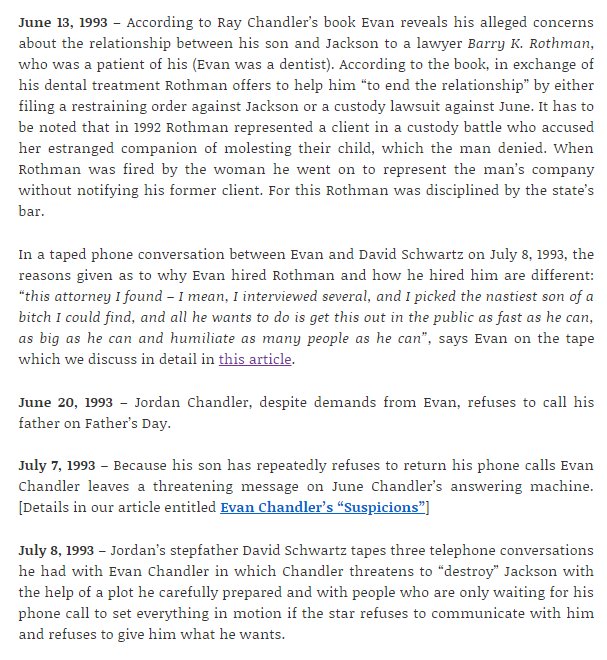

This is the long term chart of gold in USD (XAU/USD in investing.com)

Period considered - from Jan 2007 to date

For an Indian investor owning gold, they gained in '08, but primarily because of INR weakening. Gold price in USD did not move as much during the tough year of 2008. Now let us see what happened in 2007 and bring in the rate cuts of the Fed. (5/n)

(9/n)

(10/n)

There is simplicity in the TF route where you assume that all the things that matter are in the price :)

(11/n)