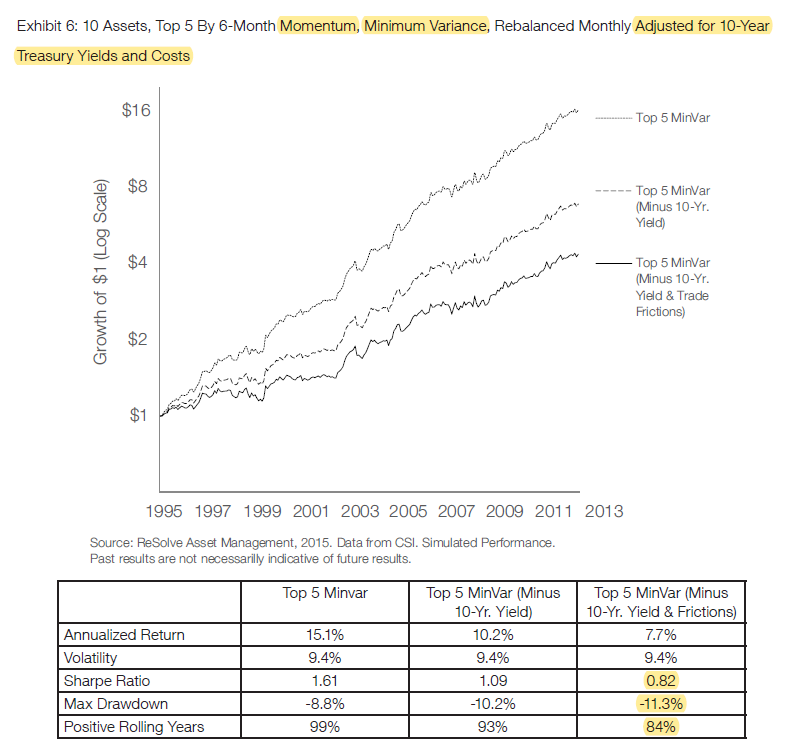

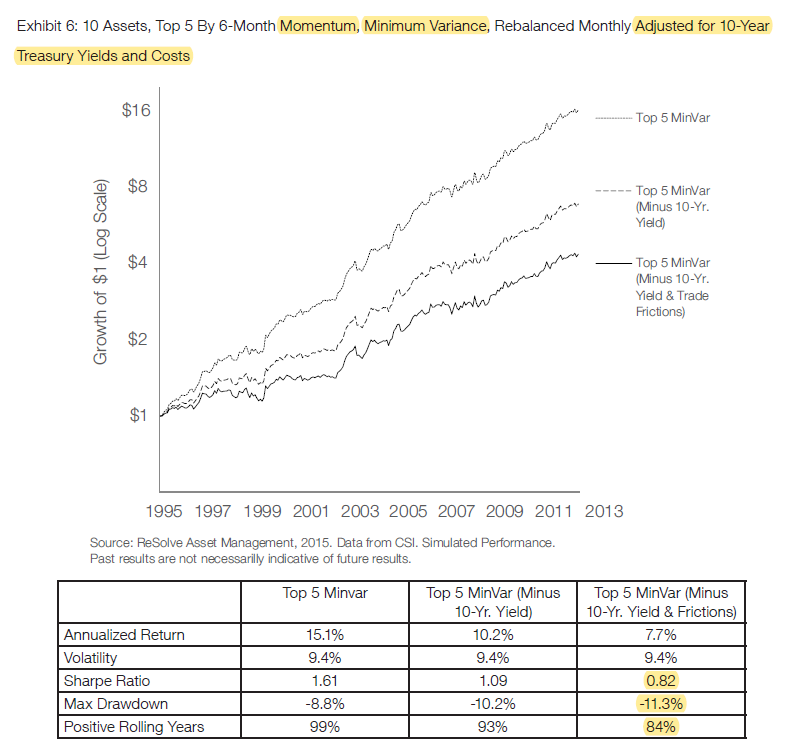

"Estimates of parameters for portfolio optimization based on long-term observed average values are inferior to estimates based on observations over much shorter time frames."

papers.ssrn.com/sol3/papers.cf…

Keep Current with Reformation Day 🎃

This Thread may be Removed Anytime!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!