DEBT/GDP = ratio & that ratio has to fall.

If ur output (GDP) falls, then your debt growth has to fall FASTER! That is how you deleverage. How u do so is up to u. NIRP is 1 way

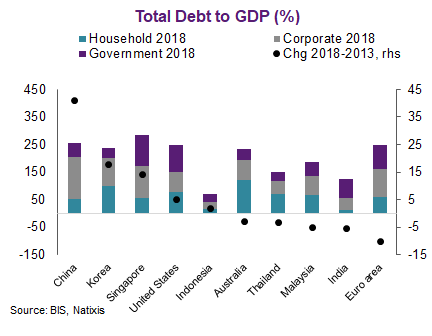

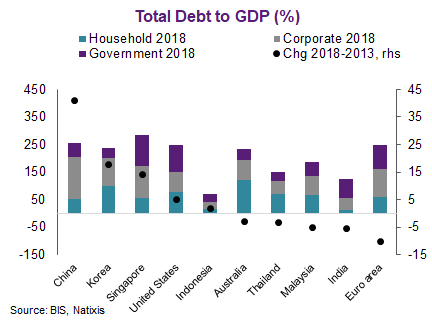

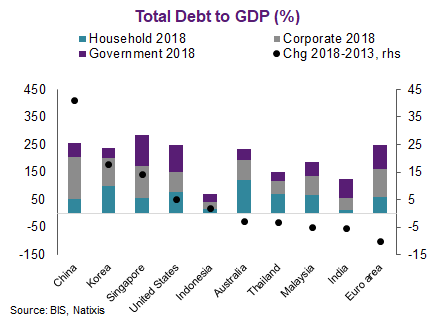

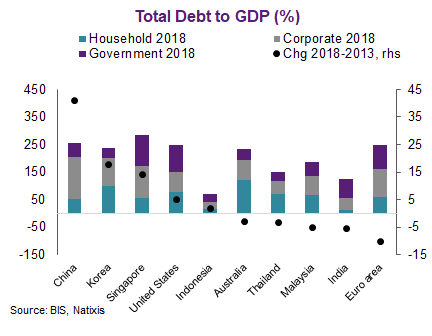

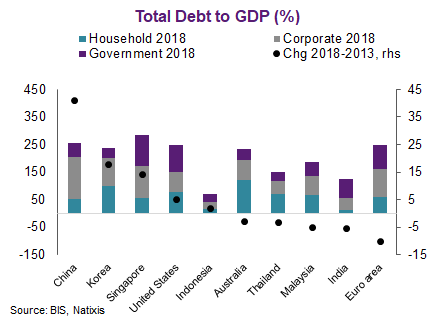

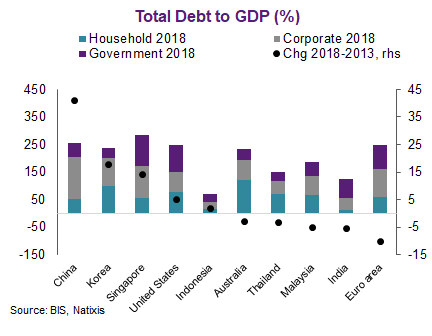

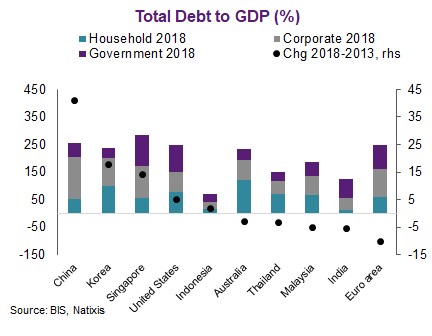

*Stock (total debt), composition of debt (household, firms, government), & finally the RATE OF CHANGE of the total & drivers of change.

Let's look

The US is more even & gov debt biggest!

