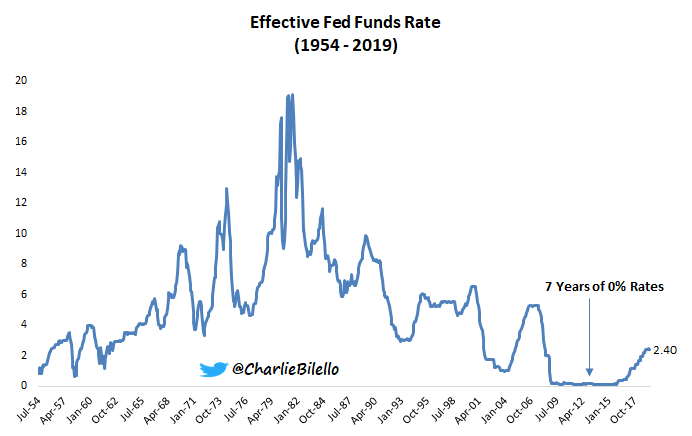

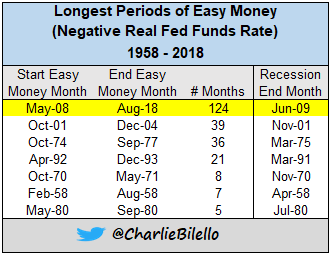

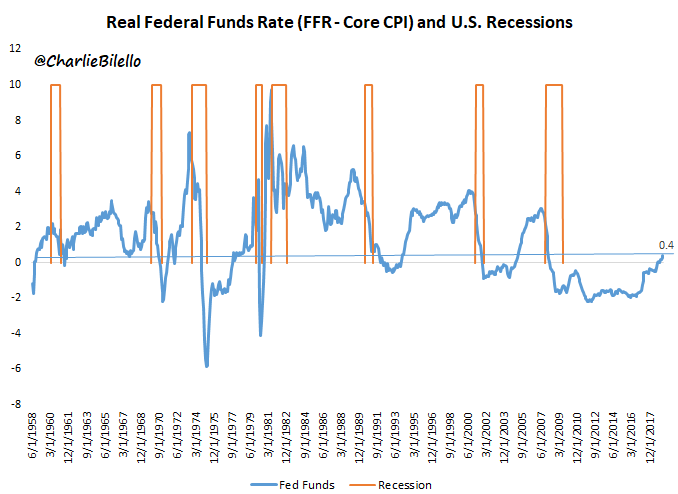

1) The Fed held rates at 0% for 7 years (December 2008- December 2015), by far the longest period of easy money in history.

2) When they finally started hiking rates, they did so in an extremely slow fashion. The real Fed Funds Rate (Fed Funds minus inflation) only turned positive last September, ending the longest streak with a negative real FFR in history at 124 months.

3) The prior record of easy money lasted 39 months, from Oct 2001 to Dec 2004. Many believe this was one of the principle causes of the housing bubble that peaked in 2006. The easy money period that ended in 2018 exceeded that record by over 7 years.

