Can we afford not to increase the VAT rate?

👇👇👇👇

Thread

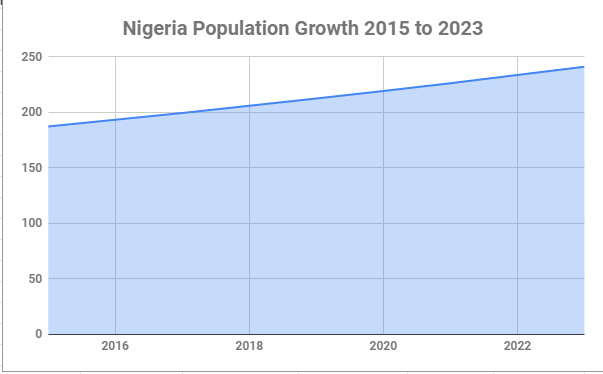

Increase in VAT will lead to an increase in the prices of commodities which will affect the poor and middle-income earners.

Reducing government spending by hiring fewer aides attached to political officeholders will eliminate the need for VAT increase.

Reduce National Assembly Budget

Higher inflation rates

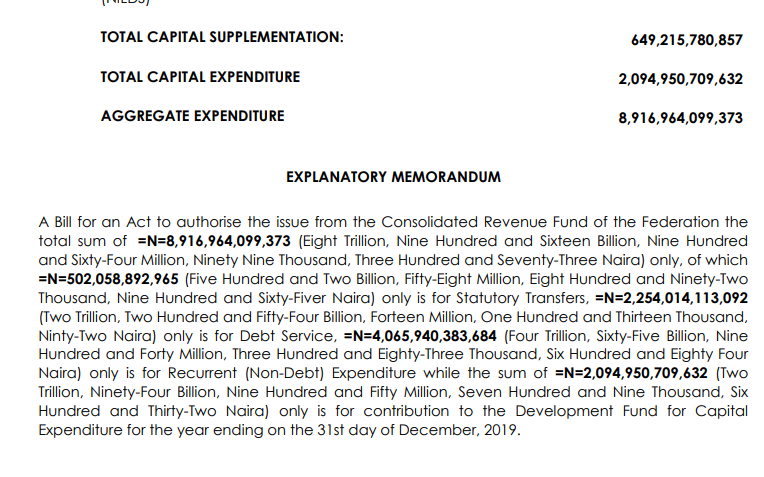

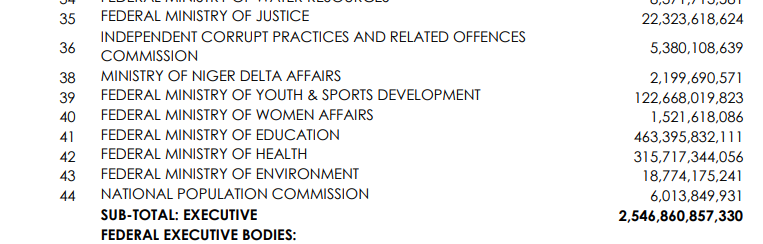

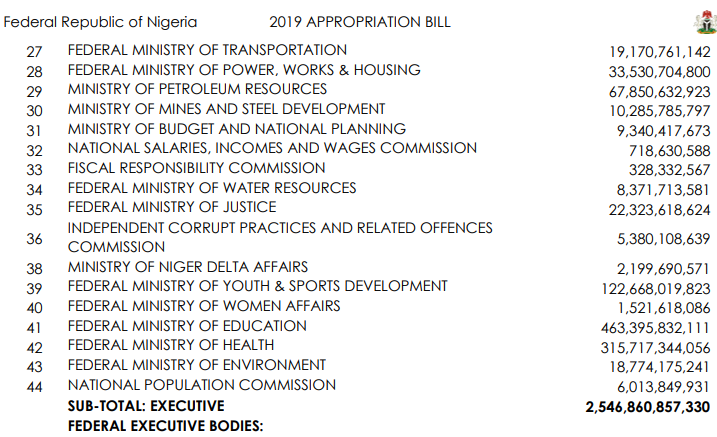

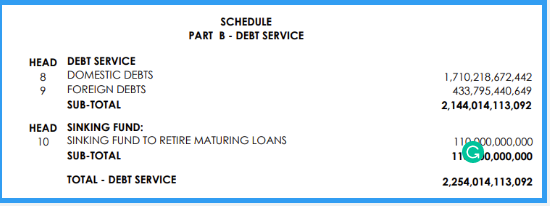

Let's first review our revenue & Expenditure

It should never be a reason why anyone opposes VAT increase.

Now what does 2018 tells us about 2019

theguardian.com/world/2017/aug…

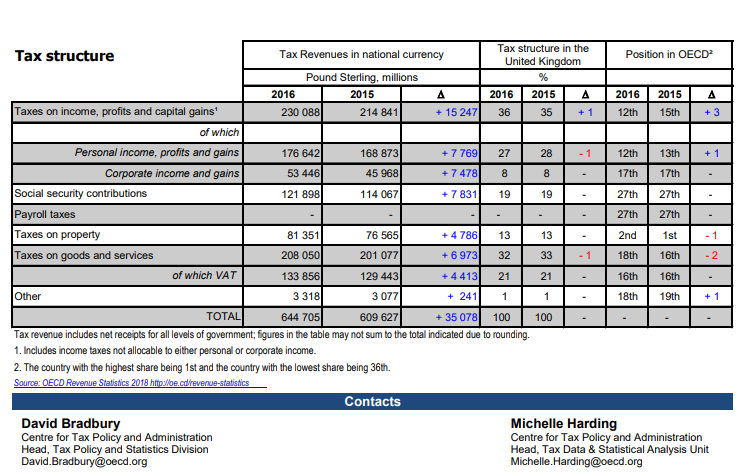

If we have no problem accepting donations and loans from the UK & US whose citizens are getting crushed with excessive taxation, then we should be willing to accept the rate increase.

usaid.gov/nigeria/press-…

Increase revenue

Cut cost

Increase revenue and cut cost.

IMO we can increase revenue and cut cost at the same time.

In the short term, loans or raising taxes seems to be the most effective.

Will VAT really increase prices on all commodities? or cause inflation?

Who bears the burden of an increase in VAT?

Are there any positives from the increase?

I will address those issues in the next thread.