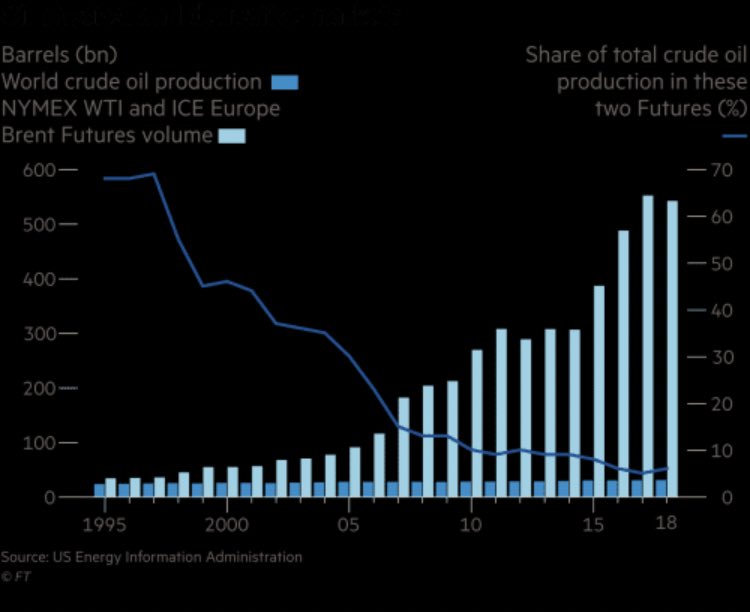

for the first time, there is a robust derivatives (futures, options) market for bitcoin. most firms looking to speculate on bitcoin will trade a derivative, not the underlying.

normally, producers set the price of a commodity (classic S = D = P from Econ 101)

when derivatives take off, producers lose the right to set prices

derivatives dominate trading. most firms trade paper contracts to speculate on the price of oil. the market is driven by speculation.

@BitMEXdotcom was the first to crack this market. then the 10,000 lb gorilla @CMEGroup got in the game. now there are hundreds of new firms popping up.

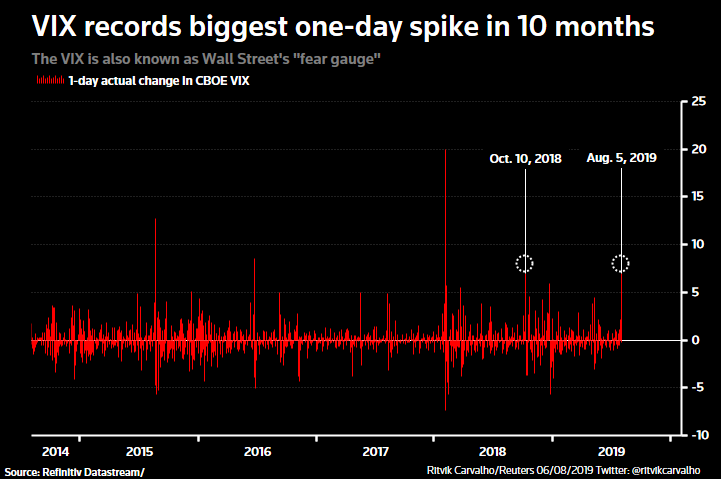

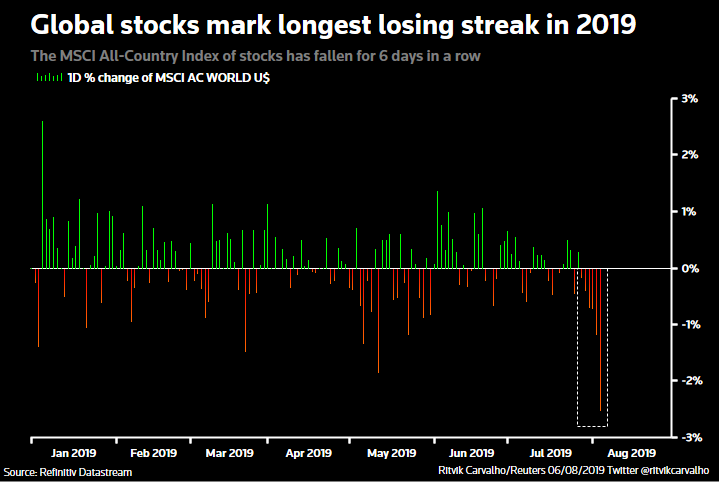

it becomes yet another backwater in the great game of global speculation. it becomes “financialized.” it becomes correlated to macro markets.

will be interesting to watch. derivatives on bitcoin are an oxymoron. but they’re the fastest growing part of the market... 💸

(derivatives 101 here - investopedia.com/articles/optio…)