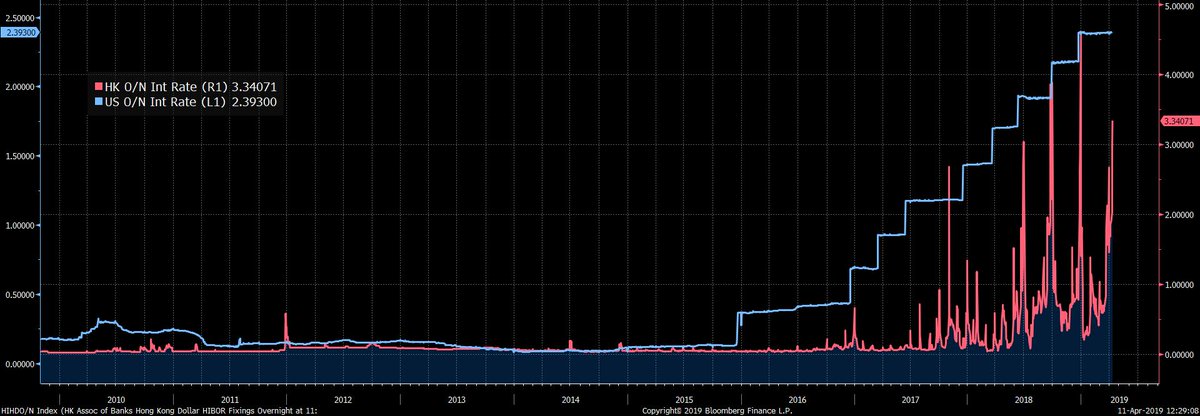

Have output grow faster (profitability) or/and lower costs of funding.

Profitability declined so..

So this'll need to change if China wants to deleverage or profitability rises.

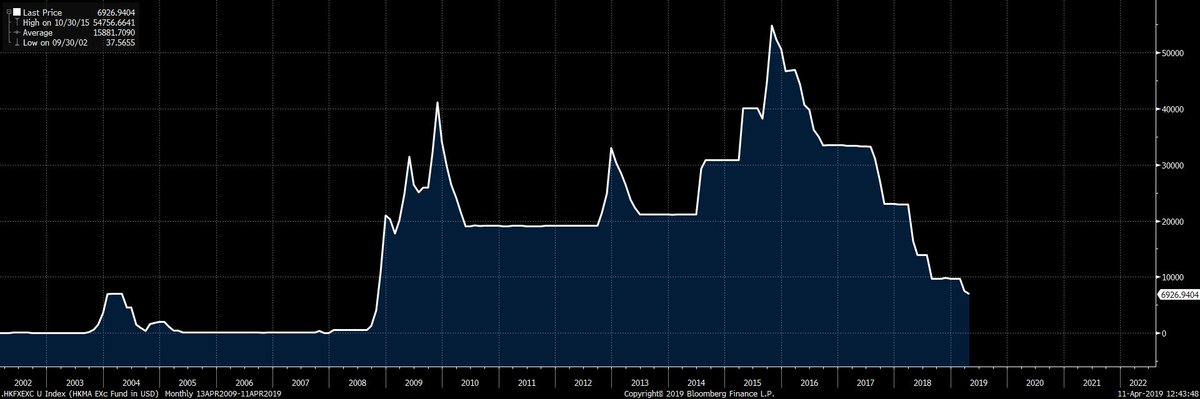

What does that mean? After the GFC, the US gov bought toxic assets & the central bank helped buy that too to lower both gov funding costs & help the economy deleverage.

Hence banks in the US recovered etc

So nominal GDP > growth of debt & interest payments

OK, Indonesia👇🏻

Why? Look at that chart & u will see. Total leverage ratio is only 70%👇🏻

Households>firms>gov

So if an economy has A LOT OF HOUSEHOLD DEBT (Australia, Canada, Korea, etc) then u know that COSTS OF DEBT HIGH!!!

RBA rate = 1% but mortgages, credit card??

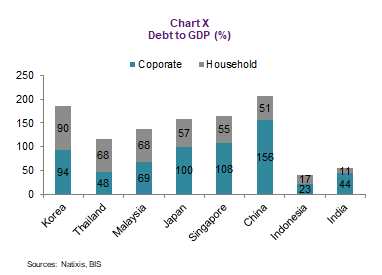

#1 Korea

#2 Thailand

#3 Malaysia

#4 Japan

#5 Singapore

#6 China

#7 Indonesia

#8 India

Korea has 90% of GDP household debt. BOK rate is 1.5% & u bet Korean households paying higher

Now u know why the RBA lowered rates. U bet they are not paying 1% RBA cash rate.

Indian INC balance sheet CONTRACTED!

What about households? Well, they have limited access to banking & 11.3% of GDP!

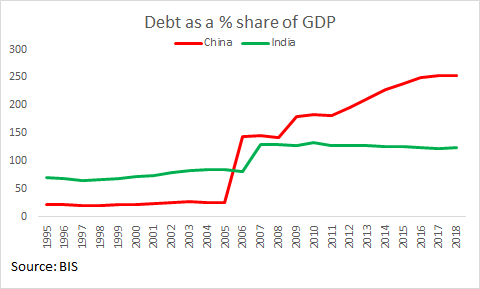

You can see clearly below India basically DELEVERAGED 👇🏻👇🏻👇🏻 as China massively expanded its balance sheet. Modi accelerated the deceleration!