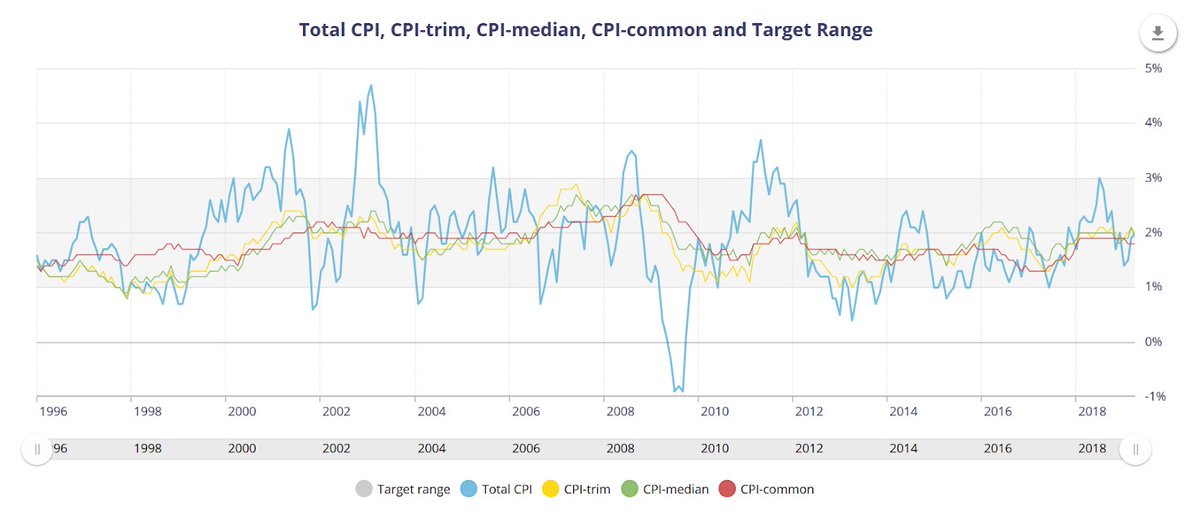

1. Canada’s labor market appears to be historically tight. Not true in the US. Nevertheless, no signs of inflation acceleration in Canada. We really should’ve seen something sustained by now at least

medium.com/@skanda_97974/…

For that reason alone, we should be using employment rates, which are simply employment divided by population (no labor force participation distinction needed)

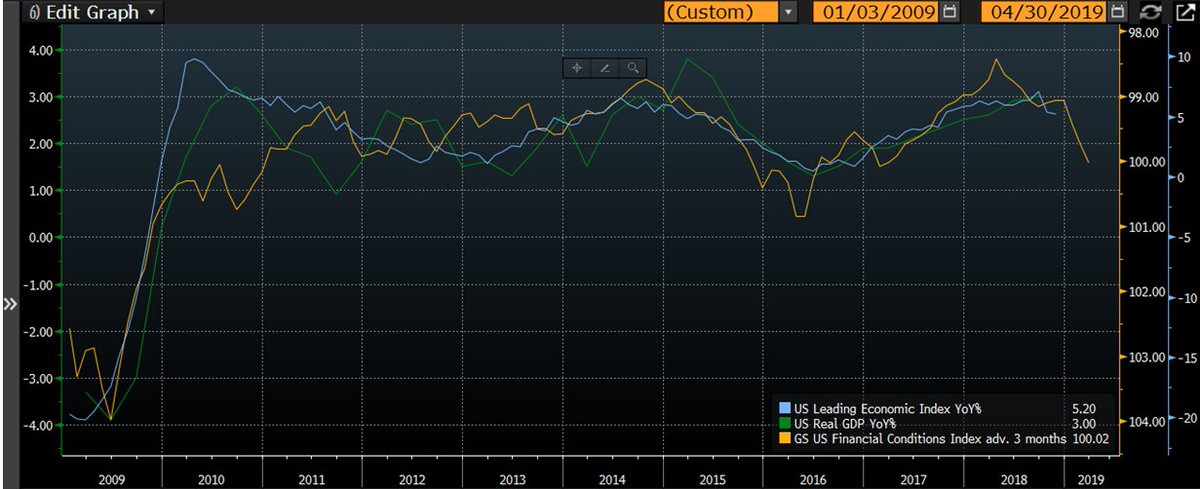

When your model fails to be useful neither at the more well-traveled points nor the more extreme ones...

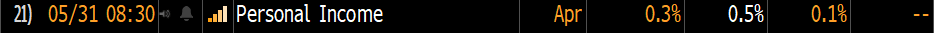

But let’s not forget the other side:

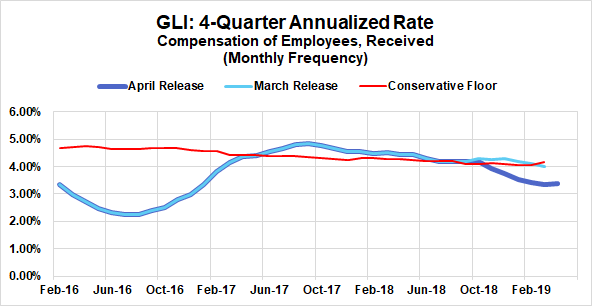

Monpol over the last 10yrs has shown more ability to support labor markets than affect inflation itself!

1. Simplistic tradeoff b/w employment and inflation

2. Emphasis on longer-run monetary neutrality (supposedly only employment can be affected in short run, prices in long run)