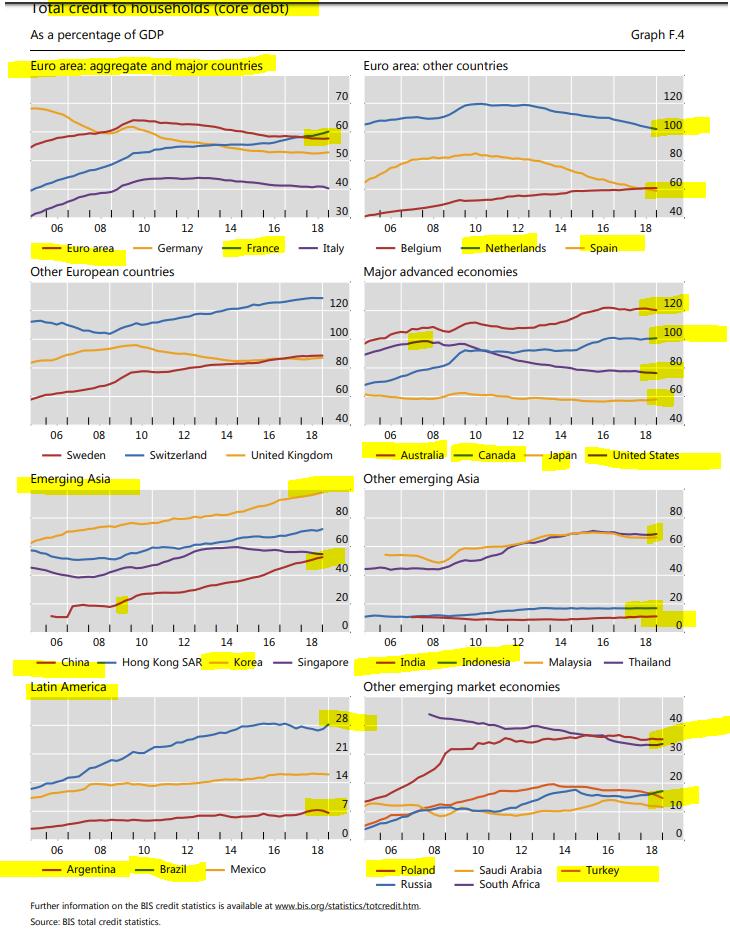

bis.org/publ/bppdf/bis…

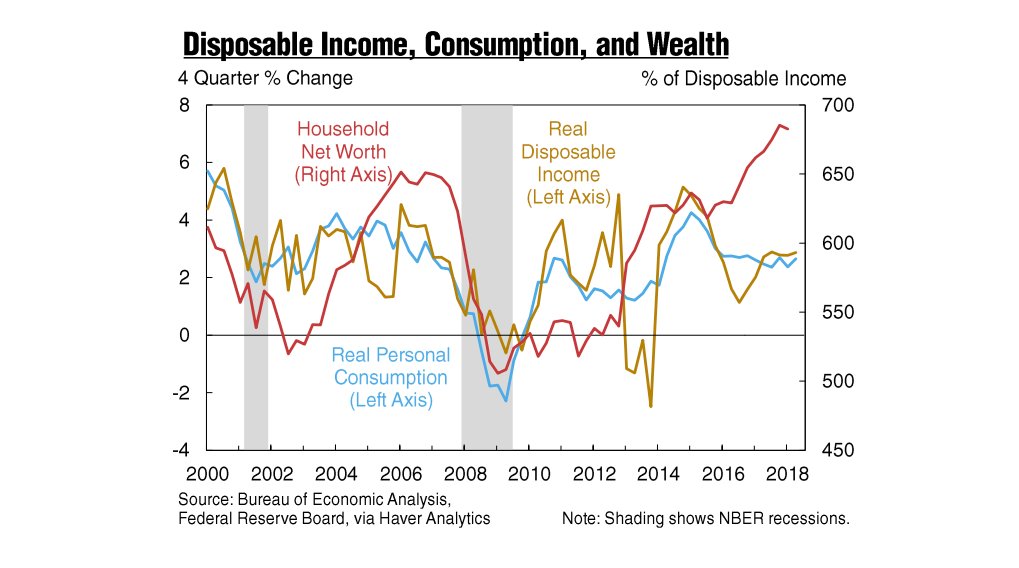

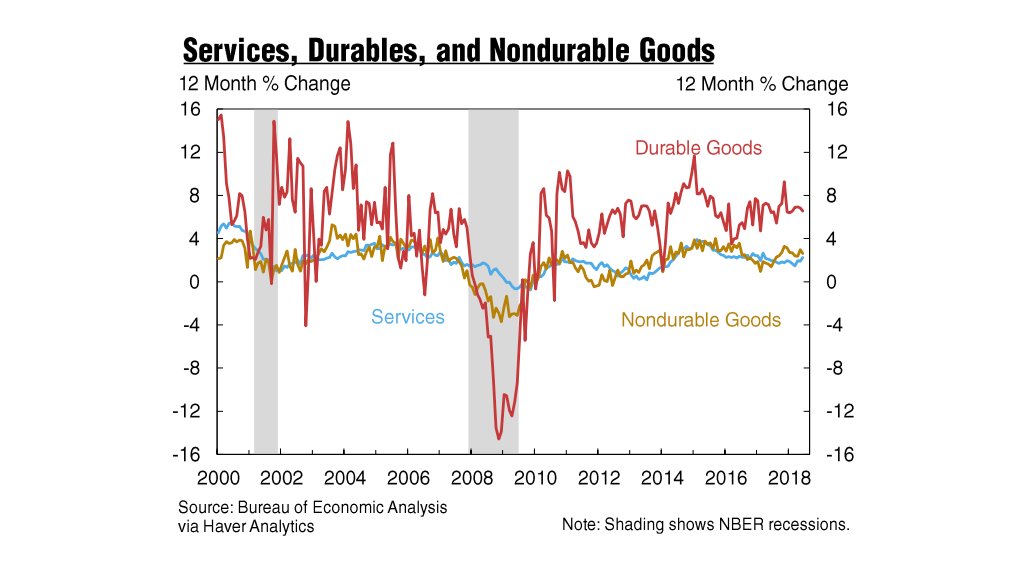

