There's a bunch of enlightened, all seeing, & all wise folk and Twitter & elsewhere constantly tweeting about how easy it is to pick a good stock. You'll see tweets like:

"Buy a good stock and hold it forever" 1/n

Investing is 10% stock picking, 90% patience.

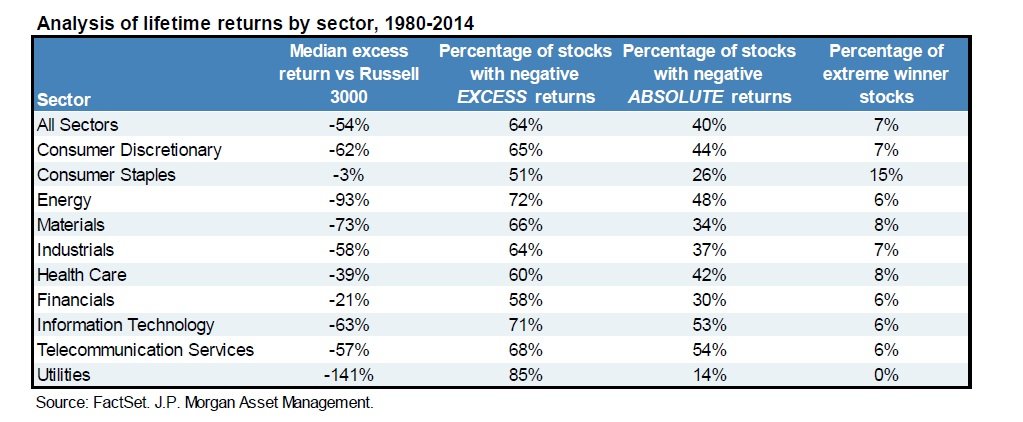

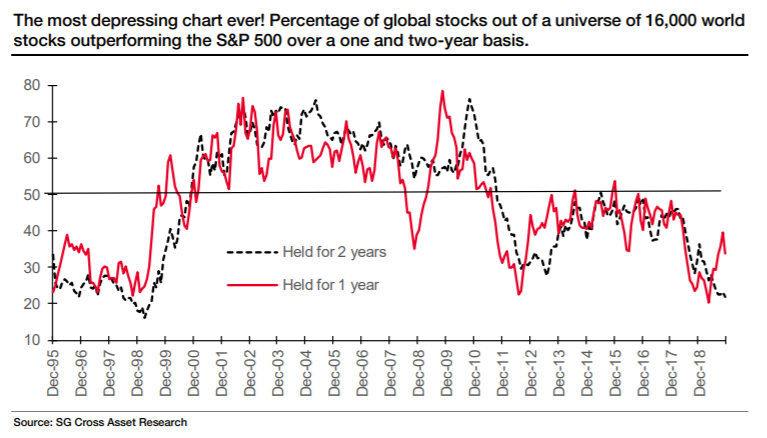

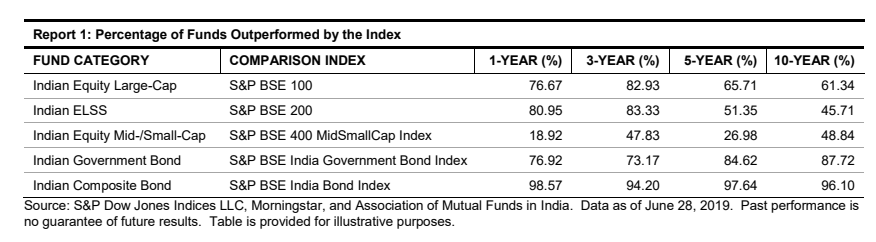

And a deluge of Warren Buffet, Charlie Munger quotes. Long term this, psychology that & such simplistic bullshit. But one thing these wise men don't talk about is just how tough stock picking is2/n

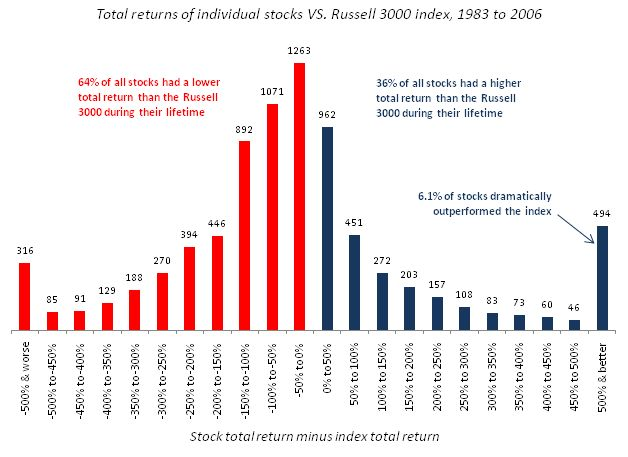

"The best-performing 4% of listed companies explain the net gain for the entire US stock market since 1926, as other stocks collectively matched Treasury bills. 5/n

From the paper:

papers.ssrn.com/sol3/papers.cf… 6/n

We don't have too many studies for the Indian market, but 7/n

"Just 1% of Indian stocks account for 83% (90-2018) of net wealth creation!" How do you like the odds. 8/n

mebfaber.com/2008/12/02/the…

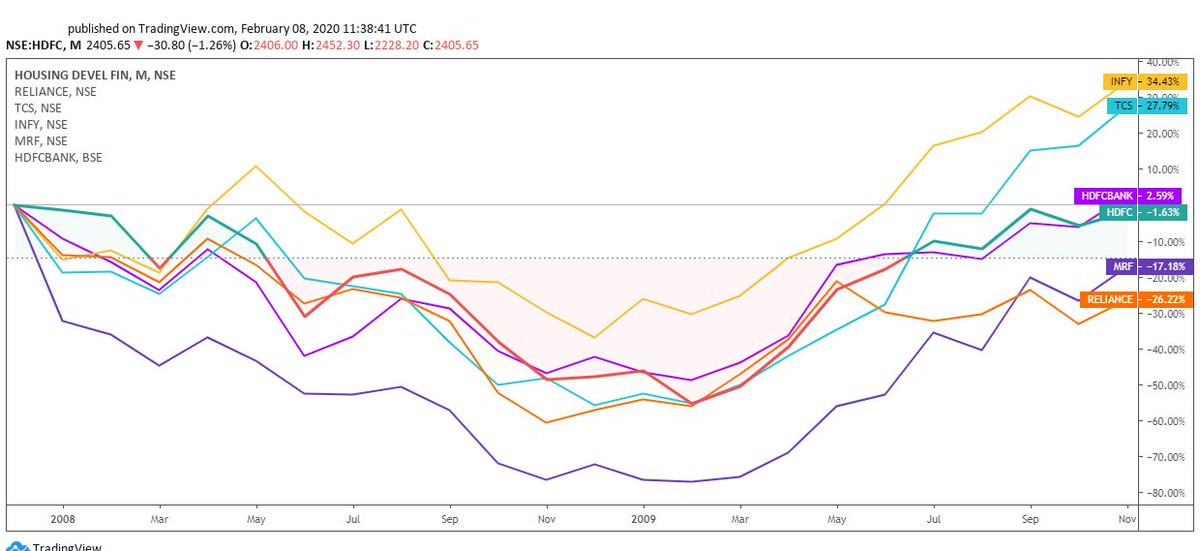

And then you'll have to deal with the self doubt, noise on TV, papers, newsletters twitter, friends, 16/n

"Everybody's got a plan until they get hit in the face" 19/n