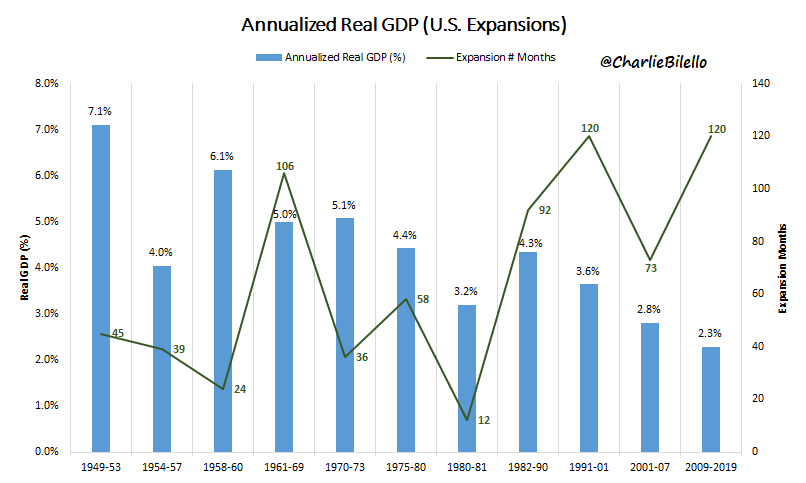

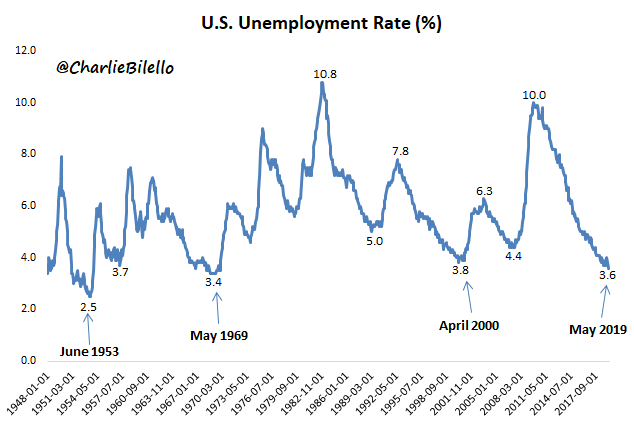

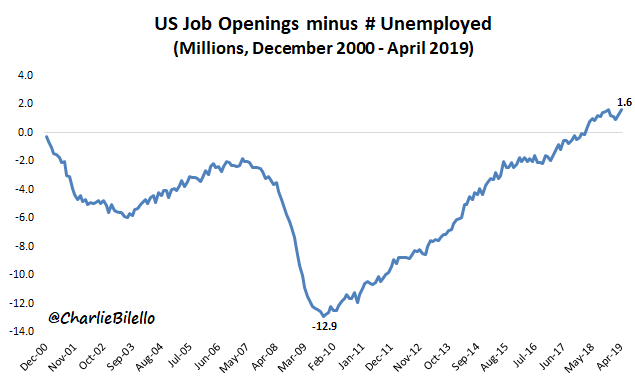

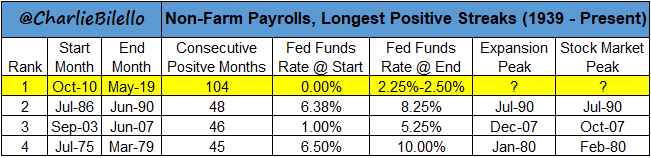

4) The US economic expansion will be the longest in history in July, Unemployment Rate is at a 50-yr low (3.6%), # job openings is a record 1.6 million higher than # of unemployed, & there's been 104 straight months of job growth (longest in history).

5) REAL Fed Funds Rate (Fed Funds minus inflation) stands at 0.4%, which if the Fed is done hiking (market saying 100% probability of a cut next month) would be lowest terminal rate of any expansion ever. Monetary policy remains extraordinarily easy.

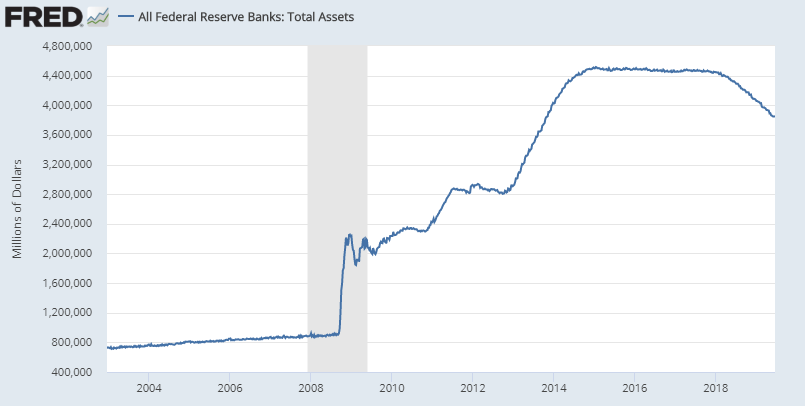

6) During the 2007-09 recession, the Fed increased its balance sheet from $890 billion to $2 trillion (QE1). After the recession ended, they added another $2.5 trillion (QE2/3). Today, the balance sheet is still at $3.8 trillion.