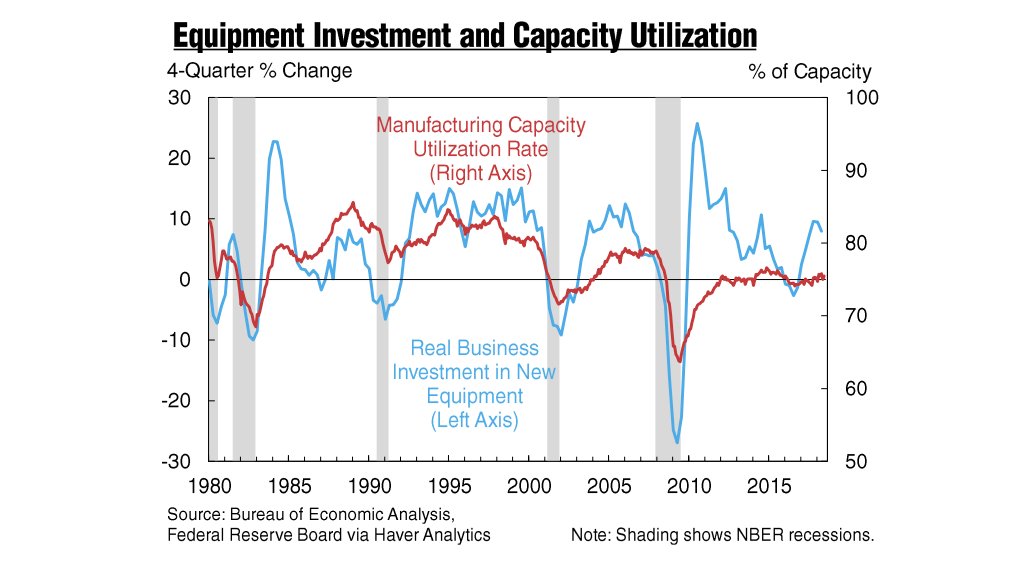

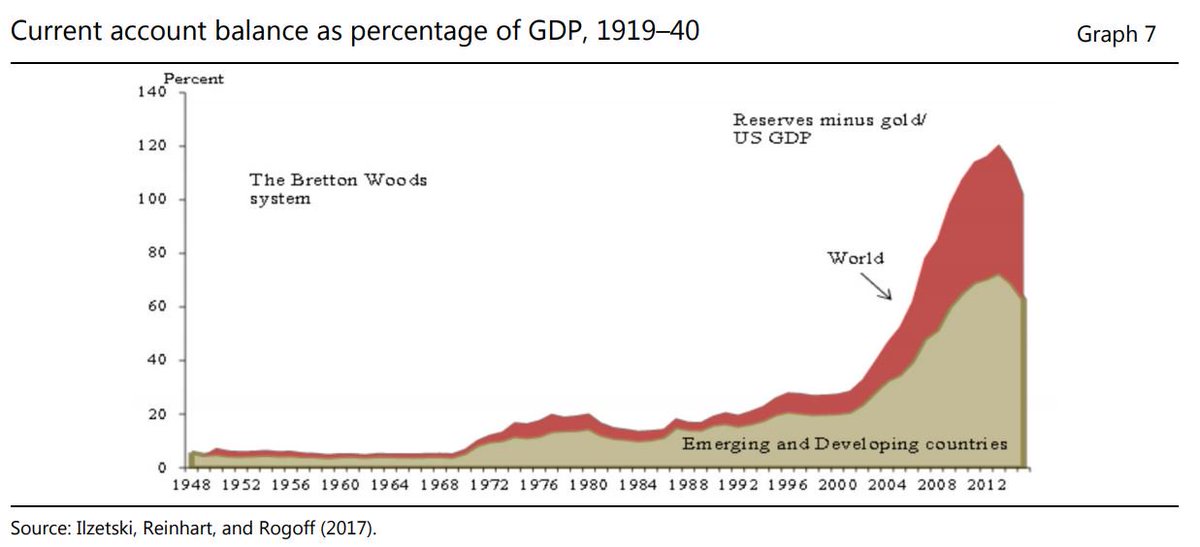

And u can see the reasoning here 👇🏻👇🏻

