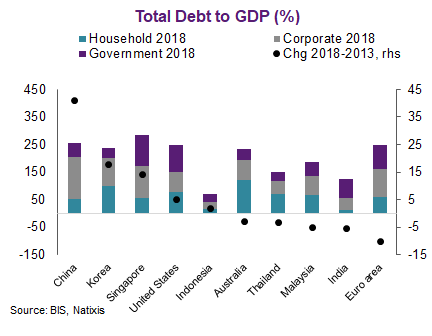

*Australia now has RBA cash rate 100bps lower than USD at 0.75% as the KING of Asia household debt wants to help consumers (they got floaters for mortgages & defo not paying sub 1%)

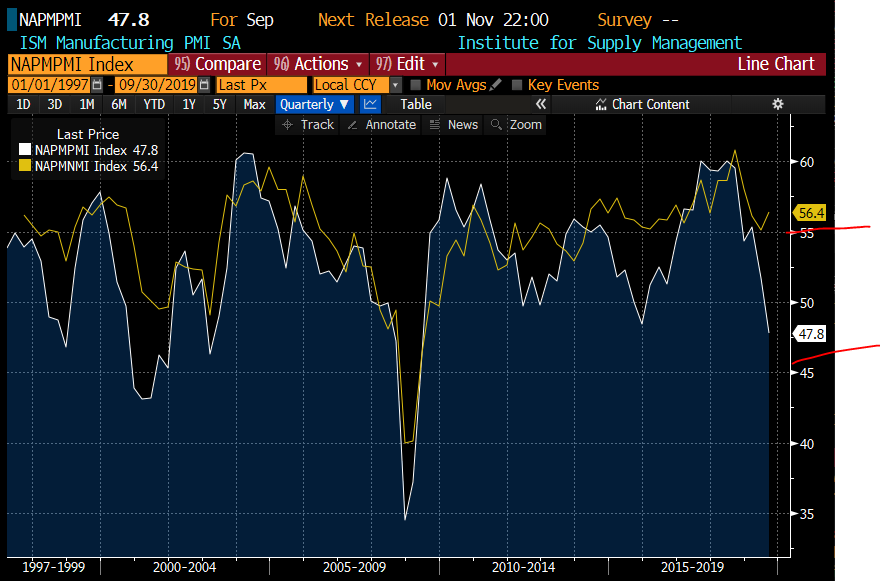

*Global manufacturing contracting, yep, true story. 🥶

So the Bank of Korea will cut rates. Household debt high!

Korea lack of social security, worsening job market + aging = debt 📈

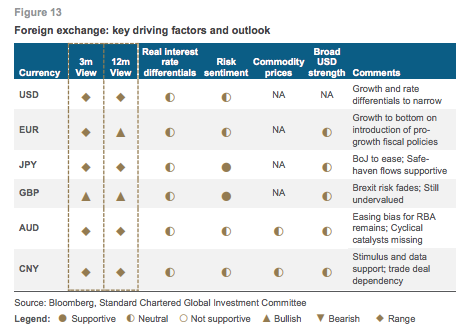

Anyway, regarding India, the RBI meeting is this Friday. Last time, the RBI cut rates by 35bps & rate cut'll come Friday👇🏻

The double Ds - debt & demographic 👇🏻👇🏻👇🏻

Question: What happens next?

You bet not more leverage for Chinese firms. Not more leverage for Australian households, Korean, Thai, Malaysia. If they lever, it is likely just to pay down debt not to accelerate CONSUMPTION.

Yep.

What is the historical relationship b/n manu & non-manu?

Let's look at the chart below. You can see that manufacturing is much more volatile than services & services remain resilient. Manufacturing dipped in 2015 & 2012 while services sticky 👇🏻