The financial crisis of 2008 explained

I have been asked quite often about the crisis – what really caused it, and what are the implications – what should we learn (or have learned) from this? And what is the connection between this and Islamic banking?

Why is this important

First of all, non-finance people generally do not understand (very well) how money and markets work, yet they (we) are the ones who bore the brunt of the crisis.

We have a right to know why it ruined so many lives

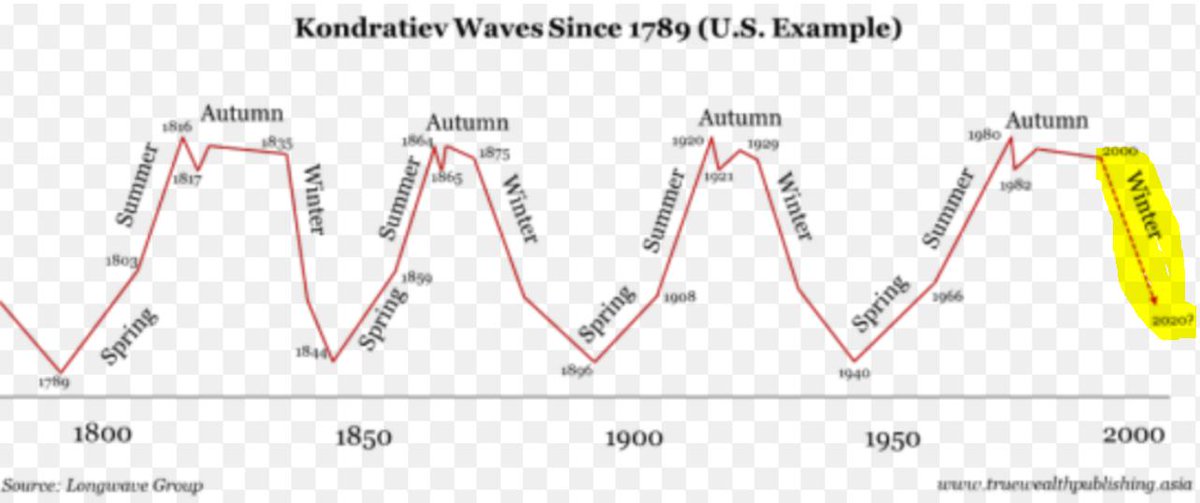

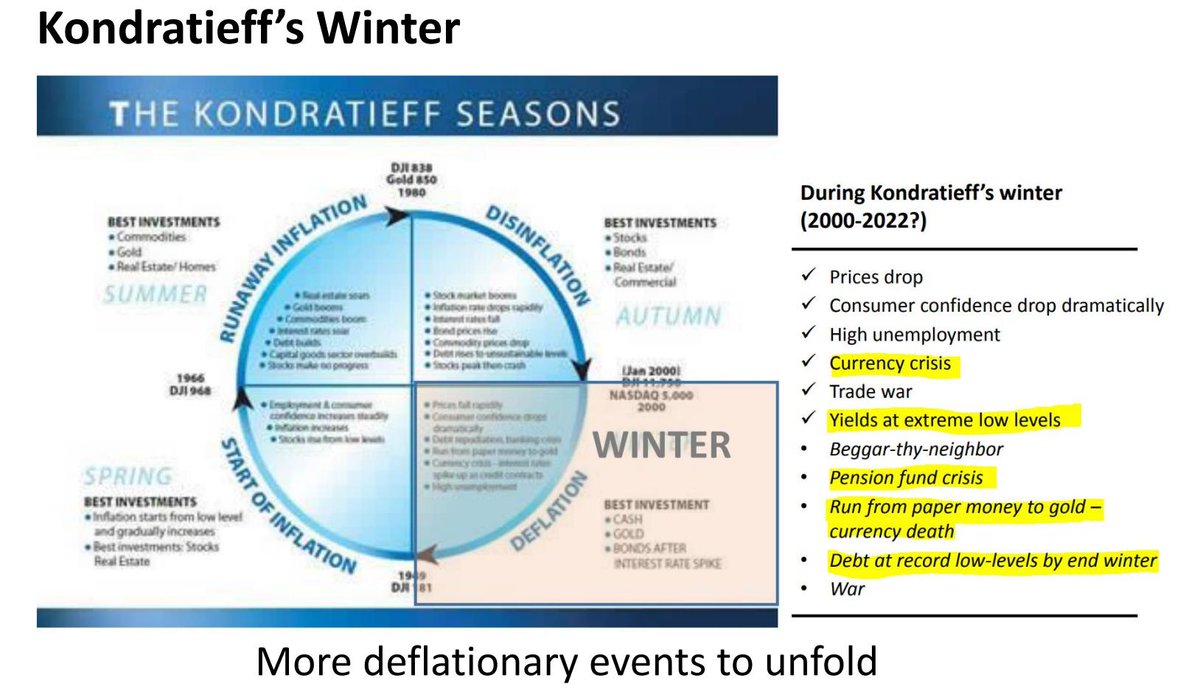

But I think we have short memories and it can easily happen again.

