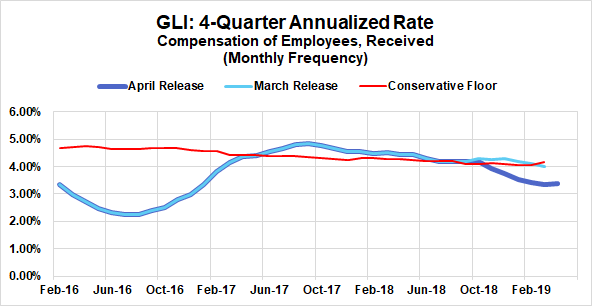

Chair Powell is recognizing that the Fed can shape labor market outcomes over the longer-run. That is a big deal.

This is a serious departure from the orthodox view of his predecessors: that the Fed can't affect the labor market over the longer-run, only inflation

“Monetary policy — as a general rule — cannot influence the long-run level of employment or unemployment. And that’s certainly correct. What we are trying to address is the short run cyclical gap.”

Powell: "With this tight labor market, employers are waving issues that might have prevented people from being in the work force.”

Those insights now require a fundamentally different reaction function, one that is not centered around constraining the unemployment rate to its "natural rate"

Waiting for signs of a rising unemployment rate is a recipe for doing too little too late, especially given the proximity to the ZLB

The July cut was a start, but the Fed now needs to update its reaction function to reflect the full set of benefits that stem from a tighter labor market and the costs of this expansion potentially ending. (end)