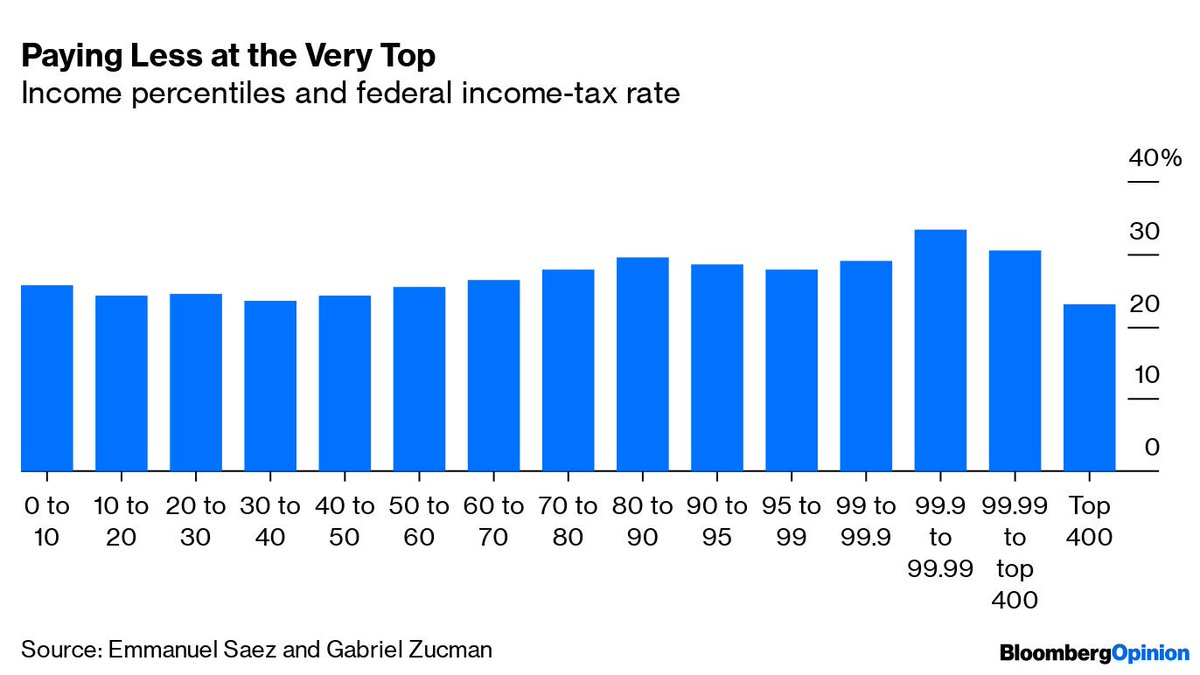

Higher taxes are in order for the Zuckerbergs and Buffetts of the world bloom.bg/2M0Oaoz

When the animation starts, the 400 highest earners are paying 70%. When the animation finishes, the top 400 are paying just over 20% – lower than any other bracket bloom.bg/35joV8D

1. The graph zooms in on the top brackets

2. It doesn't include transfers

3. The tax rate of top earners is hard to measure

Despite these limitations, it’s clear that rates for the richest Americans have gone down bloom.bg/35joV8D

Mark Zuckerberg has gone even farther, declaring that “no one deserves” the amount of wealth that he's accumulated bloom.bg/35joV8D

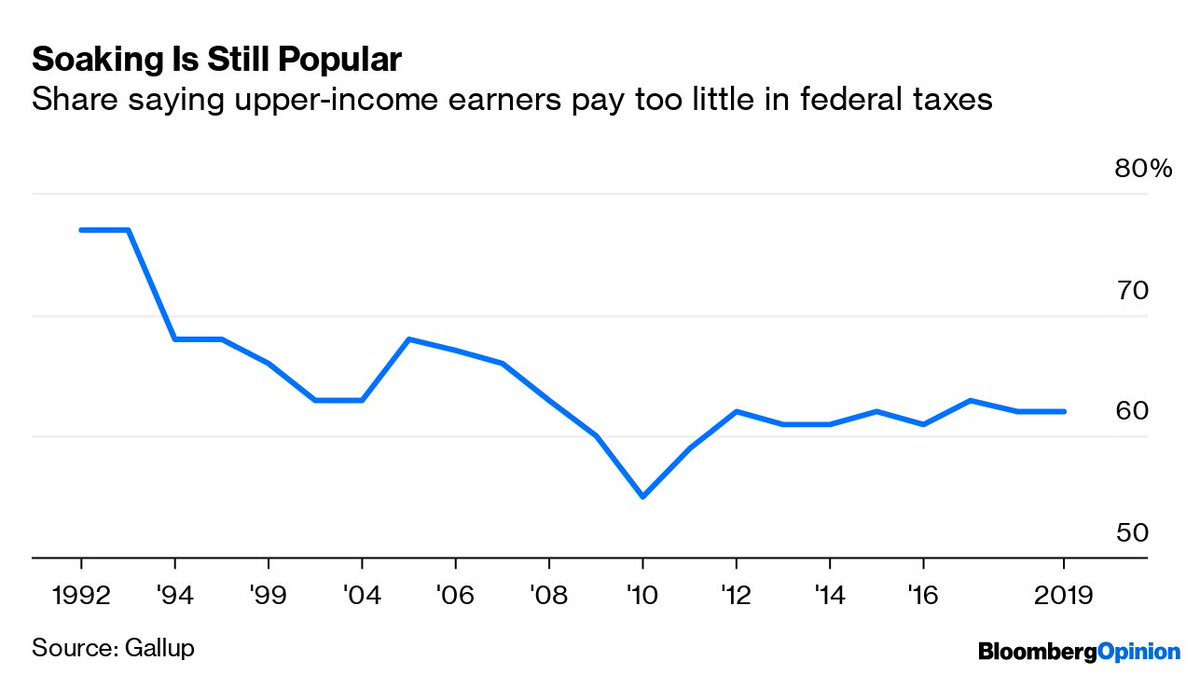

The share of people who believe that high earners pay too little in taxes has come down a bit over the years, but it’s still a substantial majority bloom.bg/35joV8D

Step #1: Raise the capital-gains tax rate. ⬆️The very top earners make most of their income from the financial assets they own bloom.bg/35joV8D

📑This lets many top earners pay lower taxes by passing their income through an S corporation or other closely held company bloom.bg/35joV8D

📈In 1920 there were more than 50 federal income-tax brackets. As of 2019 there are only seven. Adding more brackets at the top would allow steeper rates to be targeted at very high earners bloom.bg/35joV8D

🇺🇸American society shouldn't be every man for himself. Successful individuals must give back to the country that gave them the opportunity to succeed bloom.bg/35joV8D