We have to go back to 1933 when the Glass Steagall Act was first passed. It separated investment and commercial banking activities. This was in response to the 1929 crash - the Great Depression. Banks had begun to act irresponsibly,

The aim was to tell banks either to look after customer funds, OR invest and speculate – but you cannot do both!

In,1998, several key parts of this act were removed,

So, what are MBS?

Simply, they allow banks to give mortgages, and then bundle them together and sell them

This was easy money for banks, so they went all out and gave as many loans as they could, and as quickly as they could.

They gave mortgages to homebuyers of lower credit quality, and these were called sub-prime mortgages. They also skipped on the paperwork requirements, because it was more important to create these mortgages so

Fund managers and investors bought these MBS in a frenzy, due to the higher returns

“ in the mid-1990s $30 billion of mortgages constituted "a big year" for subprime lending, by 2005 there were $625 billion in subprime mortgage loans, $507 billion of which were in mortgage backed securities”

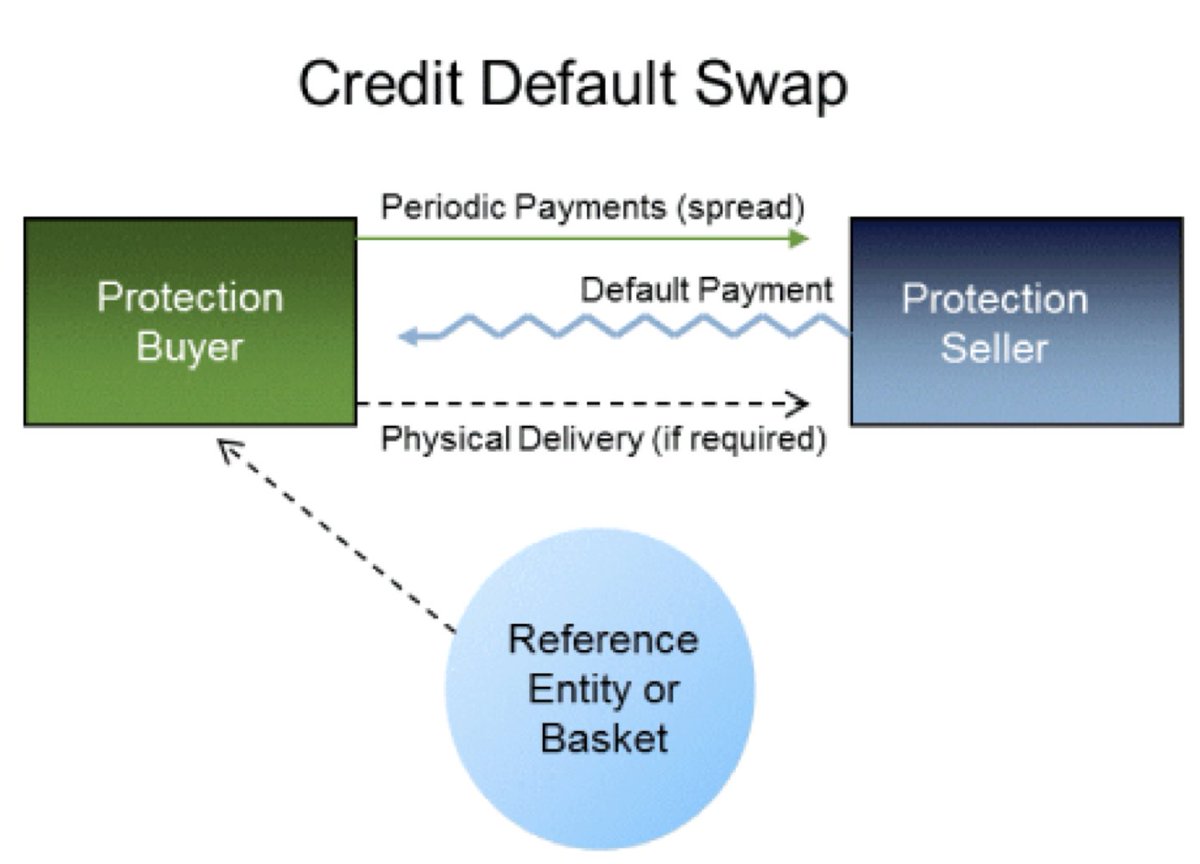

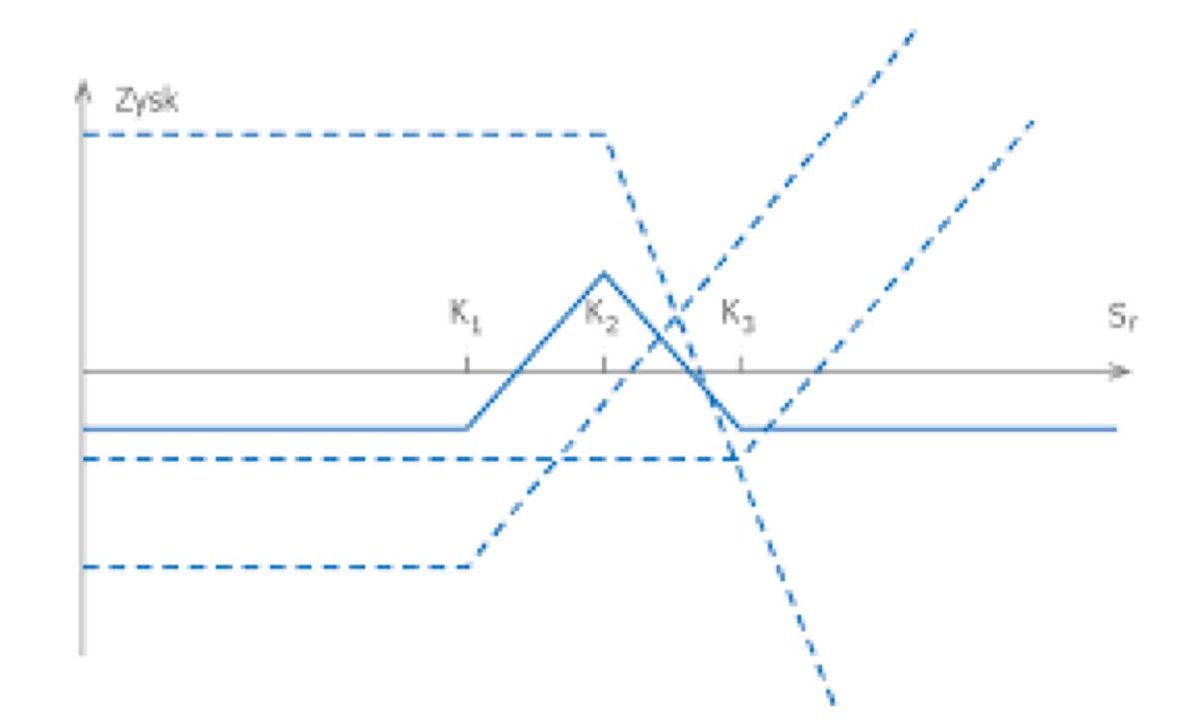

MBS is explained above – CDO (Collateralised Debt Obligations) are similar - but they have one additional feature – the risk of the underlying mortgages was sliced into different levels of risk – from the “safest” (Senior tranche) to