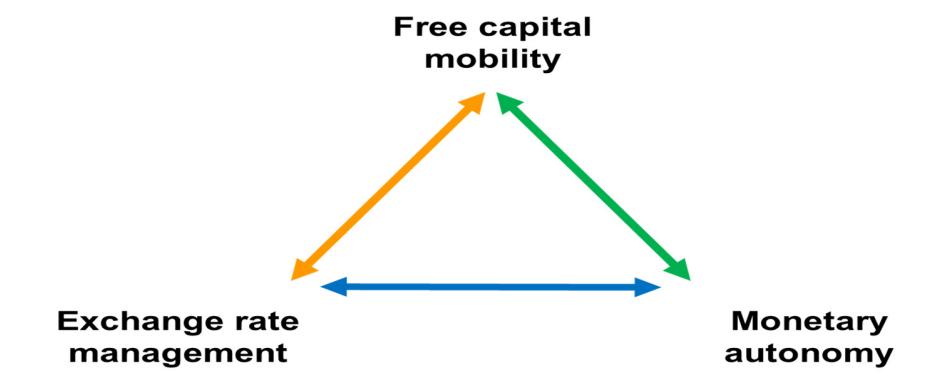

Question: Are you convinced now that USD is King 👑???

bis.org/publ/qtrpdf/r_…