Insurers were more than happy to rake in insurance premiums as they thought these borrowers just would not default – they saw this as free and easy money, and issued CDS at a startling rate.

CDS are not regulated, meaning there are no exact figures for how many were created. One estimate states the volume of the CDS market is 3x global GDP.

It is amazing that with a single debt, you can create multiple CDS to insure it – all because the issuer of the CDS thought it was

However, when property values began to decline from 2006, re-financing became more difficult. Also, the impact

These banks and fund managers were selling bad securities to

Ok, so the defaults happened, investors took BIG losses. Many, of course, had insurance in the form of CDS, so they now went to the insurers such as AIG, and asked for their compensation.

AIG had to pay out around $25bn. The government had to step in to bail out AIG.

The drive for short term profit now came home to roost.

Not only did investors

On 9 August 2007, BNP Paribas froze 3 funds

Banks began to record losses from

1) defaults on mortgages they lent out

2) Losses on MBS they invested into

3) High bank levels of debt, leverage

Now, banks started to fail, Why?

Before the crash Lehmans bought 5 mortgage lenders, and of course, the aim was to pump out a lot of mortgages quickly, then to bundle them into MBS, and repeat. Easy money.

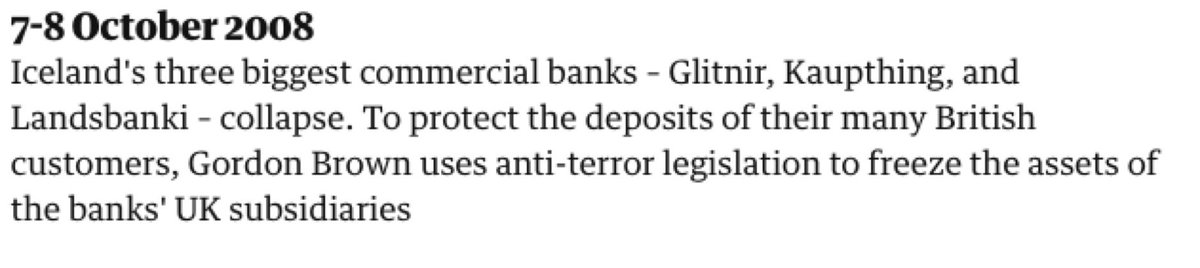

The US Govt declined to bail them out – Lehmans folded.

Let’s not feel too sorry for the banks

February 2008, UK govt nationalises Northern Rock

March 2008, Bear Stearns “bought out” by JP Morgan

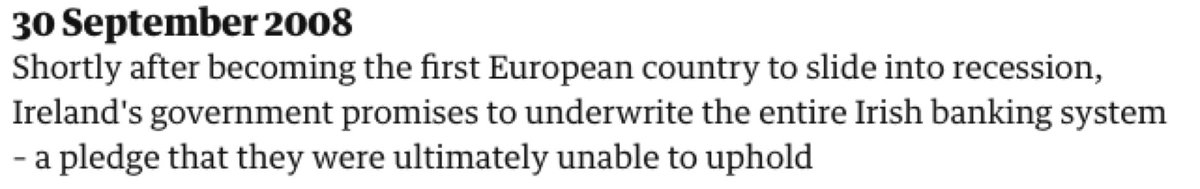

Sep 2008 US govt bails out Fannie Mae and Freddie Mac – two huge firms that had guaranteed

So what can we learn from all this?

Impact of debt creation and derivatives

Debt is not without consequence.

Even though low levels of debt, can support the growth of businesses - we all know that, when there is money to be made by

When it reaches unsustainable levels, we all suffer.

The lending banks were happy to push out new debt because they could rapidly package into MBS and do the same all over again. It was easy money, and nobody paid any attention to the risk of delivering

Also, the creative investment bankers were happy to package this debt into securities and make short term profit. As long as they sold the risk to investors, it was no longer

Ratings agencies were happy to give unrealistic ratings, maybe because they were being paid to do so. They still have a clear conflict of interest in the markets now.

Not understanding everything is connected

We learnt, the hard way, that foreclosures can

Can it be repeated?

Well, the key causes were:

2) Mechanism to repackage debt into derivatives

3) Proliferation of non-regulated derivatives in order to make profit

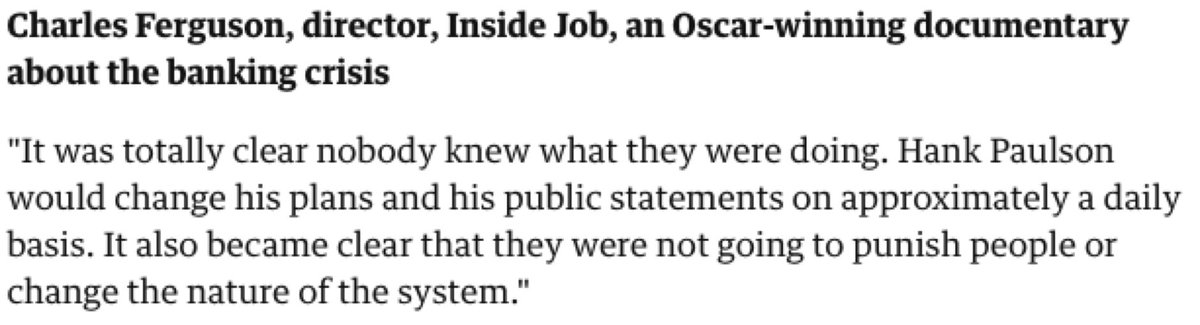

4) Regulators really having no clue of the impact of the complexity of financial markets

Connection with Islamic banking

The key causes were:

1) debt – debt (at interest is forbidden) – so in theory we cannot get into this mess but the reality is Islamic banks love debt and interest.

2) Derivatives – really they should not exist in any form. Where some derivatives can deliver benefit is in hedging and reducing risk - to deliver this we must focus more on better forms of insurance and protection

In theory, we “could” say that adherence to Islamic principles would has avoided

However, in reality, Islamic finance, as practiced, is dominated by debt (99% of everything Islamic banks do is priced at interest – this means this is debt (at interest)).

Also, we definitely execute derivatives in many areas –

And we have failed to develop proper insurance and protection products – instead we deliver

And profit before everything – we do all the above in the name of profit. So, clearly we are failing here too

I firmly believe the theory of our system is incredibly powerful – yet we consistently fail to put any of this into

We love debt, we love interest, we use derivatives in every sector, and so the only reason we avoided being hurt (that much) in the crash is because the economies where Islamic banking operates were not developed enough (in terms of financial products and

Give us a decade or more, and we will be getting there.

If you believe we escaped because of Islamic banking, you must educate yourself.

Just because we like to believe something does not mean it is true.

END THREAD (if you got this far!)